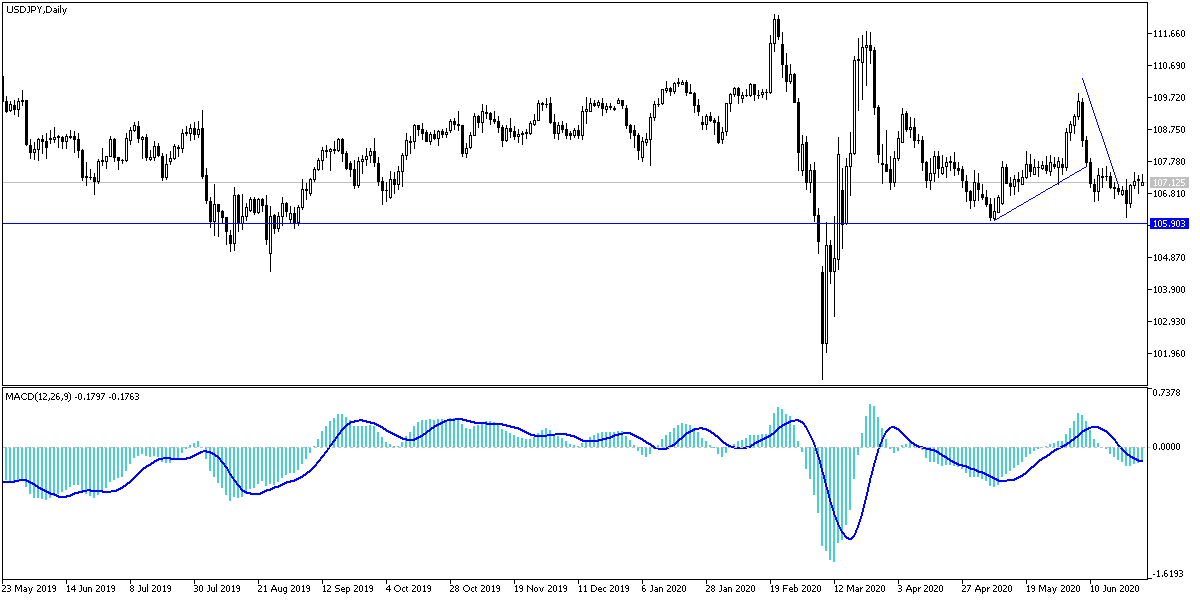

For the fourth consecutive day, the USD/JPY pair is trying to reach higher, but its attempts have not crossed the 107.45 level barrier and is settling around the 107.20 level. This contains the details of the US jobs report and important testimony of Federal Reserve Governor Jerome Powell as well as The US Treasury Secretary, and the content of the last Federal Reserve meeting’ minutes. In addition to that, monitoring the Covid-19 numbers, a new outbreak is a clear challenge to the future of reopening the world economy. As is the case, the United States still tops the numbers globally, whether in the first or second wave. The gains in the US currency are increasing as investors take it as a safe haven.

After months of closure, restaurants, shops and even parks announced that they would reopen with great caution, states like Texas and Arizona have seen a worrying escalation in newly reported cases of COVID-19, and therefore large and small companies must decide whether to keep their doors open or not. In some cases, governments paused plans to reopen them temporarily. Last Friday, Texas and Arizona closed bars except for outdoor dining and reduced the ability to eat in restaurants. Florida has banned alcohol consumption in bars.

Many companies have already taken these steps alone, saying that the high number of cases and the change of advice from state and local governments do not give them the confidence to stay open. Apple, which started reopening its stores on May 11, has closed at least 32 stores in hotspots like Florida and Texas. Many companies have moved in the same direction.

Amid global concerns about the second wave of the Coronavirus, the South African Minister of Health said that the current increase in COVID-19 cases in the country is expected to increase significantly in the coming weeks and put pressure on the country's hospitals to the maximum extent. South Africa, a country with a population of 57 million people, already has more than a third of the cases reported in all 54 countries in Africa, a continent with a population of 1.3 billion.

More than 4,300 people have been hospitalized out of 138,000 confirmed cases in South Africa, Health Minister Zweleni Mkhiz said in a statement. He cautioned that this number is expected to rise rapidly. "We are witnessing a rapid rise in the cumulative number of positive COVID-19 cases, which indicates that, as we expected, we are approaching a peak during ... July and August," he added.

On the global level, important numbers have been surpassed. The number of confirmed deaths from the epidemic has exceeded 500,000, and the number of confirmed cases has crossed the 10 million mark. The United States of America remains the first in the world in terms of infections and deaths.

According to the technical analysis of the pair: Despite the recent rebound attempts, the general trend of the USD/JPY pair is still downward, and in the midst of the safe havens struggling to obtain the most gains in light of the anxiety that prevails in the global financial markets. The JPY will be the winner and the pair is ready to test support levels at 106.85, 106.00 and 105.35 respectively. There will not be a strong opportunity for a bullish correction without crossing the 108.60 resistance. The pair is awaiting a return to risk appetite and announcing a decline in the number of cases.

From Japan, retail sales will be announced, then the US pending home sales data will be released.