Despite heavy criticism, Mexican President López Obrador defends his decision to meet with US President Trump. It will be his first foreign trip since he took office. The majority of Mexicans have an unfavorable view of President Trump, but Mexico depends heavily on its northern neighbor. Approximately 80% of all exports are to the US, and over 35 million Mexicans work in the US, resulting in billions of US Dollars in remittances, providing essential capital to Mexican households, particularly poor ones. The USD/MXN is in the process of challenging the bottom range of its short-term resistance zone.

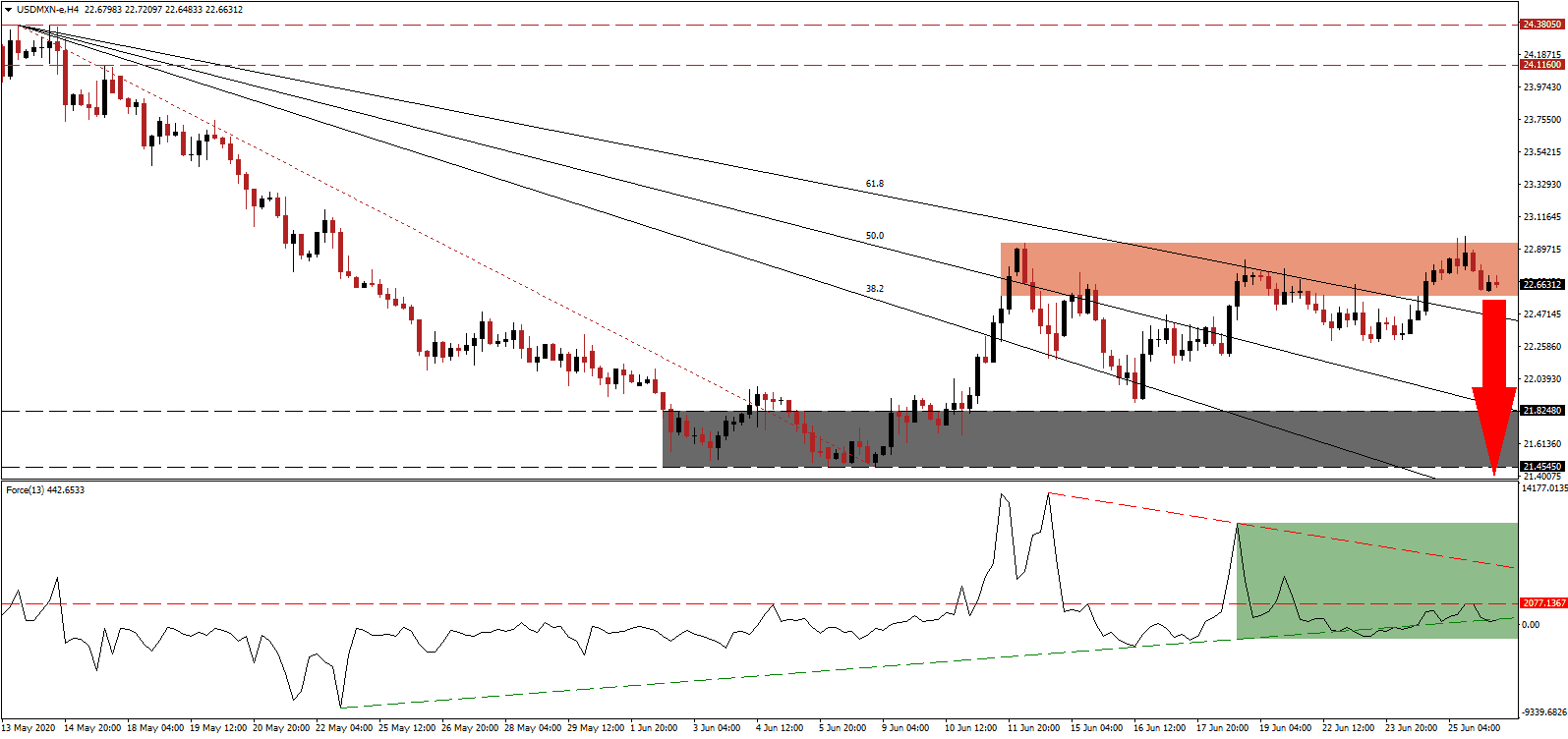

The Force Index, a next-generation technical indicator, shows the emergence of a negative divergence. While this currency pair drifted higher, the Force Index recorded a significantly lower high. After the horizontal resistance level rejected an advance, this technical indicator reversed below its ascending support level and is favored to plunge into negative territory, ceding control of the USD/MXN to bears. The descending resistance level is expected to maintain downside pressure.

Critics claim that President Trump is attempting to improve his image with Hispanic voters, after ruining his perception in the community. Repeated calls that Mexico pay for his border wall and labeling Mexican migrants as criminals tarnished his reputation. President López Obrador is aware of the disastrous meeting his predecessor Pena Nieto had in 2016. A June 20 poll showed 68% of Mexicans viewed Trump negatively. The USD/MXN is under rising breakdown pressures inside of its short-term resistance zone located between 22.5895 and 22.9384, as marked by the red rectangle.

For President López Obrador, this trip allows him to fuel the anticipated nearshoring trend following the global Covid-19 pandemic. Mexico s ideally positioned for supply chain adjustments out of China. Violence and attacks on transport lines remain a critical hurdle for more massive moves into Mexico by US companies, a concern López Obrador is likely to address. It adds to rising bearish pressures in the USD/MXN, on course for a correction below its descending 61.8 Fibonacci Retracement Fan Support Level. An accelerated sell-off into its support zone located between 21.4545 and 21.8248, as identified by the grey rectangle, should follow. More downside is expected, with the 38.2 Fibonacci Retracement Fan Support Level below the support zone.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 22.6600

Take Profit @ 21.4200

Stop Loss @ 23.0600

Downside Potential: 12,400 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 3.10

Should the Force Index accelerate above its descending resistance level, the USD/MXN could attempt a second breakout. With new Covid-19 infection setting new daily records in the US, Texas and Florida pausing the economic reopening process, and the latest bank stress test revealing problems, any push higher should be considered an excellent selling opportunity. The next resistance zone is located between 24.1160 and 24.3805.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 23.5000

Take Profit @ 24.1000

Stop Loss @ 23.2000

Upside Potential: 6,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.00