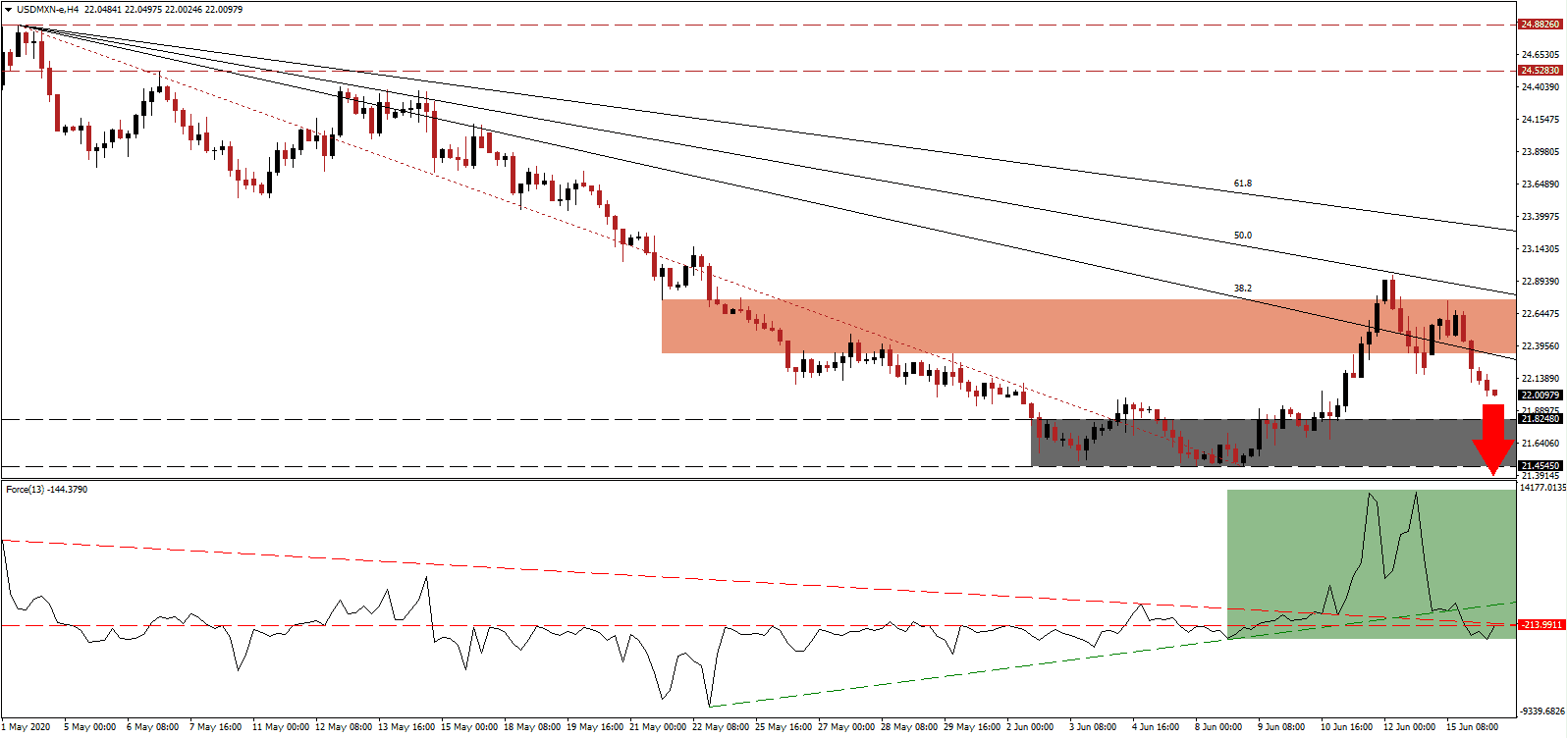

Mexico’s economy struggles under Covid-19 lockdown measures, facing identical challenges as most countries are balancing the healthcare system with job losses and economic activity. While the government of President Lopez Obrador issued a delayed nationwide lockdown, exceptions for his landmark infrastructure projects were made. They include the Felipe Angeles airport, a Gulf coast refinery at Dos Bocas, and rail line along the Caribbean coast connecting Chiapas state to the Yucatan Peninsula, referred to as the Maya Train. After the 50.0 Fibonacci Retracement Fan Resistance Level rejected the USD/MXN, the breakdown sequence is anticipated to gather steam.

The Force Index, a next-generation technical indicator, confirmed the preceding advance with a surge to a multi-week peak before rapidly collapsing. Adding to the rise in bearish momentum was the breakdown below its ascending support level. The Force Index also converted its horizontal support level into resistance, as marked by the green rectangle, followed by a move below its descending resistance level. Bears have regained complete control of the USD/MXN after this technical indicator corrected below the 0 center-line.

Critics of the megaprojects point out that they do not cover the lack of stimulus for the economy as a whole. A survey conducted by INEGI determined 12.5 million job losses for April, together with a record plunge in industrial production of 25.1%. It assisted the short-covering rally in the USD/MXN, but negative progress out of the US where new Covid-19 infections are soaring ensured the dominance of the long-term correction. After this currency pair contracted below its short-term resistance zone located between 22.3351 and 22.7508, as marked by the red rectangle, selling pressure intensified.

One significant bullish catalyst for the Mexican economy is nearshoring. The global pandemic will lead to essential changes in the supply chain, and Latin America’s second-largest economy is ideally positioned to attract manufacturing and services from US and Canadian clients. It offers qualified and cheaper labor with proximity to target markets. Drug-related violence needs to come under control, as it has prevented companies from moving into Mexico. The USD/MXN is expected to challenge its support zone located between 21.4545 and 21.8248, as identified by the grey rectangle. A breakdown into its next support zone between 19.8919 and 20.2760 is likely to materialize.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 22.0000

Take Profit @ 19.9000

Stop Loss @ 22.6000

Downside Potential: 2,000 pips

Upside Risk: 6,000 pips

Risk/Reward Ratio: 3.50

A breakout in the Force Index above its ascending support level, serving as resistance, is favored to result in a brief price spike in the USD/MXN. Forex traders are advised to view it as a secondary short-selling opportunity, due to the ongoing negative progress in the US economy. The US Federal Reserve announced more market manipulation, suggesting a worse than previously determined in the underlying economy. The 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to maintain the bearish chart pattern.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 22.8500

Take Profit @ 23.2500

Stop Loss @ 22.6000

Upside Potential: 4,000 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.60