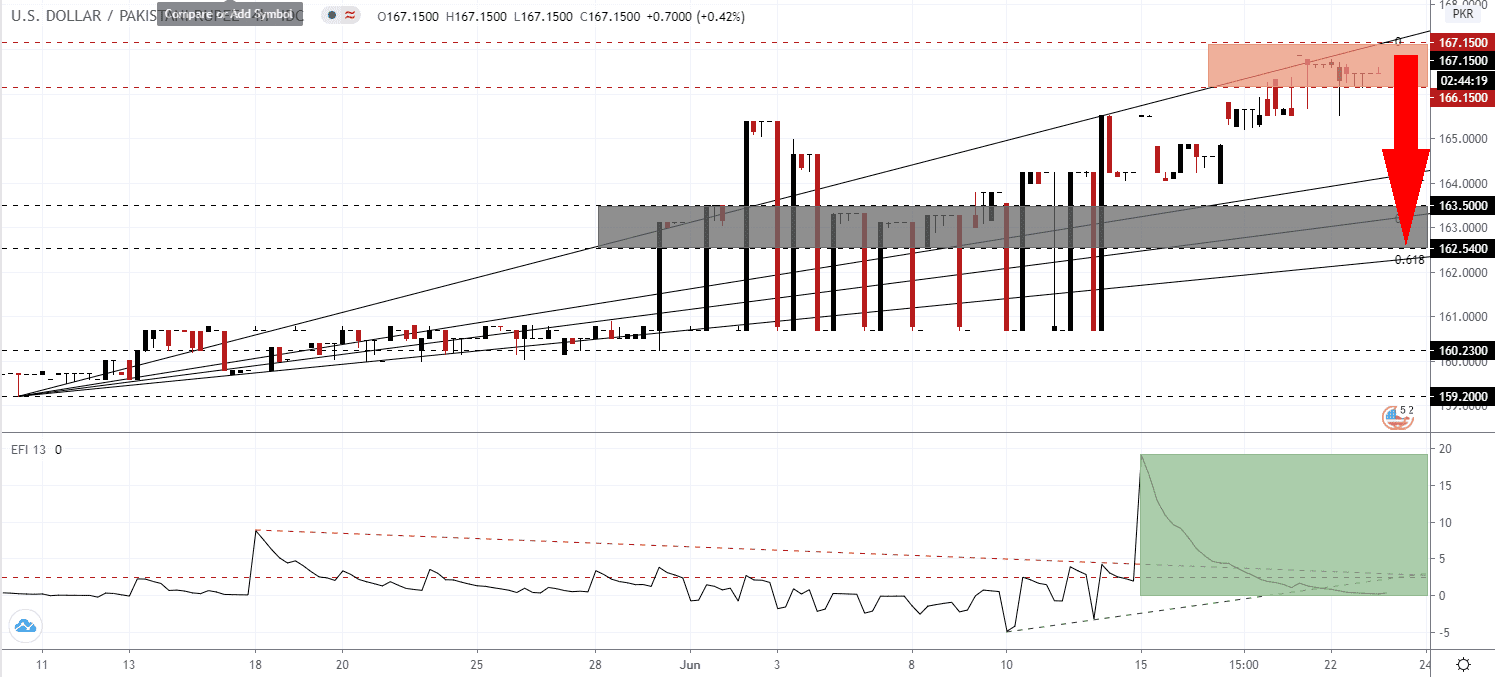

Pakistan remains on a path to implement structural economic reforms, which were initiated before the Covid-19 pandemic suspended activities. The Asian Development Bank (ADB) predicts GDP will expand by 2.0% in the 2020-2021 fiscal year, following a 0.4% contraction in the 2019-2020 period ending June 30th. Inflation remains a concern but is forecast to decrease from the current 11.0% to 8.0% in the next fiscal year. The ADB confirmed that accelerated growth rates in 2021 are due to depressed levels in 2020, and do not resemble a V-shaped economic recovery. The USD/PKR remains inside of its resistance zone from where breakdown pressures are expanding.

The Force Index, a next-generation technical indicator, continues to retreat from a brief spike to a new multi-week high. After moving below its descending resistance level, it converted its horizontal support level into resistance, as marked by the green rectangle. Adding to the accumulation of bearish momentum was the breakdown in the Force Index below its ascending support level. This technical indicator is on the verge of crossing below the 0 center-line, placing bears in complete control of the USD/PKR.

Before the Covid-19 pandemic, Pakistan was continuously seeking international bailouts. It resulted in a slow downward spiral, with the country skipping from one financial crisis to another. The latest sign of a continuation patter was the third budget of Prime Minister Khan’s government. It is based on unrealistic GDP predictions, and Abdul Hafeez Sheikh, the Advisor to Prime Minister Khan on Finance and Revenue or the de facto finance minister, acknowledged the budget as being an evolving document. Despite skepticism over the budget, the USD/PKR is vulnerable to a profit-taking sell-off driven by US Dollar weakness. A breakdown below the resistance zone located between 166.150 and 167.150, as identified by the red rectangle, is anticipated to initiate the correction.

Critics point out that the Pakistani government is more concerned with remaining part of the International Monetary Fund’s Enhanced Fund Facility (EFF) program. Losing access to it will also exclude it from the financial support provided by the World Bank and the Asian Development Bank. Therefore, the US-based IMF dictates terms of Pakistan’s economy, with reports surfacing an insistence to freeze public salaries and pensions. Uncertainty over Pakistan’s economy remains dominant, but a surge in new Covid-19 infections in the US supplies breakdown pressures. The USD/PKR is well-positioned to correct into its short-term support zone located between 162.540 and 163.500, as marked by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/PKR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 167.1500

Take Profit @ 162.5500

Stop Loss @ 168.2000

Downside Potential: 46,000 pips

Upside Risk: 10,500 pips

Risk/Reward Ratio: 4.38

In the event the Force Index accelerates above its descending resistance level, the USD/PKR could pressure for more upside. Any price spike will offer Forex traders a secondary selling opportunity to consider. While Pakistan’s budget is overly optimistic, the US is planning to pile on more debt as the economy remains under increasing pressure. The next resistance zone awaits between 168.19000 and 169.8719, with a potential challenge of the 170.000 level.

USD/PKR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 168.7500

Take Profit @ 169.7500

Stop Loss @ 168.2000

Upside Potential: 10,000 pips

Downside Risk: 5,500 pips

Risk/Reward Ratio: 1.82