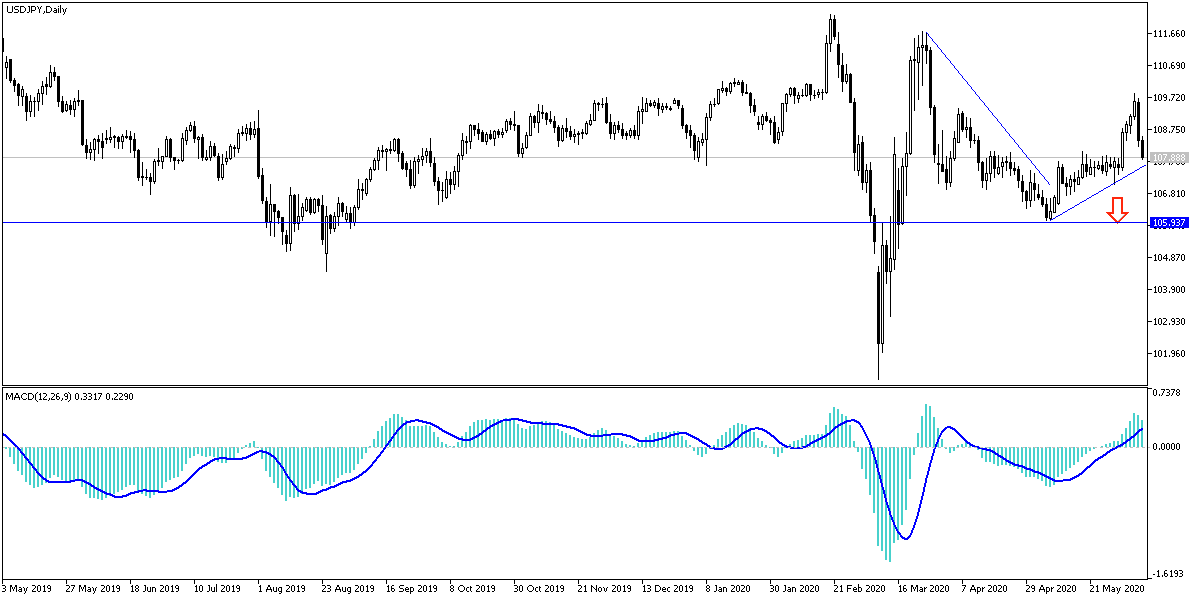

Suddenly, USD/JPY gains evaporated to reach the 108.23 support and gains at the end of last week’s trading reached the 109.84 resistance, the highest level in two and a half months, and is now settling in the beginning of today’s trading around the 108.47 level. After recent gains, I noted in the pair’s technical analyzes, that it has reached overbought levels and it is possible to have selling operations to take profits at any time, which is what happened during yesterday's trading.

With the beginning of this week’s trading, Japan's Cabinet Office said in its final reading that Japan's gross domestic product fell to - 2.2 percent year on year in the first quarter of 2020 - putting the country firmly in an economic recession. Analysts had expected GDP to be revised up to -2.1 percent after last month's initial reading which suggested an annual decline of 3.4 percent.

On a seasonally adjusted quarterly basis, the GDP growth reading was revised to -0.6 percent - missing forecasts of -0.5 percent and after the initial reading of 0.9 percent. In the fourth quarter of 2019, GDP decreased by 1.9 percent on a quarterly basis, and rose by 7.2 percent year on year (-7.3 percent in origin).

Capital increased by 1.9 percent on a quarterly basis, after a decrease of - 4.8 percent in the previous three months - while the price index increased by 0.9 percent year on year, down from 1.2 percent in the fourth quarter. External demand fell 0.2 percent on a quarterly basis after rising 0.5 percent in the previous three months, while private consumption fell 0.8 percent on a quarterly basis after a drop - 2.9 percent in the fourth quarter.

On the other hand, the Finance Ministry said that Japan has a current account surplus of 262.7 billion yen in April, down 84.2 percent year on year. That missed expectations of a 480 billion yen surplus after the 1.917.0 billion yen surplus in March.

As for the coronavirus developments on the market. The number of deaths caused by the COVID-19 virus has increased by more than 400,000 people around the world, while anti-racism protests have increased in the United States and most of the world, adding to fears raised last week that gatherings may help spread the disease aggressively. Public health experts are concerned that crowds gathering to protest the death of an unarmed black man by a white police officer in Minnesota earlier this month, make social distancing difficult, and tracking contact is impossible. Another widespread use of tear gas and pepper spray to control crowds is another risk factor, as it causes coughing and respiratory distress, which may increase the proliferation of drops containing COVID-19.

In this context, Dr. Anthony Fossey, President of the National Institute of Allergy and Infectious Diseases, and a key member of the White House task force that was set up to manage the epidemic response, said he was concerned about the increase in crowds in areas where infection is still transmitting effectively.

According to the technical analysis of the pair: The Japanese yen still maintains the glow of its demand as a safe haven, and after the announcement of better than expected numbers for American jobs, the markets will focus again on the global risks represented by the Coronavirus and its impact on the global economy, along with the possibility of renewed tensions between the United States and China, and the future of the US elections and Brexit. Any move by the USD/JPY pair below the 108.00 support will increase the bear's control over the performance to move the pair to stronger support levels. Thus, the latest hopes for an upward correction were evaporated, as the pair failed to test the 110.00 psychological resistance, which supports the future of bulls controlling performance for a longer period. From Japan today, average wages will be announced, and later US employment opportunity numbers will be released.