During yesterday's trading session, the USD/JPY moved lower and broke below the 107.00 support with losses to 106.95 before settling around the 107.05 level in the beginning of Thursday's trading. Risk aversion contributed strongly to the gains of the Japanese yen as one of the most important safe havens. Increased global geopolitical tensions amid armed conflict between China and India and between the two Koreas, along with the emergence of new outbreaks of the deadly Coronavirus with the timing of the reopening global economies. All of these factors combined weakened investor sentiment in completing recent risk-on path.

For economic data. Japan's exports fell more than expected in May, indicating the continued effects of the coronavirus pandemic on the country's main growth engine. The results of the official data showed exports declined by -28.3% in May compared to the previous year, after a decrease of -21.9% in the previous month. Economists surveyed by FactSet data provider forecast of a - 22.9% decrease.

Exports to the United States were particularly weak, falling 50.6% due to lower demand for cars and auto parts. Exports to the rest of Asia fell 12.0 percent year on year to 2.744 trillion yen, while exports to China alone fell 1.9 percent to 1.126 trillion yen. Imports fell 26.2 percent annually to 5.018 trillion yen, compared to expectations for a 15 percent drop after falling 7.2 percent a month ago.

Imports from the rest of Asia fell by 11.8 percent year on year to 2.739 trillion yen, while imports from China only fell 2.0 percent to 1.511 billion yen.

As for the American economy. New housing construction in the U.S. showed a notable rebound in May, according to a report released by the US Commerce Department, although housing starts are still far below economic estimates. The report said that housing starts jumped by 4.3 percent to an annual rate of 974 thousand in May, after falling by 26.4 percent to an average of 934 thousand in April. Economists had expected housing to increase 22.9 percent to 1.095 million from the 891,000 that was announced the previous month.

The Ministry of Commerce also announced that building permits rose by 14.4 percent to an annual rate of 1.220 million in May, after falling by 21.4 percent to a rate of 1.066 million in April. Building permits, an indicator of future demand for housing, were expected to increase by 14.3 percent to 1.228 million from the 1.074 million that was announced the previous month.

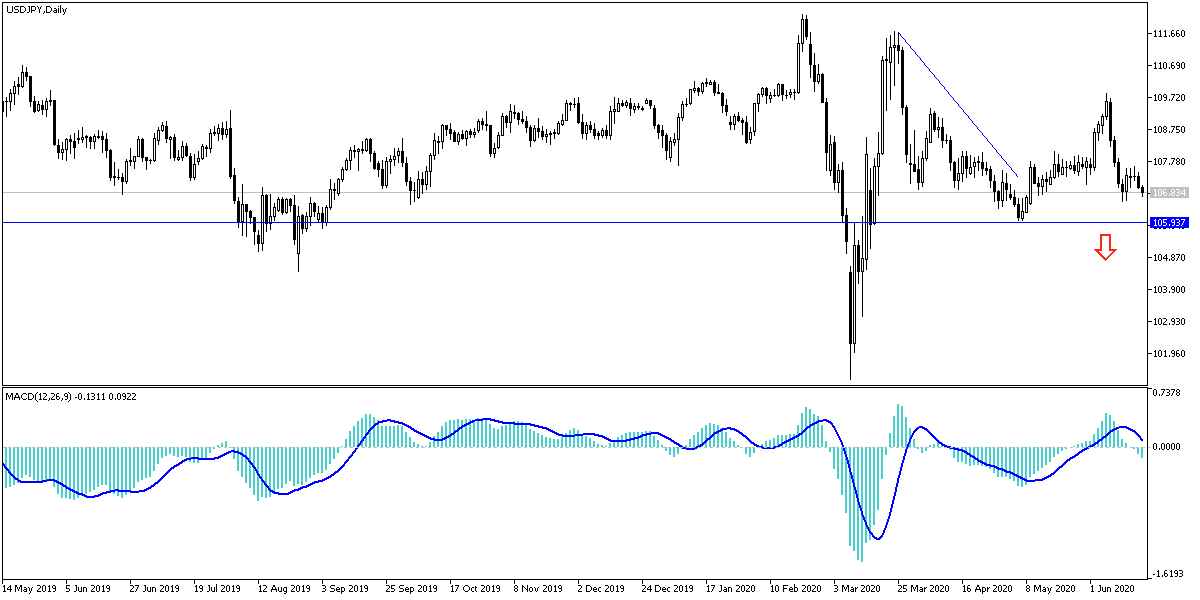

According to the technical analysis of the pair: Bears control over USD/JPY performance is getting stronger, and stability below the support will increase the downward momentum to move towards stronger buying levels, and the closest ones are currently at 106.55 and 105.80, respectively. There will be no real reversal of the current situation without the stability of the pair above the 108.55 resistance, and in general I still prefer to buy the pair from every lower level. Today, the pair will react to the release of the US jobless claims numbers and the Philadelphia Industrial Index. As well as the extent of investors’ risk appetite of to take risks.