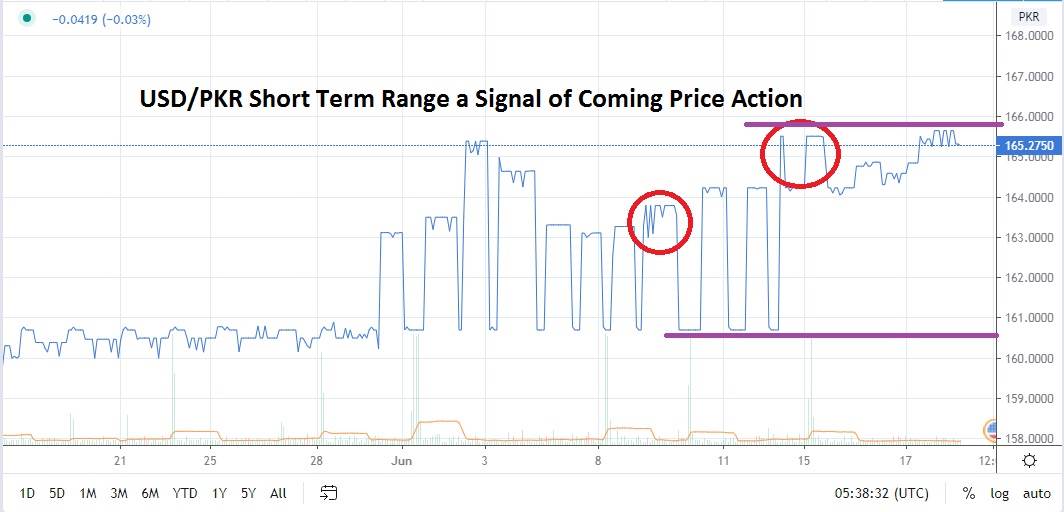

The Pakistani Rupee continues to test important resistance and interestingly has developed a consolidated range this week. The USD/PKR is not known for a large amount of trading volume and its usual range is typically wider than it has displayed compared to its price action the last few days. This development typically is interpreted by experienced traders as a signal for potential coming volatility.

What should get the attention of traders is the current support level for the Pakistani Rupee seems to be justified near the 164.0000 level. This support level could prove vulnerable if the USD/PKR sees a sell-off and the Pakistani Rupee resumes a drive towards better value.

However, the Pakistani Rupee in fact has not shown much ability to move away consistently from a strong resistance level of 166.0000. The combination of a higher level of support and a seemingly magnetic resistance level the past few days of trading makes the current value of the USD/PKR rather suspicious. The Pakistani Rupee also remains weaker by a considerable margin compared to its value in early May when it flirted with the 158.0000 juncture below.

In April of this year when sentiment about Coronavirus was possibly at its most negative, the value of the USD/PKR traded within the 166.6000 to 168.0000 range. Speculators may find the current pricing of the Pakistani Rupee interesting because its mark around 165.5000 looks like an inflection point. Which means that a test of its current range may be ready to ignite and the question is which direction the Pakistani Rupee will follow?

The USD/PKR may not be the biggest international forex pair and its volume can be shallow all too often. However, the Pakistani Rupee is indeed affected by international sentiment generated in the broad markets and because of this, it not only offers a speculative opportunity with the US Dollar, but the potential to take advantage of trends which are sometimes overlooked by many traders. Because overall sentiment in the markets appears choppy today, a speculative trade testing the range of the USD/PKR using good stop losses and take profit entries is not a bad idea. The USD/PKR looks like it is about to move in a rather dramatic way. If I were going to wager, I would actually be inclined to sell the USD/PKR and look for stronger values from the Pakistani Rupee over the next two trading days.

Pakistani Rupee Short Term Outlook:

Current Resistance: 166.0000

Current Support: 164.0000

High Target: 167.0000

Low Target: 163.0000