Norway’s economy is emerging from the depths of the Covid-19 pandemic ahead of the curve. Retail sales, which increased by 4.8% in April, produced another fact confirming what is locally known as annerledeslandet. It is translated as the Nordic kingdom being a very different country from most others. Norwegian consumers experience elevated confidence regarding economic survival, a nod to the country's domestic policies. It is also home to the world’s biggest sovereign wealth fund, established to invest its massive petroleum income for future generations. The outlook for the USD/NOK carries a distinct bearish bias, but the rise in bullish momentum suggests a brief counter-trend breakout before resuming an accelerated sell-off.

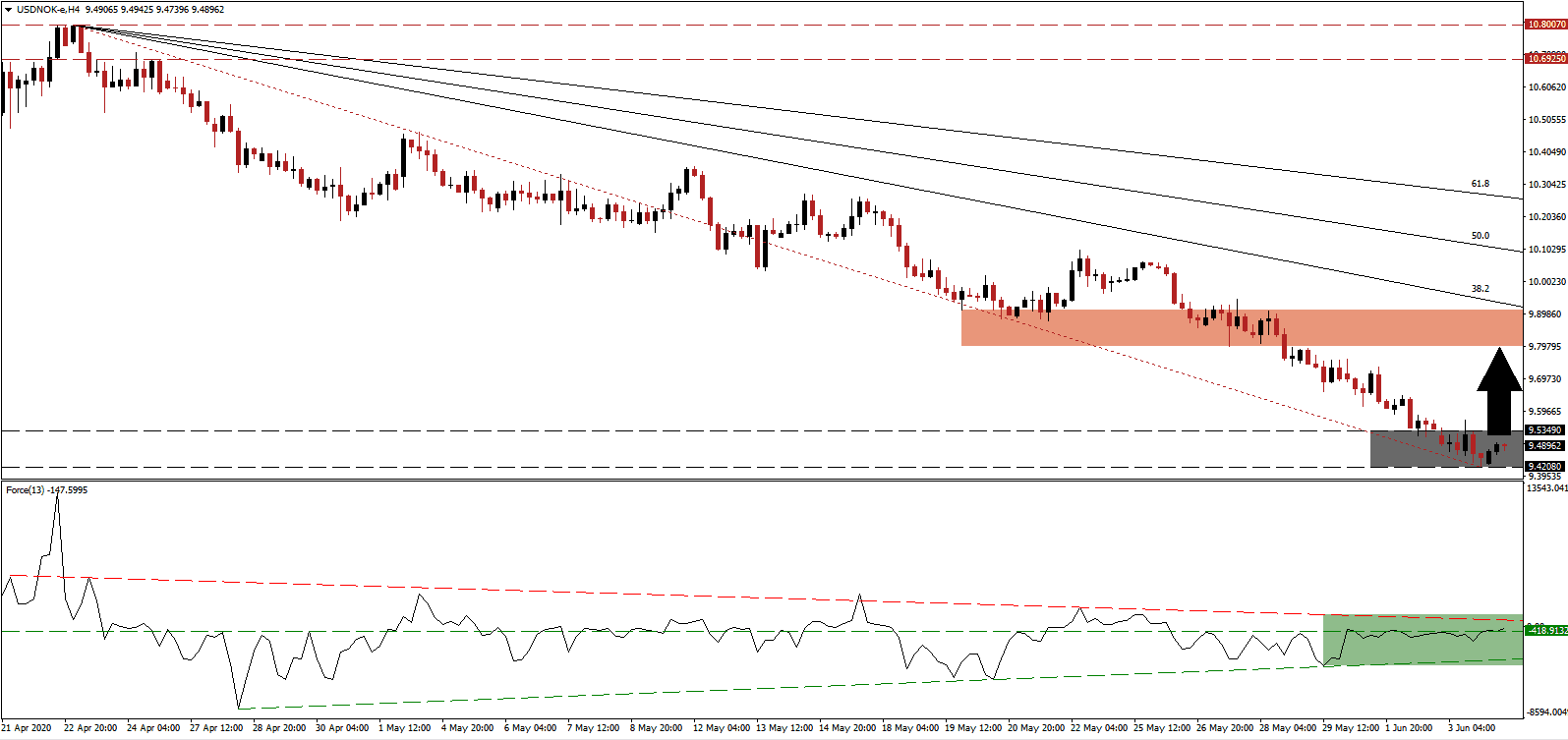

The Force Index, a next-generation technical indicator, was driven higher by its ascending support level, as marked by the green rectangle. It resulted in the conversion of its horizontal resistance level into support, but the descending resistance level is applying bearish pressures. With this technical indicator in negative territory, bears remain in control of the USD/NOK. A temporary spike higher cannot be excluded, which will keep the long-term downtrend intact.

Adding to positive developments for Norway is the Nordic travel bubble with Denmark. It excludes Sweden due to its controversial relaxed approach to the Covid-19 pandemic. Norway also announced a NOK3.6 billion crisis package to support and enhance green projects focused on hydrogen, battery technology, offshore wind, and low-emission shipping. While the long-term outlook for Norway and the Norwegian Krone is increasingly bullish, the excessive rally in the USD/NOK is vulnerable to a short and necessary counter-trend breakout above its support zone located between 9.4208 and 9.5349, as identified by the grey rectangle. It will ensure the longevity of the long-term bearish trend.

US economic data may provide a brief bullish catalyst if initial jobless claims follow yesterday’s ADP surprise to the upside. Intensifying riots across the US endanger a violent acceleration in Covid-19 infections, adding distinct downside pressure on the US Dollar. The upside potential in the USD/NOK is confined to its short-term resistance zone located between 9.7997 and 9.9107, as marked by the red rectangle. It continues to be lowered, reflecting the dominance of the bearish chart pattern. The descending 38.2 Fibonacci Retracement Fan Resistance Level is adding a continuous supply of downside pressure.

USD/NOK Technical Trading Set-Up - Brief Breakout Scenario

Long Entry @ 9.4900

Take Profit @ 9.7900

Stop Loss @ 9.3900

Upside Potential: 3,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 3.00

Should the Force Index collapse below its ascending support level, the USD/NOK is expected to follow with a breakdown. It will then continue its long-term corrective phase, driven by a combination of Norwegian strength and US weakness. Any breakout from current levels is favored to keep the bearish trend intact, offering Forex traders a secondary short selling opportunity. Price action will challenge its next support zone between 9.0074 and 9.0688, which includes the closure of a price gap to the upside.

USD/NOK Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 9.3300

Take Profit @ 9.0000

Stop Loss @ 9.4300

Downside Potential: 3,300 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 3.30