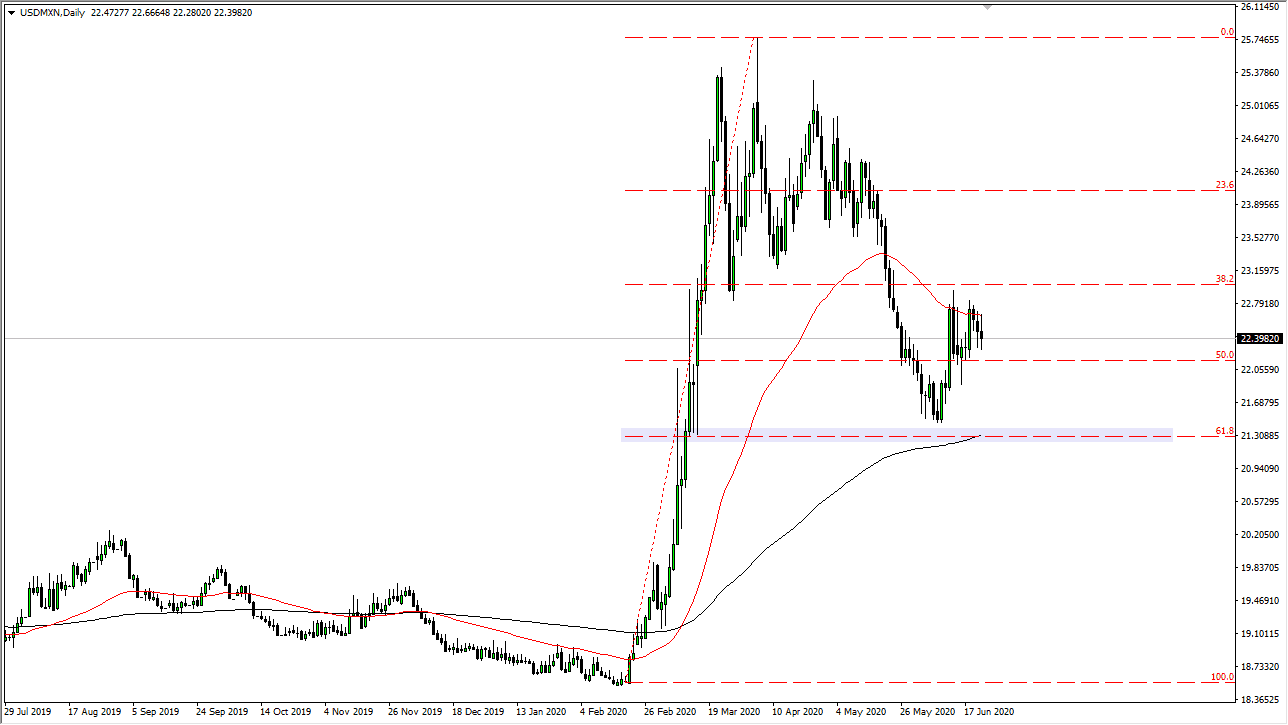

The US dollar has gone back and forth during the Tuesday session as we are trading just below the 50 day EMA. The 50 day EMA, colored in red on the chart, is of course offering a little bit of resistance but looking at this chart it is likely that we will continue to see volatility. This makes quite a bit of sense considering that there are a lot of concerns when it comes to the coronavirus infections in Mexico, and of course, this is a gateway currency for Latin America.

The Latin American region of the world has seen a massive surge in coronavirus infections, and of course in the Forex world, the Mexican peso and the Brazilian Real are the two main currencies people used to express their opinion of that part of the world. This pair does tend to be very choppy but all things being equal, the market is likely to continue a lot of this choppy behavior. One thing you can see is that we are potentially forming a bit of a rising wedge, which could see the market go back towards the 61.8% Fibonacci retracement level. At that level, you would see the 200 day EMA come into the picture and should offer plenty of support. However, if we were to turn around to break above the 23 pesos level, then the market should go to the 24 pesos level, possibly even the 25 pesos level.

All things being equal, this is a market that I think will continue to see a lot of noise but as soon as we get an impulsive candle and a break out above the 50 day EMA on a daily close or perhaps a bounce from the 200 day EMA, then the buyer should come back into the picture. Remember that the US dollar is considered to be a safety currency, especially when it comes to emerging markets like the Mexican peso. However, if we suddenly go “risk-on” that could drive money back into currencies such as the Mexican peso. I do not see that as a likely scenario, at least not for anything more than a quick trade as the world is essentially a whole hot mess of negative headlines just waiting to happen. I think the one thing that you can probably count on is that it is going to be a wild ride.