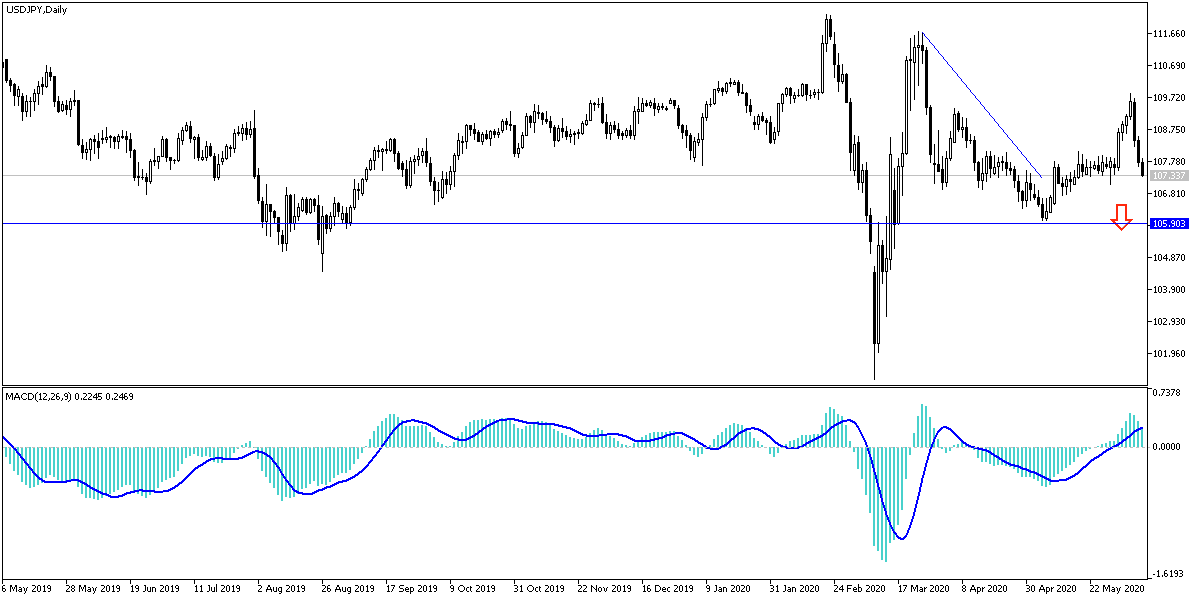

For the third straight day, the USD/JPY continues its bearish correction, which pushed it towards the 107.38 support at the time of writing, and before the announcement of US inflation figures, the update of the monetary policy of the US Federal Reserve, and the statements of its Governor Jerome Powell. The pair gave up all the gains made last week, which drove it towards the 109.85 resistance, its highest level in nearly three months, and it got strong support from better than expected numbers for the American labor market. The monthly nonfarm payrolls data in the United States of America, released on Friday (June 5), has produced a big surprise, as job growth showed a big addition in May. The unemployment rate came much lower level than expected. However, many analysts expect the US central bank to continue making a cautious note on the near-term outlook for the economy.

The central bank is widely expected to keep interest rates unchanged at this time, but further stimulus measures are not excluded. The US dollar index, DXY, which measures the performance of the US dollar against a basket of six competing currencies, fell to the lowest level at 96.60, and against the Euro, the dollar weakened to 1.1370, despite weak data on German industrial production for April, which affected the Euro for a short period. Data from Destatis has shown that German industrial production recording its largest decline since the chain began in 1991 as measures to contain coronavirus significantly affected industrial activity. Industrial output decreased by -25.3% on an annual basis in April, after declining by -11.3% in the previous month.

From Japan, the results of the economic data showed today that the value of basic machinery orders in Japan fell by a seasonally adjusted rate of -12.0 percent on a monthly basis in April, to stand at 752.6 billion yen. That was missed expectations for a decline of - 8.6 percent, after a drop - 0.4 percent in March. On an annual basis, core machinery orders declined - 17.7 percent - again below expectations for a decline of - 14.0 percent after a 0.7 percent drop the previous month.

For the second quarter of 2020, basic machinery orders are now expected to decrease by 0.9 percent on a quarterly basis and 10.4 percent on an annual basis.

Government requests decreased 7.2 percent on a quarterly basis and 5.2 percent year on year to 259.8 billion yen, while orders from abroad fell 21.6 percent on a monthly basis and 16.8 percent year on year to 689.4 billion yen, and requests through agencies decreased by 8.9% on a monthly basis and 17.8% on an annual basis to reach 105.3 billion yen.

The total value of machine orders received by 280 manufacturers operating in Japan decreased by 8.3 percent per month in April.

Among what was also announced, the Bank of Japan said that producer prices in Japan fell - 0.4 percent on a monthly basis in May, below expectations for a 0.3 percent decline after a 1.5 percent decline in April. On an annual basis, producer prices sank 2.7 percent - again below expectations for a 2.4 percent drop after losing 2.3 percent in the previous month.

According to the technical analysis of the pair: On the daily USD/JPY chart there is a sudden reversal of the recent bullish momentum and stability below the 108.00 support will remain a catalyst for the bear to hold the reins at least until the after of the announcement from the US Federal Reserve today, and the statements of its Governor Jerome Powell. The pair is awaiting a return to confidence in the US dollar and more investor’s risk appetite to get enough momentum to launch towards the 110.00 psychological resistance after its failure last week to breach it. I still prefer buying the pair from every lower level.