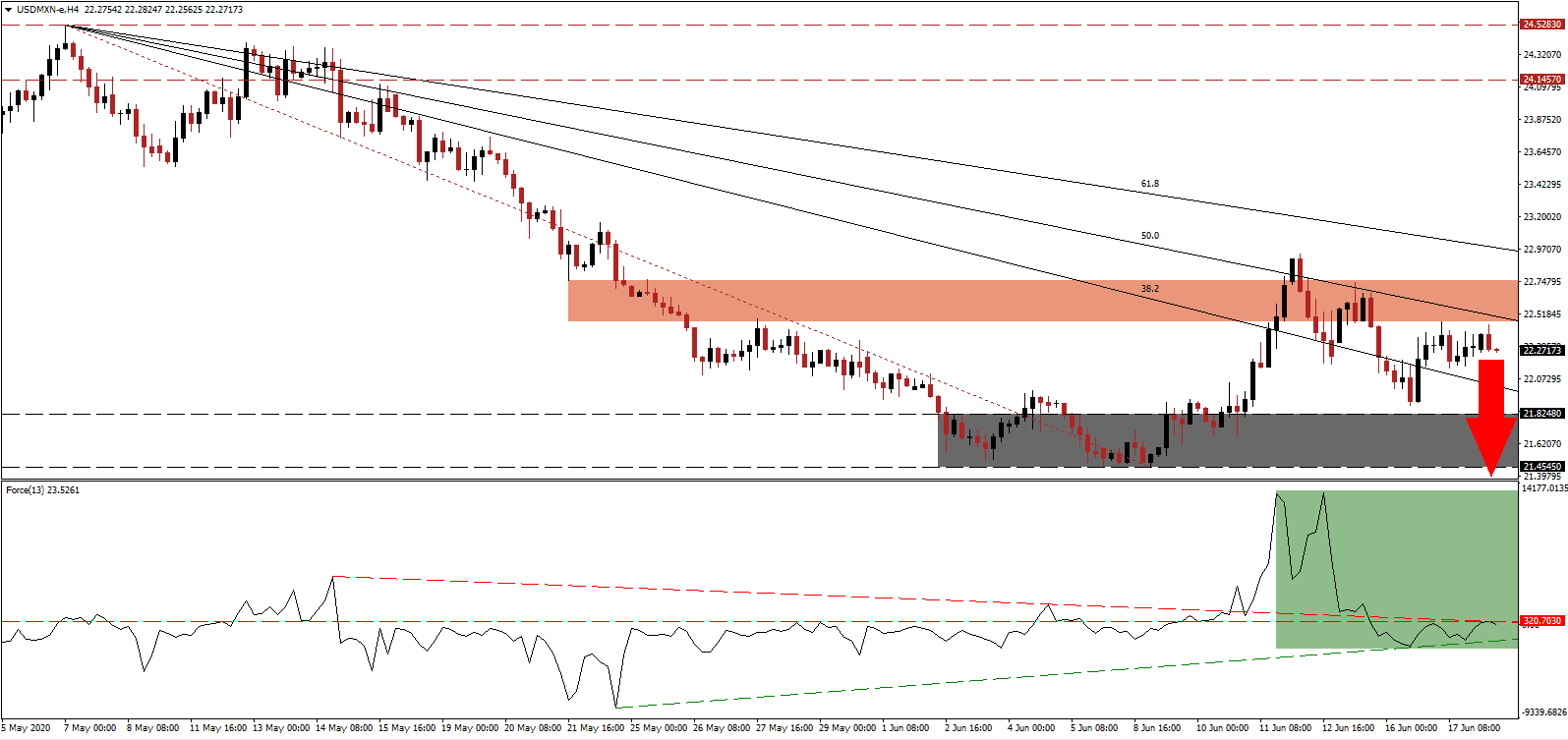

Mexican President López Obrador is under intensifying criticism for his government’s strategy in response to the Covid-19 pandemic. While most countries favor the US approach of spiking unsustainable debt levels, he announced more spending cuts in April. Rather than bailing out businesses, the response focuses on assisting those in need through more welfare spending and social programs. It adds a significant positive catalyst to the Mexican Peso, driving the corrective phase in the USD/MXN. Following a minor reversal, the short-term resistance zone is set to reject price action and extend the sell-off.

The Force Index, a next-generation technical indicator, surged to a new multi-week high together with this currency pair’s temporary counter-trend advance. Bullish momentum deflated rapidly, and the Force Index converted its horizontal support level into resistance, as marked by the green rectangle. The descending resistance level is now increasing downside pressure, anticipated to result in a breakdown below its ascending support level. This technical indicator is on course to correct into negative territory, granting bears complete control of the USD/MXN.

Despite being a socialist government, Mexico’s approach to the Covid-19 pandemic is more capitalistic than those in the developed world, claiming to favor free-market capitalism. Short-term criticism will remain, but the long-term verdict carries more significance. The current US bailout and stimulus package amounts to roughly 12% of GDP, and more is debated due to bearish economic data. Mexico’s response is merely 0.7% of GDP, confirming fiscal responsibility. The USD/MXN may challenge the bottom range of its short-term resistance zone located between 22.4646 and 22.7508, as identified by the red rectangle, before resuming an accelerated breakdown.

Job losses from the absence of government bailouts are countered, in typical socialist fashion, by mega infrastructure projects. President López Obrador did confirm they will add over two million jobs by the end of 2020, well short of the estimated 12.5 million job losses reported in April alone. Besides ensuring manageable debt, his strategy also manifests the role of government in day-to-day life. The descending 50.0 Fibonacci Retracement Fan Resistance Level is expected to enhance the sell-off, pressuring the USD/MXN below its support zone located between 21.4545 and 21.8248, as marked by the grey rectangle. Price action will face its next support zone between 19.8919 and 20.2760.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 22.2500

Take Profit @ 19.9000

Stop Loss @ 22.7500

Downside Potential: 23,500 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 4.70

Should the Force Index accelerate above its descending resistance level, the USD/MXN is likely to push higher. It may result in a brief price spike, but the 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to maintain the long-term bearish trend. Forex traders are advised to view any breakout attempt as a secondary selling opportunity, backed by increasing negative progress out of the US.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 22.8500

Take Profit @ 22.9500

Stop Loss @ 22.8000

Upside Potential: 1,000 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 2.0