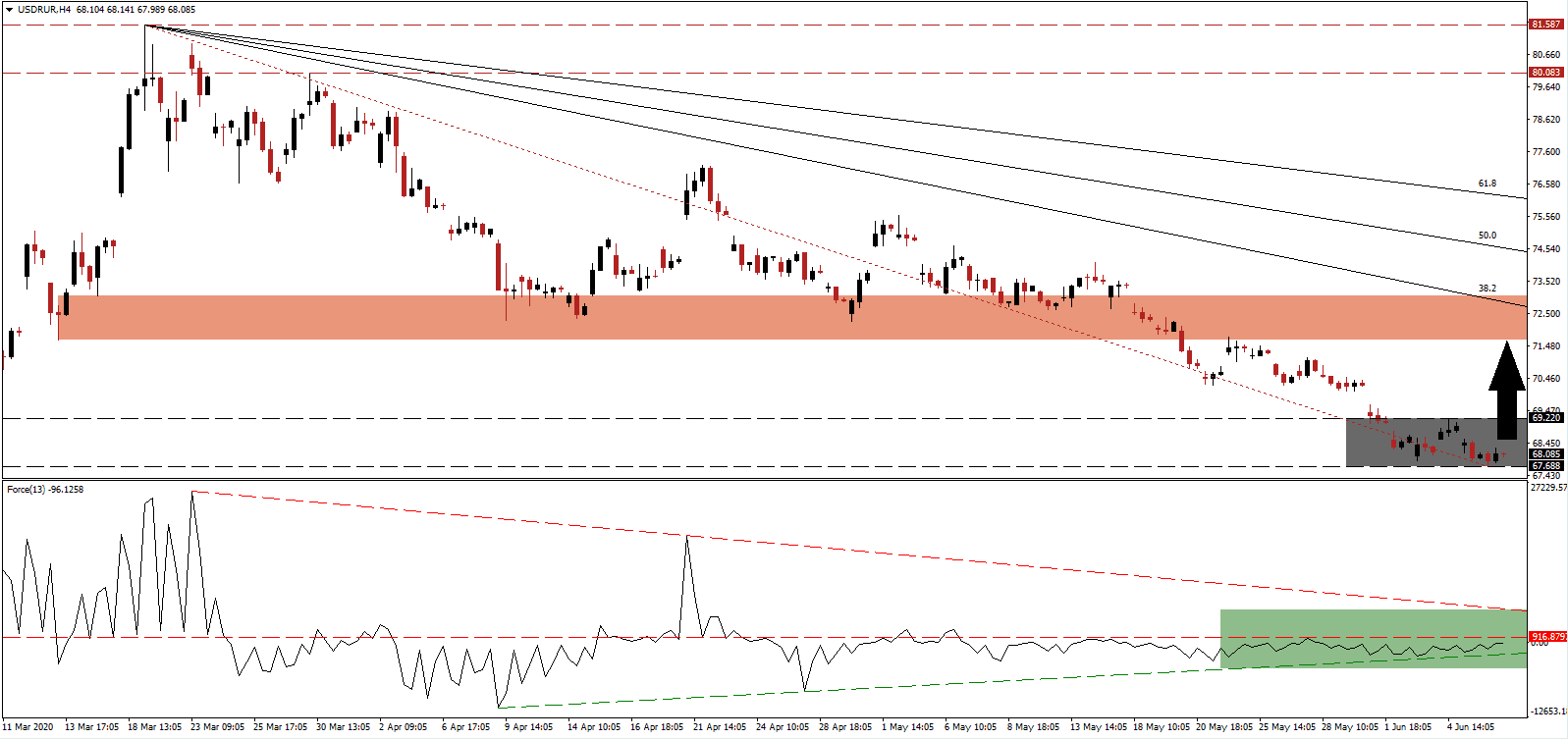

Russian President Putin ordered his government to implement a swift economic recovery plan, which includes RUB5 trillion in emergency spending until the end of 2021. This includes raising incomes and decreasing unemployment. The latest retail sales data indicates consumer spending is recovering, as outlined by presidential aide Maxim Oreshkin during the Startup Village online conference. The Central Bank of Russia cautioned against hopes for a V-shaped recovery, echoing calls by other central banks, but ignored by financial markets. A minor price spike in the USD/RUB out of its support zone, given the magnitude of the sell-off in this currency pair, is anticipated to extend the dominant bearish trend.

The Force Index, a next-generation technical indicator, confirms the absence of bullish momentum and shows a sideways trend. With the Force Index trapped above its ascending support level and below its horizontal resistance level, as marked by the green rectangle, the long-term downtrend is expected to remain intact. Adding to bearish pressures is the descending resistance level, limiting the upside potential. This technical indicator remains in negative territory, allowing bears to keep control of the USD/RUB.

OPEC+ agreed in April to cut output by 9.7 million barrels per day for May and June, followed by 7.7 million until the end of 2020. It was an attempt to stabilize crumbling oil prices with futures briefly turning negative. Global storage is near-maximum capacity, and demand remains soft. Saudi Arabia seeks to extend those cuts for an additional three months, a move opposed by Russia, which favors a one-month extension. The USD/RUB is vulnerable to a brief short-covering rally, taking price action out of its support zone located between 67.688 and 69.220, as marked by the grey rectangle.

Adding to bearish pressures on the USD/RUB are ongoing riots and demonstrations across the US, forecast to scar the economy for years to come. It is on top of the Covid-19 related disruptions and failure by US policymakers to understand that changes to the current debt-centered approach are required. Many economies use the global pandemic to recalibrate and reset, a vital development ignored by the US. The short-term resistance zone located between 71.688 and 73.059, as identified by the red rectangle, limits any counter-trend advance, and continues to be revised lower. It is enforced by the descending 38.2 Fibonacci Retracement Fan Resistance Level.

USD/RUB Technical Trading Set-Up - Brief Short-Covering Scenario

Long Entry @ 68.050

Take Profit @ 71.650

Stop Loss @ 66.850

Upside Potential: 360 pips

Downside Risk: 120 pips

Risk/Reward Ratio: 3.00

A contraction in the Force Index below its ascending support level is favored to allow the USD/RUB to extend its corrective phase. Forex traders are advised to take advantage of any breakout attempt with new short positions, on the back of an intensifying long-term negative outlook for the US economy. The next support zone is located between 64.138 and 65.154, while more downside cannot be excluded.

USD/RUB Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 66.250

Take Profit @ 64.150

Stop Loss @ 66.850

Downside Potential: 210 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.50