During yesterday's session, the USD/JPY traded within a limited range that did not exceed 40 points. It settled around the support 107.30 performance at the beginning of today’s trading. We are waiting for the markets' reaction to what Jerome Powell, governor of the US central bank, will deliver in front of the congressional committee on the bank's plans to revive the US economy in the face of the Corona pandemic. There was demand for the dollar as risk-taking currencies declined following the release of disappointing May industrial production data that gave the US dollar a fresh boost. This came after the better-than-expected retail numbers which encouraged short-term stability for riskier currencies and a temporary weakening of the dollar.

The price action came amid increasing geopolitical tensions in some parts of the world, most notably between India and China after the outbreak of a border dispute between the two countries resulted in clashes said to have resulted in deaths on both sides while tensions were rising between North and South of Korea as well.

The tension undermined the temporary improvement in risk appetite, as the US central bank significantly expanded the corporate debt assistance program, details of which came along with reports from the White House that would seek support for the large infrastructure spending package in the United States of America.

US retail data indicates that key components of the US economy may recover quickly from the historical recession caused by the Coronavirus, although it is not the first. The May non-farm payrolls report surprised the markets when it showed that the US economy succeeded in creating 2.5 million new jobs, defying expectations for a net loss of -7.7 million jobs. However, the industrial production figures for that month confirm that there are some important sectors of the US economy that may take longer to get back to where they were before.

For his part, Federal Reserve Chairman Jerome Powell said that there is still great uncertainty about the timing and strength of the economic recovery. This is widely believed to have begun with the reopening of some US states in May, which is important because of the hope for a V-Shaped global economic recovery, which is the main driver of the massive gains seen in the stock markets since last March.

In testifying before Congress, Powell stressed that the Federal Reserve is committed to using all of its financial tools to mitigate coronavirus damage, but he said that until the public trusts that the disease is contained, "complete recovery is unlikely." He also warned that a prolonged slowdown could be bad, especially for low-income workers that were hit hard.

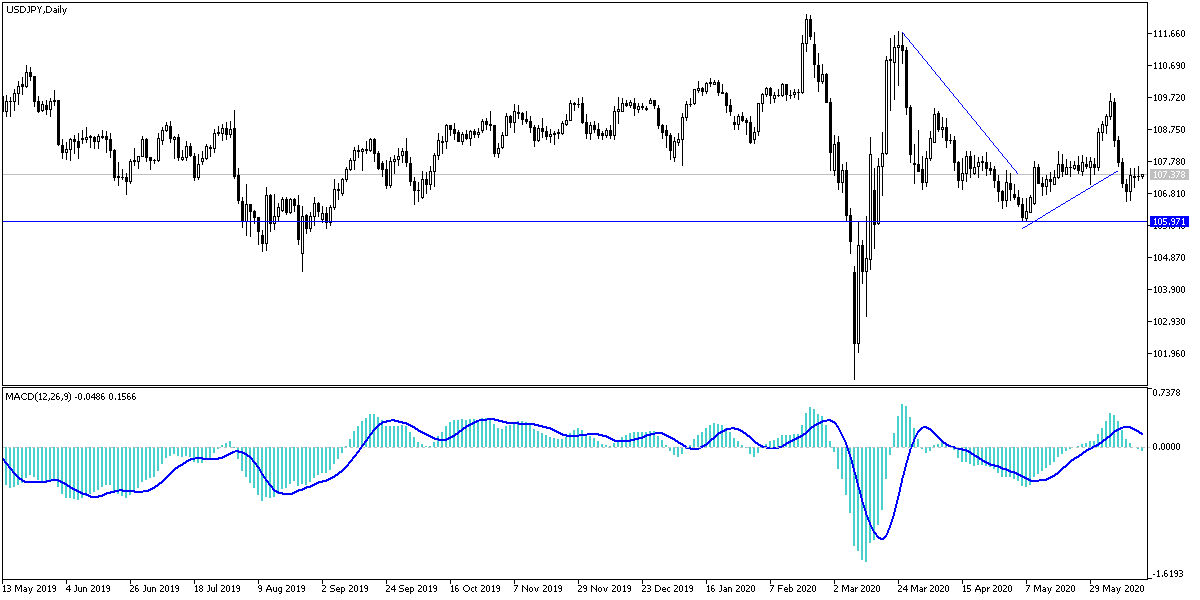

According to the technical analysis of the pair: On the USD/JPY daily chart, the pair is still in a downward correction range with stability below the 108.00 support, heading towards oversold areas, from there, investors start thinking about buying the pair. The pair is awaiting the release of the US housing data and the content of Jerome Powell's second testimony.