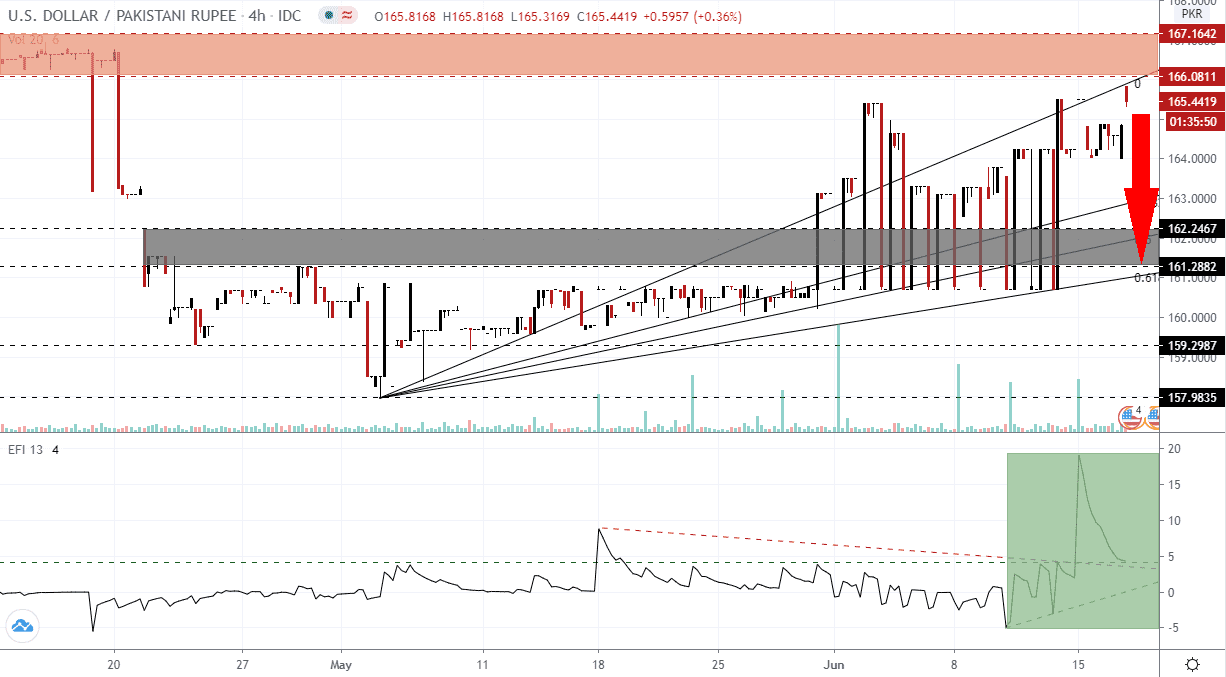

Pakistan changed its Covid-19 strategy to limit economic damage. Rather than implementing a nationwide lockdown, the government of Prime Minister Khan deploys what it refers to as a smart approach to seal-off virus hotspots with strict new quarantine measures. It will allow other parts to resume restricted activities. The initial strategy saw a broad nationwide lockdown, followed by widespread relaxation of rules. It led to a surge in new infections, mirrored across the world. Pakistan is presently on course to enter the top ten list of most confirmed Covid-19 cases. Bullish momentum in the USD/PKR is quickly collapsing as price action is nearing the bottom range of its resistance zone.

The Force Index, a next-generation technical indicator, spiked to a new multi-week peak before retreating. It is now challenging its horizontal support level, as marked by the green rectangle. A breakdown below its descending resistance level, serving as short-term support, is anticipated to lead to an accelerated collapse in the Force Index. Bears wait for this technical indicator to move below its ascending support level into negative territory to take control of the USD/PKR.

Opposition leaders blame the government for the change of tactics and the confusing message it sends to the population. Pakistan’s National Command and Operations Centre (NCOC), tasked with executing the strategy, identified twenty cities as potential hotspots. The target quarantine can comprise an area as small as a single street to an entire administrative region. Cautious optimism remains, but the country relies heavily on daily wage earners and risks forcing its poor into destitution. Rejection in the USD/PKR by its resistance zone located between 166.0811 and 167.1642, as marked by the red rectangle, remains a probability, followed by a breakdown sequence.

One potential solution to Pakistan’s problem, suggested by the World Health Organization, is a two-week cycle between lockdown and relaxation of ruled. A recent study revealed the optimal solution is a 50-day lockdown, followed by 30-days of relaxation. It did note that countries need to adjust the cycles to reflect domestic conditions. It has not gained widespread acceptance, but Pakistan may implement a version of it as it runs out of alternative options. The USD/PKR remains vulnerable to a profit-taking sell-off into its short-term support zone located between 161.2882 and 162.2467, as identified by the grey rectangle. US Dollar weakness could result in a breakdown in the USD/PKR below its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/PKR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 165.4400

Take Profit @ 161.2900

Stop Loss @ 166.4400

Downside Potential: 41,500 pips

Upside Risk: 10,000 pips

Risk/Reward Ratio: 4.15

In the event the Force Index uses its descending resistance level as a platform to reverse to the upside, the USD/PKR is likely to attempt a breakout. Given the surge in new Covid-19 cases in the US, which accompanied the aggressive rush to reopen the economy, the long-term outlook has turned more bearish. Forex traders are advised to consider any price spike as selling opportunity, with the next resistance zone located between 168.19000 and 169.8719.

USD/PKR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 167.1900

Take Profit @ 168.1900

Stop Loss @ 166.6900

Upside Potential: 10,000 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 2.00