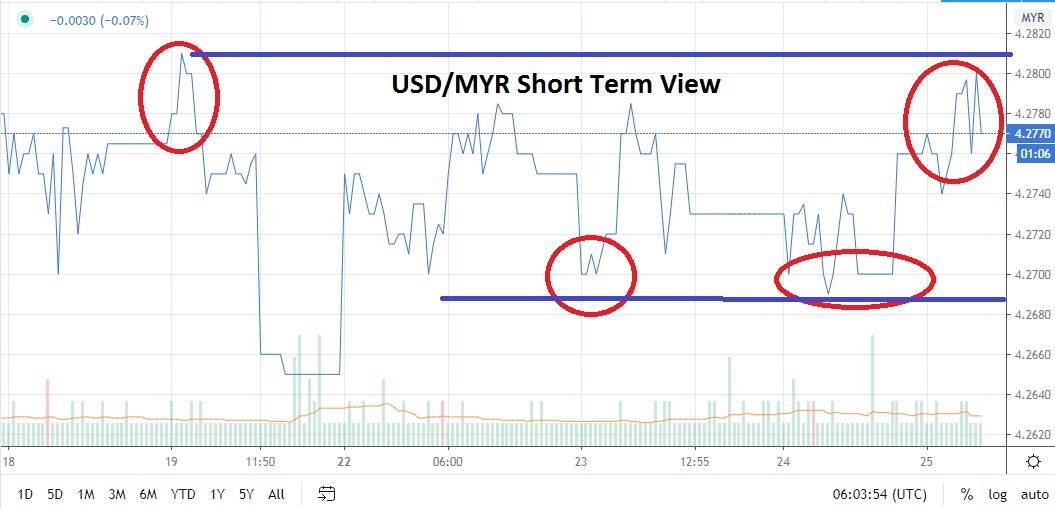

Even as global equity markets roiled late yesterday and early today the USD/MYR has been able to hold onto its known value range. This is an important consideration for speculators who prefer to stay away from sudden bursts of volatility when trading emerging market currency pairs. The Malaysian Ringgit continues to offer opportunities to short term traders who are ready to take positions.

Speculators will have to keep their eyes open today and tomorrow and make sure media hyperbole doesn’t trigger widespread fear in global markets. If investors can regain their composure the USD/MYR could easily maintain its known range. However, when forex markets turned volatile, the USD/MYR did see a flurry of buying a test of resistance at the 4.2800 value juncture. The question is if this resistance level will prove vulnerable in the next two days?

The Malaysian Ringgit has done well in trading, has proven its value, has staying power, and may even have the ability to make further gains against the US Dollar mid-term. Short term traders however may look at the current value levels of the USD/MYR and believe that the Malaysian Ringgit may face a test of its value today and tomorrow via buyers of the US Dollar who may seek to take risks off the table. Resistance for the USD/MYR may be weak.

A target for buyers of the USD/MYR short term may be the higher resistance level of 4.2850. However, if a speculator can buy the USD/MYR at levels around the 4.2750 to 4.2770 marks and use carefully chosen stop losses, upside potential and a target near resistance levels of 4.2810 would be a profitable target too.

The current trading range of the USD/MYR is attractive because it offers a solid value range for speculators to take advantage of using technical charts. The value of the USD/MYR clearly demonstrates there has been an opportunity for traders on both sides of the trading spectrum via short and long positions. Because of today’s existing trading sentiment and negative price action on many Asian equity indices, and an opening decline expected in the US markets today, buying the USD/MYR based on its current price levels seems like a logical speculative position.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.2810

Current Support: 4.2740

High Target: 4.2850

Low Target: 4.2680