The US dollar has gone back and forth during the trading session on Monday, as we are sitting just above a potentially important support level. When looking at the technical analysis, a couple of things should start to stand out. The first thing of course is that the US dollar has absolutely nosedived against the Mexican peso, which means that it is probably somewhat overdone to the downside. Having said that, we have seen a lot of US dollar weakness in general, so it makes quite a bit of sense that a thinner market like the USD/MXN pair would see an exaggerated move.

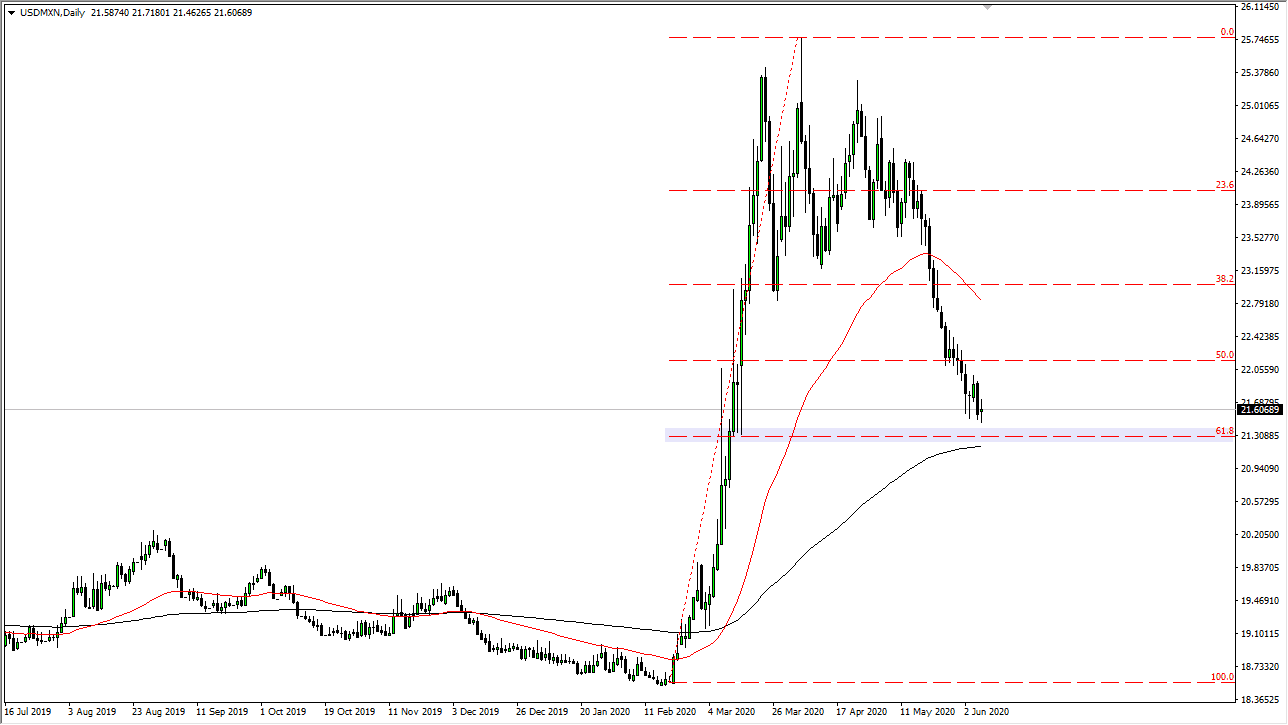

Looking at this chart, you can also see that the 61.8% Fibonacci retracement level is just below, and underneath there is the 200 day EMA, because of this, it should be an area that sees a lot of support near the 21.30 pesos level.

Ultimately, I think that the market is probably going to continue to see a lot of technical support in this area, as we have seen quite a bit of buying pressure in this general vicinity back in the early part of March. Having said all of that, the Mexican economy certainly is going to get a bit of a boost due to the coronavirus subsiding a bit, and the United States opening up, which is Mexico’s number one export market. That should continue to lift the Mexican economy a bit, and therefore we should see the move that we have already.

The question now is whether or not Mexico can sustain some type of major rally? With the technical analysis suggesting that there are buyers just below, we may see a bit of a bounce. Clearly, the market is overdue for that but if we were to break down below the 200 day EMA then you have to start taking into account the possibility that we could wipe out the entire move, sending this market all the way down to the 18.50 pesos level.

To the upside, the 23 pesos level could be an area of interest, as it was previous support. The market is overdue for a bounce, and I think that we will get a little bit of recovery. On a break above the 22 pesos level, that is a sign that we are in fact going to see a bit of movement to the upside.