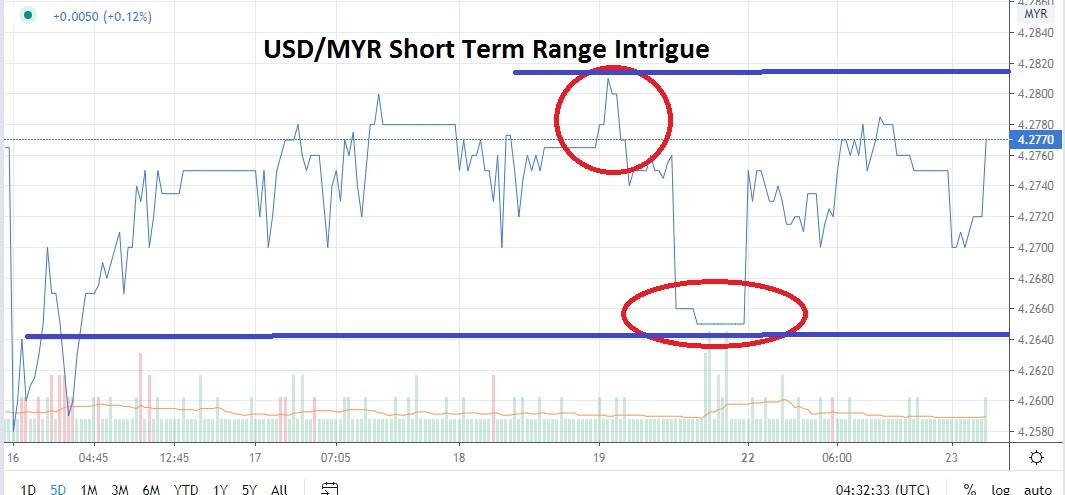

The narrow range of the Malaysian Ringgit continues to be attractive for short term traders. The relatively shallow price range of the USD/MYR provides speculators with an opportunity to enter trades at current market values and explore with buying and selling positions depending on their technical perspectives.

Resistance for the USD/MYR has proven strong near the 4.2800 level and could continue to display this strength. Up above this resistance level is a rather large stretch of trading in early June which has not been tested since the US Dollar began to sell off and saw the Malaysian Ringgit gain value afterward. This means if resistance does falter, the Malaysian Ringgit could see a test of its sentiment it has not experienced for a while and see targets for buyers of the USD/MYR around the 4.2820 to 4.2830 junctures.

However, with such prominent resistance speculators may continue to seek reversals and selling positions of the USD/MYR. The past five trading sessions of the Malaysian Ringgit clearly demonstrate that a vast amount of its trading range has been between the 4.2660 and 2.2780 levels. The USD/MYR in early trading today has continued to gravitate near resistance, but traders may be tempted to test waters which have proven rather attractive the past week and short the Malaysian Ringgit at its current price.

Global markets have displayed a taste for more risk appetite as the week has begun. Yesterday’s trading for the USD/MYR did produce a weaker value for the Malaysian Ringgit but it was able to maintain a rather fractional range and did not show signs of a sudden breakout. Forex speculators should fear volatility because it can damage their trading accounts swiftly when positions go against them. However, traders also need to use broad sentiment to their advantage and understand when the global markets want to add risk and are strong; the USD/MYR could be in a better atmosphere to sell.

Therefore, the USD/MYR offers a rather polite trading environment taking into consideration this forex pair is still well within the definition of a speculative endeavor. For some, this is even more justification to pursue the USD/MYR because even though the Malaysian Ringgit can be defined as an emerging market currency by many, it does offer the advantage of a rather tranquil trading range which can prove worthwhile.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.2800

Current Support: 4.2700

High Target: 4.2850

Low Target: 4.2650