The recent pressures on the US currency contributed to a stronger bear control on the USD/JPY performance, where its losses reached the 106.93 support at the time of writing, the lowest level for a month, ending three consecutive weeks of gains, during which the pair succeeded in testing the 109.85 resistance, the highest in more than two months. The US economic results confirmed that inflation in the United States is far from the Fed’s target. This confirms that the easing of the bank's monetary policy may remain for a longer period. Consumer prices in the United States fell in May for the third month in a row as the Coronavirus pandemic pushed the US economy into recession.

The US Department of Labor announced that the consumer price index fell by - 0.1% last month after falling - 0.8% in April and - 0.4% in March. With the exception of food and energy prices, which are always volatile, the so-called core inflation decreased - 0.1%, and fell for the third month in a row for the first time ever. And a panel of economists announced on Monday that the epidemic and quarantine aiming to contain the virus outbreak pushed the US economy into a deep recession in February, ending a record growth that started in June 2009. Poor customer demand is driving prices down.

Over the past year, consumer prices increased 0.1%, and core prices increased 1.2%. Gasoline prices fell 3.5% in May, the fifth straight decline, and they fell 33.8% over the past year. Clothing prices fell 2.3%, the third consecutive decline, and fell 7.9% over the past year.

The Federal Reserve seeks to keep the inflation at an annual rate of 2% to prevent the economy from completely collapsing, the Federal Reserve cut interest rates to zero and pumped trillions of dollars into the financial system. They have indicated that they are willing to do more.

After the announcement of the US inflation figures, the US Central Bank announced its monetary policy, and the bank kept the US interest rate between zero and 0.25%, unchanged, as was widely expected among economists. In his press conference that followed the bank’s decision, Powell said that Fed policy makers now want some time to “get a better understanding of the economic trajectory” and how they can do more to support it. One possible step, he said, would be to provide more specific guidance on how long the Fed will keep low short-term interest rates. This guidance can help the economy by reducing the possibility that investors will send borrowing costs higher.

Monetary policy makers, for example, can announce at a future meeting that they will postpone any rate hike until inflation returns to its 2% target.

Powell added that the other option discussed by the Federal Reserve Board is to fix more interest rates at almost zero, such as those in treasury bonds for two or three years, to confirm their determination to keep interest rates very low during this time period. The Australian central bank adopted such a policy.

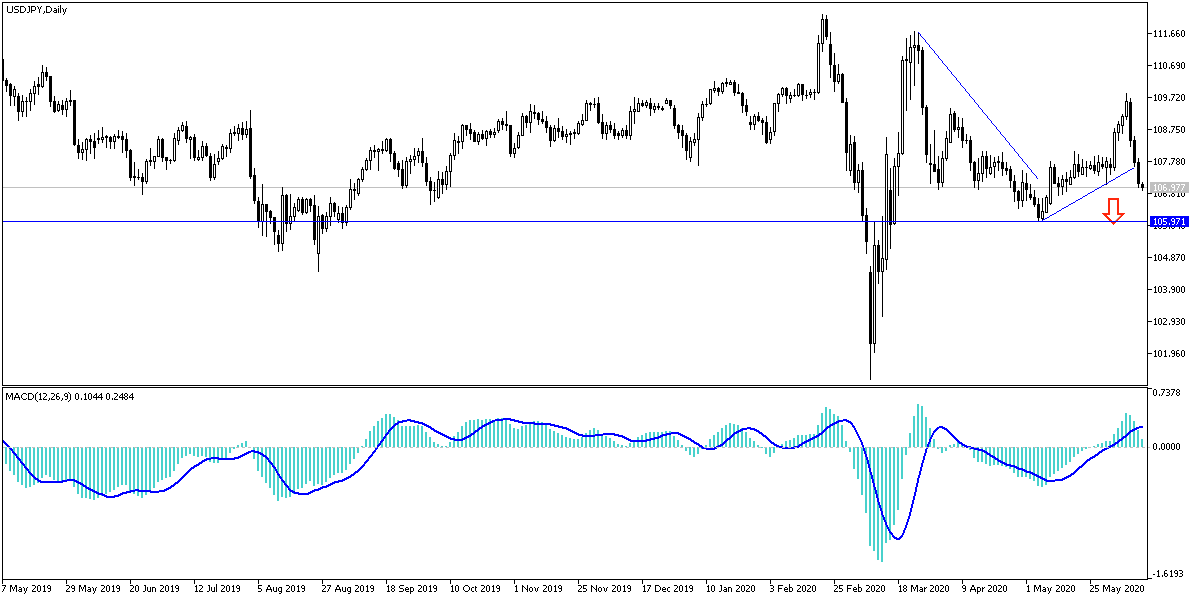

According to the technical analysis of the pair: According to the USD/JPY performance on the daily chart, the bears increased control over the performance, and with the testing of the 106.90 support, technical indicators moved towards strong oversold levels. The pair is currently best placed at 106.80, 106.10 and 105.70 support levels, respectively. Bulls will not have a chance to control performance without exceeding the 108.55 resistance. After the investors interact with the announcement of inflation figures and the Fed policy, the reading of producer prices and US jobless claims will be announced.