Mexican President López Obrador acknowledged 85,000 formal job losses related to the Covid-19 pandemic, adding that the number is forecast to increase to 130,000 by the end of June, and 1,000,000 in total. He counters it with claims his mega infrastructure program will create 2,000,000 jobs by the end of 2020. The unofficial employment loss is significantly higher, resulting in a massive negative economic impact. Mexico is on track to enter the Top 10 list of most infected countries, as the government pushes to expedite the reopening process. The USD/MXN spiked into its short-term resistance zone.

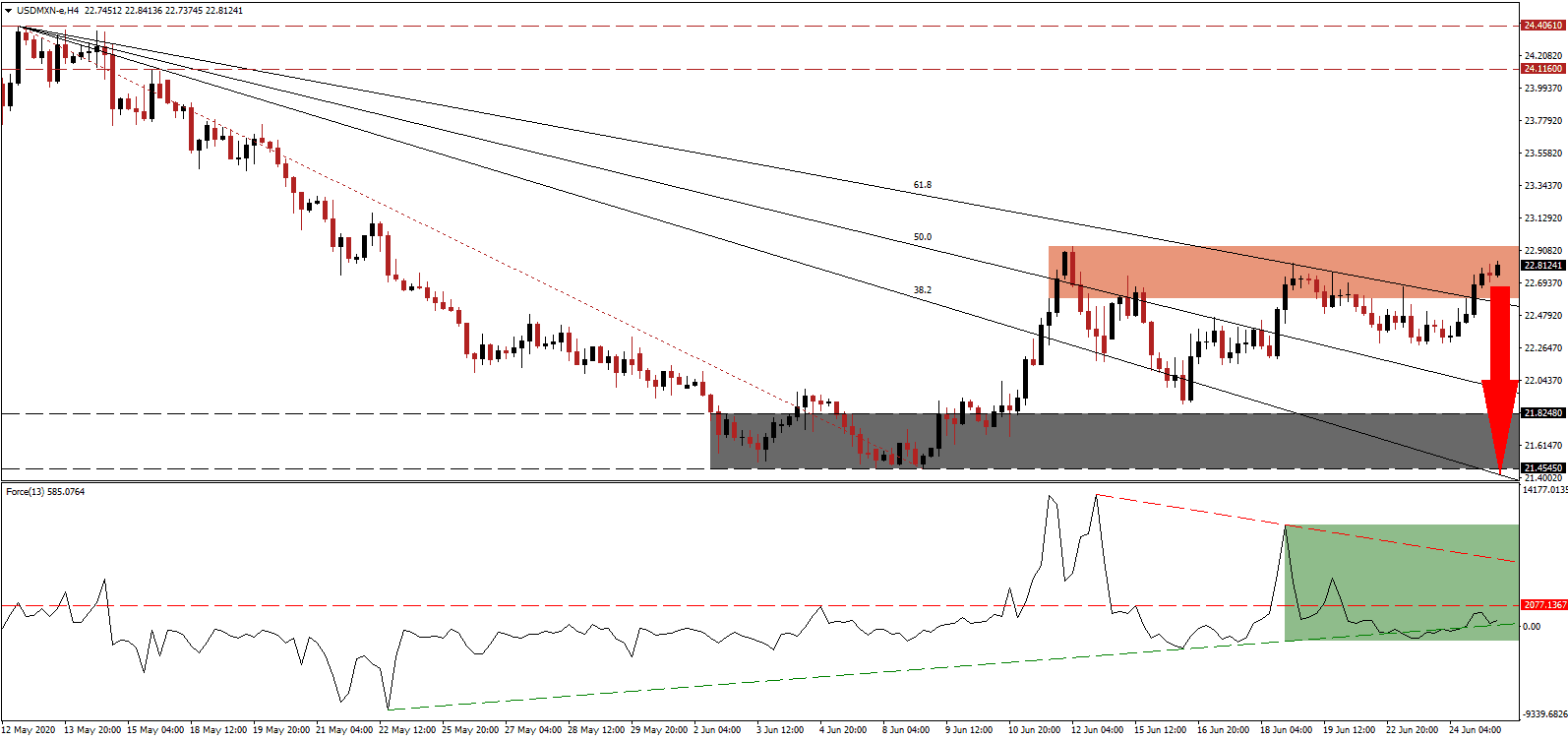

The Force Index, a next-generation technical indicator, confirms a pending correction in this currency pair. While price action advanced, a series of lower highs resulted in the formation of a negative divergence. Bearish pressures expanded following the move below its horizontal support level, converting it into resistance, as marked by the green rectangle. The descending resistance level is likely to maintain downside pressures. Bears wait for this technical indicator to collapse below its ascending support level and into negative territory to regain complete control of the USD/MXN.

Inflation during the first two weeks of June rose more than expected. INEGI, Mexico’s official statistics agency reported an increase of 3.66% in the core CPI, above predictions for a rise of 3.50%. Despite inflation ticking higher, the Bank of Mexico is favored to deliver a 50 basis-point interest rate cut to 5.00% today. The International Monetary Fund updated its economic outlook, revising the 2020 GDP forecast down to a drop of 10.5%. It added to the advance in the USD/MXN into its marginally upward revised short-term resistance zone located between 22.5895 and 22.9384, as identified by the red rectangle.

With global Covid-19 surging, numerous US states are reporting daily records after forcing the economy to reopen prematurely. Connecticut, New Jersey, and New York implemented a 14-day mandatory quarantine for out-of-state entrants. Today’s initial jobless claims data may provide the next short-term fundamental bearish catalyst. The USD/MXN is positioned for a breakdown below its descending 61.8 Fibonacci Retracement Fan Support Level. It will clear the path for an accelerated correction into its support zone located between 21.4545 and 21.8248, as marked by the grey rectangle. An extension to the downside is probable.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 22.8200

Take Profit @ 21.4200

Stop Loss @ 23.2200

Downside Potential: 14,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 3.50

In the event the Force Index pushes through its descending resistance level, the USD/MXN may attempt a breakout. Given the negative progress out of the US, Forex traders are recommended to take advantage of any advance with new net short positions. The accelerated spread of the virus may force the reimplementation of quarantine measures across the US. Price action will face its next resistance zone between 24.1160 and 24.4061.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 23.5200

Take Profit @ 24.1200

Stop Loss @ 23.2200

Upside Potential: 6,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.00