Last Friday’s US NFP report showed over 2.5 million job additions. It surprised markets and shocked economists who were, on average, predicting 8.0 million job losses. It did follow April's more than 20.0 million job losses, the worst in history. With initial jobless claims ticking up, the risk that May’s report was a head fake is increasing. The retail and hospitality sectors added interim staff to take customers' temperature and disinfect goods and surfaces. The well-established correction in the USD/RUB remains intact, but a temporary breakout cannot be excluded.

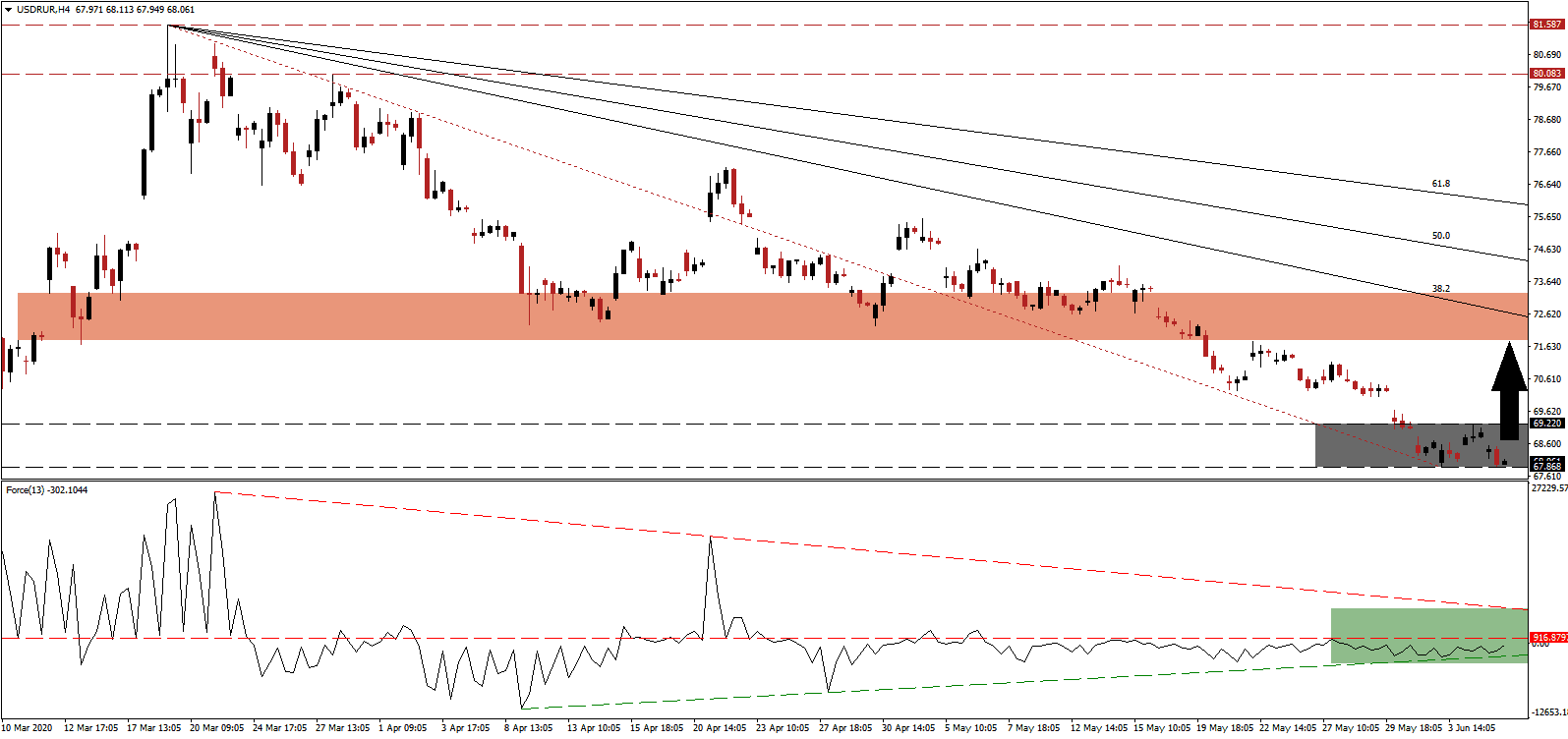

The Force Index, a next-generation technical indicator, shows the ascending support level applying upside pressure, as marked by the green rectangle. Due to the marginal build-up in bullish momentum, a brief push above its horizontal resistance level is anticipated, limited to its descending resistance level. It will take this technical indicator into positive territory in a short-term development, allowing bulls to take control of the USD/RUB until the move is reversed. You can learn more about the Force Index here.

Riots in the US remain in the headlines, with yesterday’s pledge by a veto-proof majority of the Minneapolis City Council to abolish the police department. Defunding of police departments is being considered across the nation, in a controversial measure, which could spike crime rates. The economic fallout remains uncertain and cannot be suitably assessed, but it adds to long-term bearish pressures in the US Dollar. A quick short-covering rally is likely to take the USD/RUB out of its support zone located between 67.868 and 69.220, as marked by the grey rectangle, before an accelerated move to the downside is expected.

Russia announced a RUB5 trillion recovery plan as its next phase in the economic response to the Covid-19 pandemic. The stimulus will remain in place until the end of 2021, aiming to reduce the unemployment rate below 5% and expand GDP by 2.5% annualized, the fastest growth rate since 2012. Any breakout in the USD/RUB remains limited to its continuously downward revised short-term resistance zone presently located between 71.811 and 73.274, as identified by the red rectangle. It included a previous price gap to the upside, while the descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to enforce the dominant bearish chart pattern in the USD/RUB.

USD/RUB Technical Trading Set-Up - Brief Short-Covering Scenario

Long Entry @ 68.050

Take Profit @ 71.650

Stop Loss @ 66.850

Upside Potential: 360 pips

Downside Risk: 120 pips

Risk/Reward Ratio: 3.00

In case the Force Index collapses below its ascending support level, the USD/RUB will resume its long-term correction. A brief counter-trend advance is a healthy development, ensuring the longevity of the trend, and failure to embark on one now will delay it into the future. Forex traders are advised to sell any advance, given the bearish progress out of the US. The next support zone awaits price action between 64.138 and 65.154.

USD/RUB Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 66.250

Take Profit @ 64.150

Stop Loss @ 66.850

Downside Potential: 210 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.50