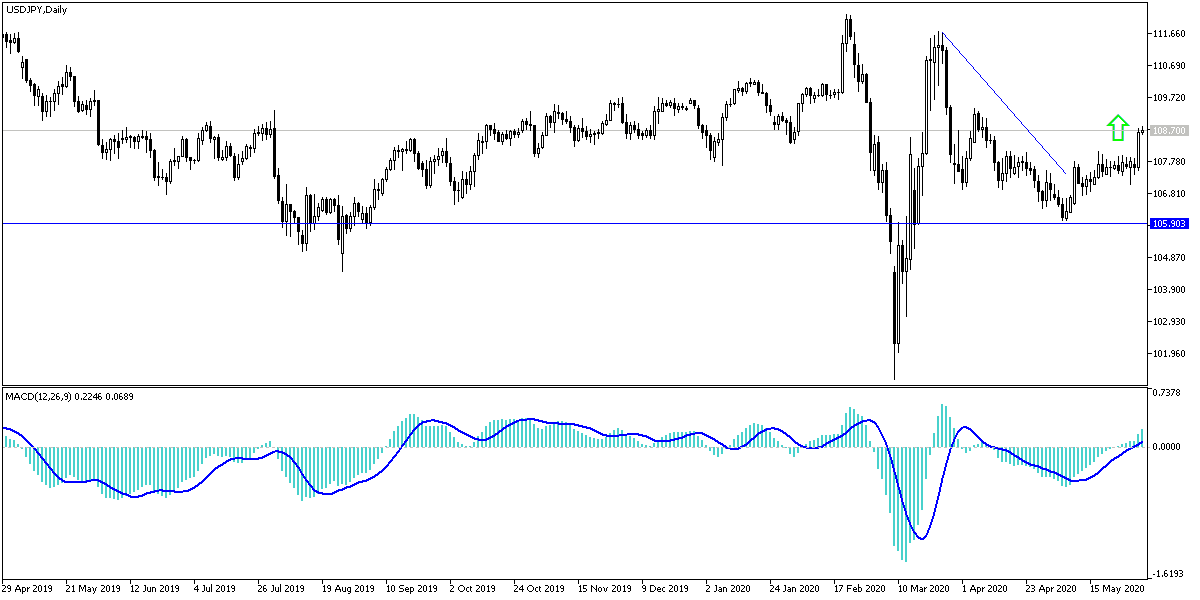

In recent technical analyzes of the USD/JPY we mentioned that stability in performance within a limited range for several consecutive trading sessions heralds a strong movement in either direction. The most prominent in yesterday's trading session was a bullish jump from the 107.51 support to the 108.77 resistance, the highest for nearly two months, before settling around the 108.66 level at the beginning of todays’ trading, and before the announcement of important US job numbers. The pair had the most prominent performance of the dollar’s pairs amid the direction of its violent drop against other major currencies.

The USD was abandoned as a safe haven as investors pinned hopes on an economic recovery after easing restrictions around the world. Those hopes of a global recovery from the consequences of the Coronavirus helped offset concerns about tensions between the United States and China and political turmoil in the United States.

Economic data showed that U.S. manufacturing activity improved in May after hitting an 11-year low in the previous month. The major economic reports due this week include Special Job Data from ADP, ISM Non-Manufacturing PMI and US Job Data for May.

Vandalism and looting in the American states recently added to the pressure on American jobs as small businesses employ nearly 60 million people, or nearly half of the workforce in the United States. Since the coronavirus has caused the American economy to stop, the government has loaned companies hundreds of billions of dollars to help them stay and keep their employees on the job, with the unemployment rate rising to 20%. But some did not succeed, and bankruptcy is already increasing. The epidemic remains a problem for companies able to continue to operate because the requirements for social distancing and weak consumer spending are likely to reduce their revenues and incomes. Many owners, especially restaurant owners, were unsure of the future due to the virus.

According to technical analysis: On the USD/JPY daily chart, the formation of the bullish channel is getting stronger, and stability above the 109.00 resistance will support the move towards the 110.00 resistance, which still supports the bulls control of the performance for a longer period. The US-China tensions will remain a stronger motivator for the pair in the coming period. The current bullish hopes will evaporate if the pair returns to the 107.55 support. All in all, I still prefer buying the pair from every lower level.

The pair will react to the results of the US economic data today, which includes the announcement of the ADP survey to measure the change in the US non-agricultural jobs, then the ISM services PMI, US factory orders and crude oil stocks.