Malaysia’s GDP outlook was revised lower by the International Monetary Fund (IMF), from a 1.7% contraction to 3.8% in 2020. It reflects the ongoing Covid-19 pandemic, harming global trade and GDP, which is forecast to drop by 11.9% and 4.9%, respectively. Since gaining independence in 1957, Malaysia endured three recessions. The 1985 commodities shock resulted in a 1.0% GDP contraction, the 1998 Asian financial crisis plunged the economy by 6.7%, and the 2008 global financial crisis caused a decrease of 1.7%. Overall, Malaysia remains a well-diversified economy with a bright outlook. The USD/MYR advanced into its short-term resistance zone from where a new breakdown sequence is favored.

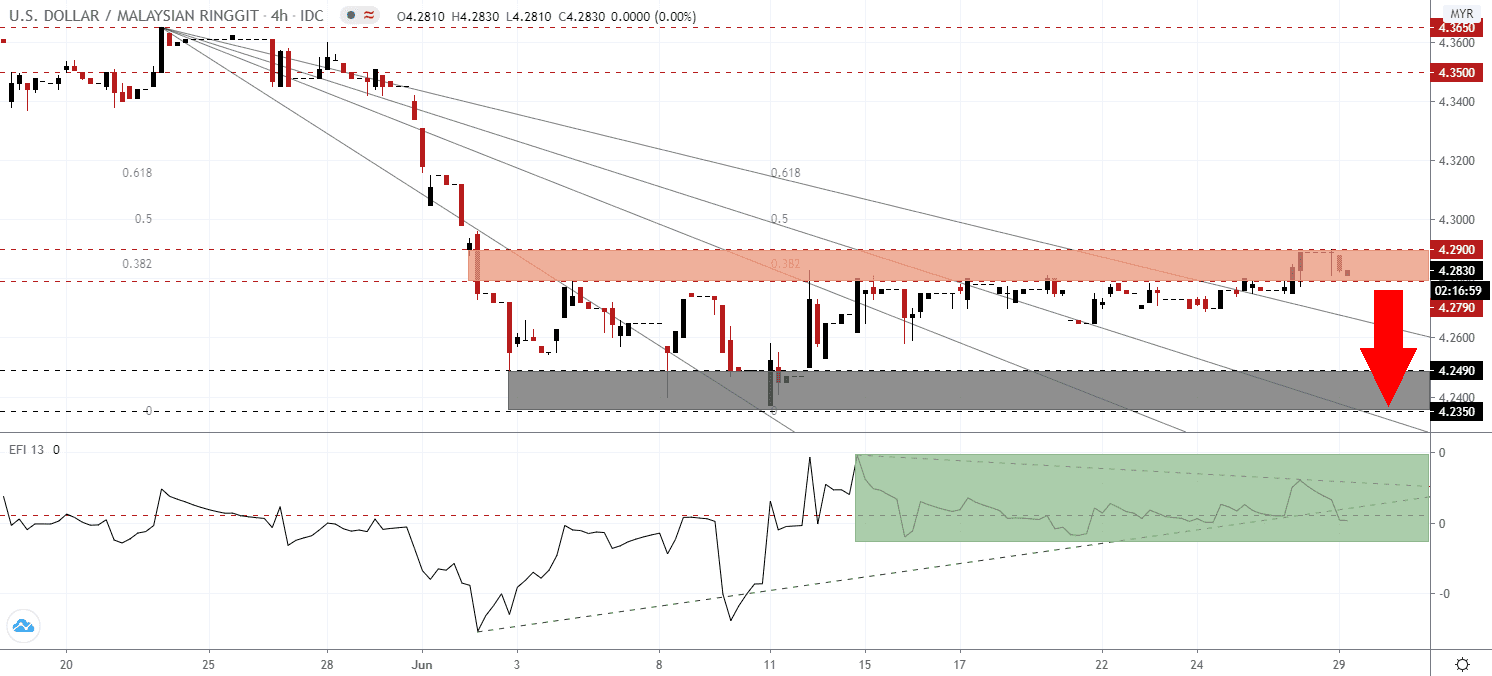

The Force Index, a next-generation technical indicator, offers an early warning that a price action reversal is imminent. While this currency pair drifted higher, the Force Index recorded a lower low, and a negative divergence materialized, as marked by the green rectangle. It was followed by a breakdown below its ascending support level and the conversion of its horizontal support level into resistance. This technical indicator is on the verge of crossing below the 0 center-line, ceding complete control of the USD/MYR to bears.

According to Bank Negara Malaysia (BNM), the country’s central bank, and the Department of Statistics Malaysia (DOSM), first-quarter 2020 GDP rose by 0.7%. BNM, in its April economic update, projected total GDP to clock in between an expansion of 0.5% and a contraction of 2.0%. The next update is expected to reflect a downward revision, as the unemployment rate continues to increase. The USD/MYR is under growing downside pressure after ascending into its short-term resistance zone located between 4.2790 and 4.2900, as identified by the red rectangle.

In response to the Covid-19 pandemic, the government implemented four stimulus packages worth RM315 billion. The relatively low debt-to-GDP ratio of 52.50% reported in 2019 allows the government a degree of flexibility without crushing the Malaysian Ringgit. At the same time, the US continues to devalue the US Dollar with an uncontrolled debt binge, driven by short-term policy goals. The USD/MYR is well-positioned to correct below its descending 61.8 Fibonacci Retracement Fan Support Level. An extension into its support zone located between 4.2350 and 4.2490, as marked by the grey rectangle, is anticipated. More downside is likely to emerge, driven by US Dollar weakness and a positive outlook on the Malaysian economy, especially after signing the Regional Comprehensive Economic Partnership (RCEP).

USD/MYR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 4.2825

Take Profit @ 4.2350

Stop Loss @ 4.2975

Downside Potential: 475 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 3.17

In the event the Force Index pushes above its descending resistance level, the USD/MYR may attempt a breakout. While the US is expected to announce another spike in its debt level, taking over $1 trillion in interest payments out GDP annually, bearish pressures on the US Dollar are expanding. Forex traders are advised to consider any advance as an outstanding short-selling opportunity, while the upside potential remains limited to its resistance zone between 4.3500 and 4.3650.

USD/MYR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 4.3175

Take Profit @ 4.3500

Stop Loss @ 4.2975

Upside Potential: 325 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 1.63