Before the announcement of the Japanese central bank monetary policy today, the USD/JPY pair remained under downward pressure. For two trading sessions, its gains did not exceed the 107.56 resistance and settled around the 107.40 level at the time of writing. Losses at the end of last week’s trading pushed the pair towards the 106.56 support amid pressure on the US dollar after the pessimistic tone of the US Federal Reserve in announcing its monetary policy last week. The stimulus to support the US economy does not stop.

Yesterday, the Federal Reserve Board said that it would start buying corporate bonds as part of a plan previously announced to ensure that companies are able to borrow through the bond market during the pandemic era.

The program will purchase bonds from the open market, in contrast to the newly issued debt. The central bank has said it will seek to build a "wide and diversified" portfolio that simulates the bond market index. The bonds must be from companies with a high rating, investment grade or companies that fit this description before the outbreak of the virus.

The announcement bolstered the US stock market, which was already recovering from recent losses.

US Federal Reserve purchases should lower corporate bond yields, making it cheaper for companies to borrow. But by reducing the return on investment in those bonds, the Fed’s actions are likely to encourage investors to transfer funds from corporate bonds to stocks in the hope of achieving a higher return.

When the US central bank announced the bond-buying program in March, few companies were able to issue bonds. Banks and other big investors were disposing of assets in favor of getting the cash. New research has found that simply by announcing the program, the Fed has been able to encourage more bond trading and improve market efficiency.

The Fed also said it would buy up to $750 billion in corporate bonds and equity trading funds made up of corporate bonds. The Treasury provided $75 billion in taxpayer money to offset any losses from investments.

In light of the ongoing American stimulus, a subcommittee of the House of Representatives calls for the investigation of billions of dollars that have provided aid to deal with the effects of the pandemic. The Trump administration and some of the country's largest banks are demanding detailed information about companies that have applied for and received federal loans for small businesses.

The requests came after US Treasury Secretary Stephen Mnuchen told Congress last week that the names of recipients of the loans and the amounts disbursed as part of the $600 billion salary protection program are "property information" and should not be made public. At the same time, Democrats see that there is nothing owned or classified about companies receiving millions of dollars from taxpayers.

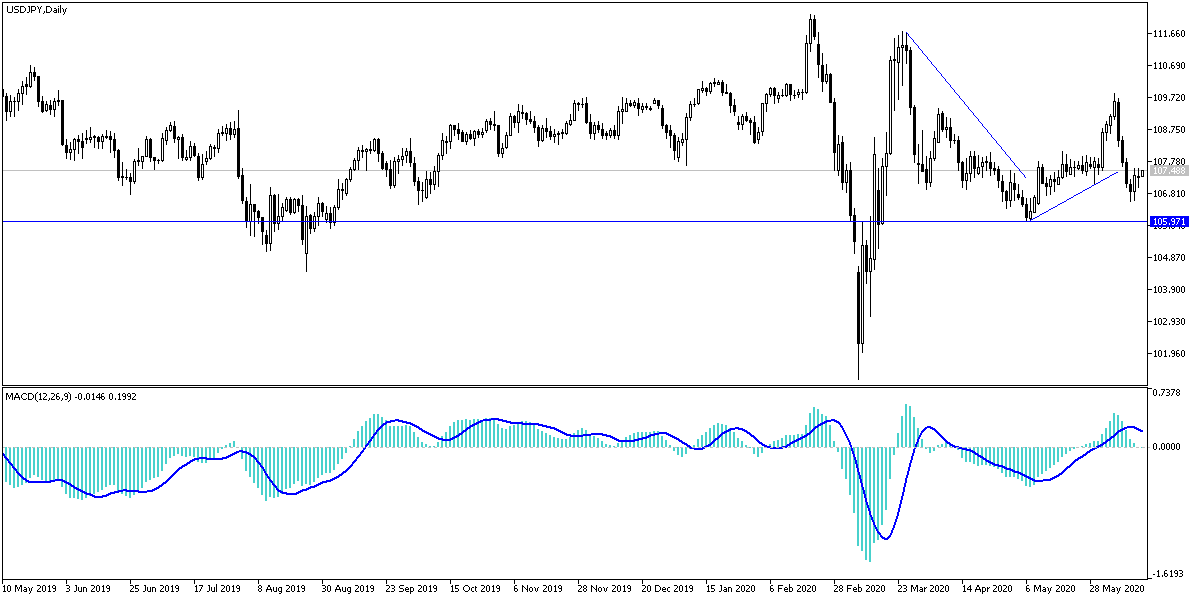

According to the technical analysis of the pair: The USD/JPY stability pair below the 108.00 support will remain supportive of stronger bear’s control of performance, this stability motivates investors to think about buying this pair to benefit from the upward rebound which is expected amid a continuous stimulus to the American economy and investor’s risk appetite. The bounce will be weaker as new fears emerge from a second wave of the deadly Corona epidemic. Upwards, I still think that the 110.00 psychological resistance will remain the most important gate for a longer period upward reversal of the pair. The MACD indicator, and according to the performance on the daily chart, is still in need of more gains to confirm the change of trend upwards.

As for the economic agenda data today: The beginning will be with the announcement of the Central Bank of Japan monetary policy, and then to the more important US data; retail sales numbers and the industrial production rate, and later statements by Jerome Powell, Governor of the US Central Bank.