The Mexican peso got absolutely crushed during trading on Thursday, as there was a major “risk off” move around the world. People are starting to worry about the reinfection rate of coronavirus potentially shutting things down again, and as a result, the markets will need to adjust to these potential issues. That being said, one of the biggest concerns that people will have is what happens in the emerging markets. They are much more susceptible to issues than some of the developed ones, so Mexico got punished.

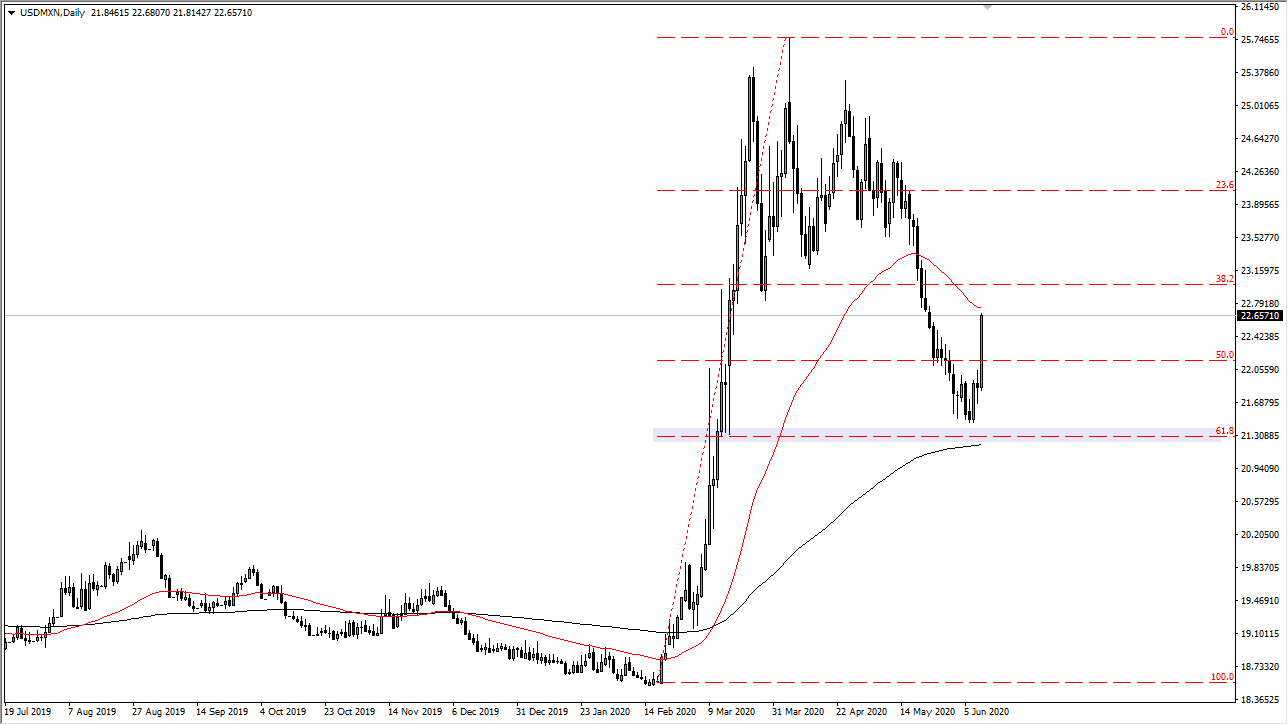

Furthermore, the market may have been a bit overdone, so it does make sense that we would see a bit of a correction. However, the ferocity of the correction tells you that something either just shifted or changed completely. It is because of this that I think we are going to start to see the market grind higher, although we may get a short-term pullback. I would look at pullbacks as potential buying opportunities because not only do I think that Mexico is a bit far out on the risk curve, but I also see several technical convergences as well. For example, the 61.8% Fibonacci retracement level has made itself known just below, and of course the 200 day EMA is right at the same spot. This move during the day on Thursday with a continuation of what started on Tuesday. It is worth noting that the internals of the stock market in New York on Monday started to show signs of selling volume picking up. That coincides almost perfectly with this chart so a lot of times that tells you that we are about to see a major “risk off” type of situation. If that is true, then the Mexican peso will find itself being sold into.

As long as we are above the 200 day EMA there is still a good chance of a recovery in the greenback, as we have seen the US dollar gain against almost everything out there during the day. Of course, the Mexican peso would be one of the weakest currencies to fight it, after all, Mexico is an extraordinarily speculative place to be, so its currency can move rather quickly.

With this, I believe that we will find pullbacks supported, and eventually, this pair will probably go towards the 23.50 pesos level. If we did break down below the 200 day EMA, then the market is likely to go down to the 20 pesos level.