Mexico’s economy plunged by 17.3% in April, the steepest contraction since 1993 per the National Institute of Statistics and Geography (INEGI), the autonomous Mexican government agency responsible for official statistics. Economists predicted a slump of 19.4%, as the Covid-19 pandemic forced lockdowns and social distancing. Primary activities decreased by 6.4%, secondary ones by 25.1%, and tertiary ones by 14.4%. Auto production was leading the collapse in economic activity, down 98.8%. The data released last Friday helped the USD/MXN extend its counter-trend advance farther to the upside, but dominant bearish momentum hints at a breakdown inside of its adjusted short-term resistance zone.

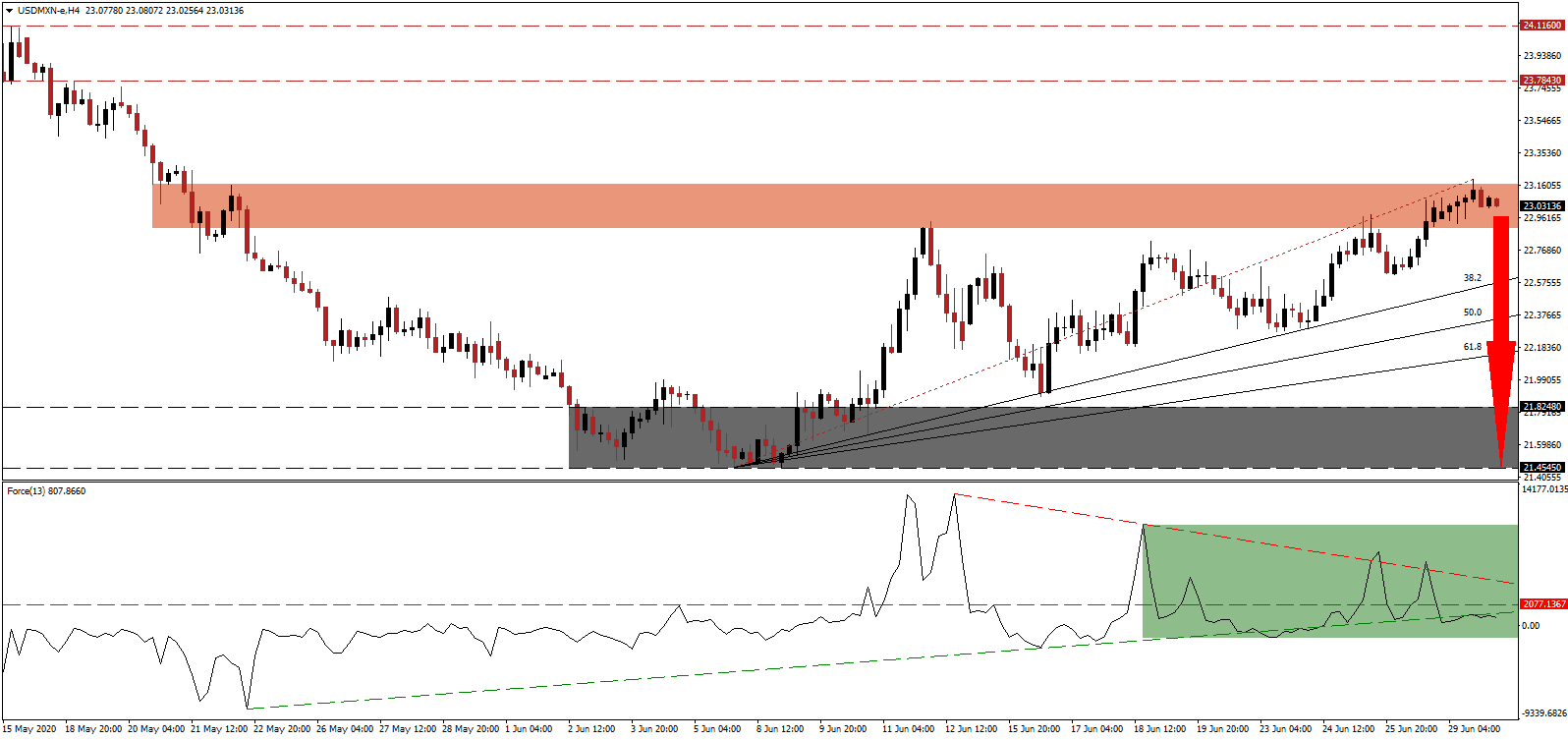

The Force Index, a next-generation technical indicator, offers a warning signal with the confirmation of a negative divergence. While this currency pair drifted higher, the Force Index created a duo of higher lows, as marked by the green rectangle, maintaining the descending resistance level. It remains below its horizontal resistance level, and the breakdown below its ascending support level added to bearish pressures. After this technical indicator crosses into negative territory, bears will have full control over the USD/MXN.

While expectations for an improvement in May’s data are likely to be met, the road to recovery for Mexico’s $2.57 trillion-economy, measured by purchasing power parity, the 11th largest in the world, remains long. Mexican President López Obrador is optimistic about the economic future, which now depends on his mega infrastructure programs and manufacturing within the USMCA trade deal. After the USD/MXN briefly pierced its short-term resistance zone located between 22.9012 and 23.1631, as identified by the red rectangle, to the upside, it reversed with an expansion in bearish momentum.

With his first foreign trip since taking office, President López Obrador defies criticism to meet US President Trump during his re-election campaign. Memories from the disastrous meeting between his predecessor Pena Nieto and then-candidate Trump continue to anger Mexicans. For López Obrador, it is a necessary meeting to take advantage of the nearshoring, a growing trend accelerated by the Covid-19 pandemic. A breakdown in the USD/MXN is favored to lead it into its ascending 61.8 Fibonacci Retracement Fan Support Level from where an extension into its support zone located between 21.4545 and 21.8248, as marked by the grey rectangle, is anticipated.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 23.0300

Take Profit @ 21.4800

Stop Loss @ 23.4300

Downside Potential: 15,500 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 3.88

In case the Force Index pushes above its descending resistance level, the USD/MXN is likely to attempt to extend its advance. Forex traders are recommended to consider any breakout attempt as a secondary short-selling opportunity, as the Covid-19 pandemic is spiraling out of control in the US. States have begun to revert the rushed economic reopening process with downside pressure in the US Dollar rising. Price action will challenge its next resistance zone between 23.7843 and 24.1160.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 23.6800

Take Profit @ 24.0800

Stop Loss @ 23.4300

Upside Potential: 4,000 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.60