After recent downward correction moves, the USD/JPY pair is trying to return to the vicinity of the 108.00 resistance to avoid further collapse. Investors have abandoned the US dollar as a safe haven after easing trade tensions between the United States and China after US President Donald Trump did not suggest imposing tariffs on China at his conference last weekend. As Trump ordered his administration to start the process of eliminating US special treatment for Hong Kong, he also said he was ending the United States relationship with the World Health Organization, claiming that China has full control over the agency.

In addition, official data released over the weekend showed that factory activity in China witnessed growth in May. In contrast, survey results from IHS Markit showed that the Australian manufacturing sector recorded a sharp deterioration in operating conditions in May, amid ongoing measures to contain the spread of coronavirus or Covid-19.

On the other hand, results of the economic data showed that the activity of the American factories slowed for the third consecutive month in May, as it continued to bear the economic damages caused by the coronavirus pandemic. Accordingly, the Institute of Supply Management, a consortium of purchasing managers, announced on Monday that its ISM manufacturing index came at a reading of 43.1 last month after a 41.5 reading in April. According to the index data, any reading below the 50 level indicates that American manufacturers are in decline. New orders, production, employment and new export orders decreased in May, but at a slower pace than in April.

The epidemic, closures, and travel restrictions to combat it have caused economic activity to stop. As the gross domestic product of the United States decreased at - 5% an annual rate from January to March, it is expected to decrease by - 40% from April to June. 11 of 18 manufacturing industries slowed last month, led by printing, primary metal and transportation equipment companies. The US Commerce Department said last week that expensive manufactured goods orders - durable goods orders – fell by - 17.2% in April after falling - 16.6% in March.

Commenting on the economic results, Oren Kalashkin and Gregory Daco of Oxford Economics University, wrote a research report: "Looking at the future, conditions may start to improve gradually in June, but industrialization faces major problems on the long road to recovery". Among the problems facing factories are weak demand, interruptions in supply and increased uncertainty. "These barriers are expected to continue, along with fears of a second wave of coronavirus infection, even after the closings are completely lifted, making V-shaped recovery is highly unlikely," they added.

Pain is not limited to the United States only. JP Morgan reported that global industrial production fell for the fourth consecutive month in May. Manufacturing production fell in 27 of the 28 countries whose results were available. The exception was China, where the virus arose and where the first economic recovery began after the strict closure. Industrialization was already hurt before the Coronavirus completely halted the economy in March. The ISM industrial index indicated a contraction in eight of the past ten months. As President Donald Trump's trade war with China raised costs and created uncertainty that investment decisions had crippled the global economy and lost momentum.

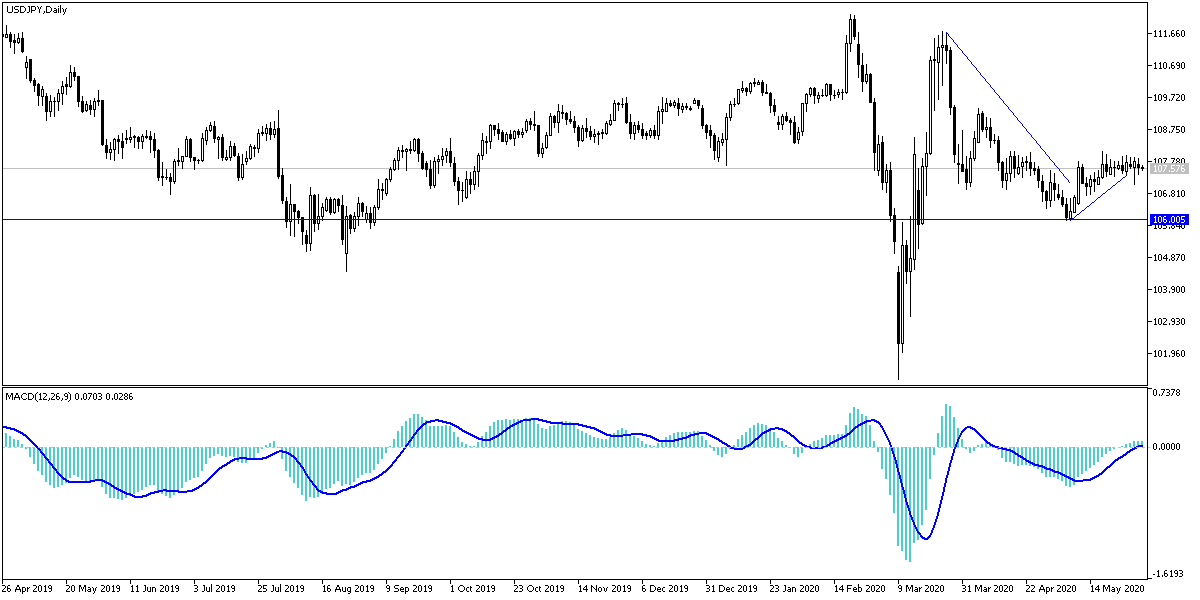

According to the technical analysis: There is no change in my technical view of the USD/JPY pair as the bear control is still the strongest as long as it remains stable below the 108.00 level and the pair's bearish momentum may increase if it moves towards the 107.45, 106.90 and 106.00, support levels respectively. I continue to hold on to the 110.00 psychological resistance as the key to the bullish correction strength and a reversal of the current downward outlook. Today's economic calendar has no important economic data from Japan or the United States of America, and the pair will be affected more by the extent of the investor risk appetite.