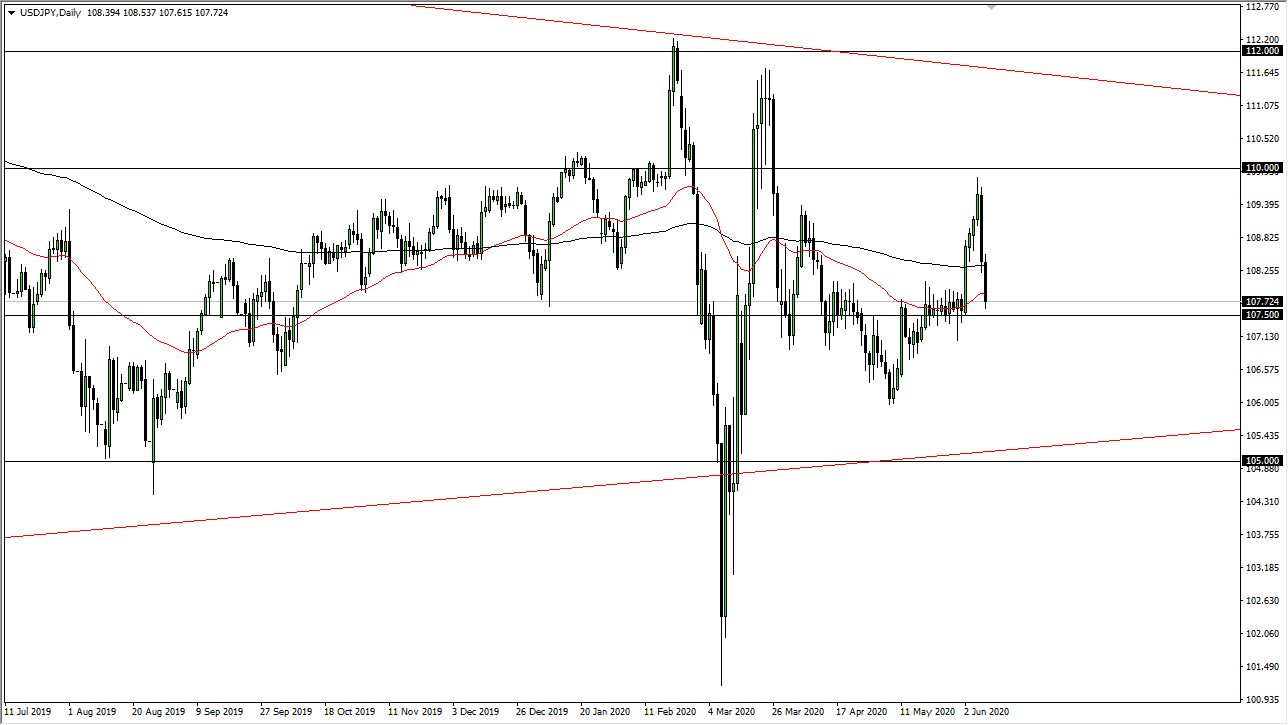

The US dollar has fallen pretty significantly during the trading session again on Tuesday, as we reached towards the ¥107.50 level. That is an area that has been supportive several times in the past, so I would anticipate some type of bounce. This would probably move right along with a potential “risk on” type of scenario, as the currency pair is likely to follow right along with the S&P 500. That being said, it will be interesting to see how this plays out, but ultimately, I think that the Japanese yen probably will be somewhat shunned if there is any risk taking out there whatsoever. I believe ultimately this is a market that will try to bounce back towards the ¥110 level, as we have obvious support and resistance levels.

We are currently dancing around the 50 day EMA, so that of course is something to pay attention to. The 50 day EMA of course is a moving average that a lot of traders pay attention to, but it is not the “be-all and end-all” of technical analysis. This is just simply another reason to think that there are buyers in this area, so it is worth paying attention to.

If we break down below the ¥107 level, then we could go looking towards the 100 section level. Quite frankly, markets are very choppy, and they seem to be bent on chopping up as many accounts as possible. This environment that we find ourselves and reminds me very much of 2008, when things would turn around suddenly in sporadic fits and starts. With Chairman Powell speaking on Wednesday, and the statement, if the markets do not get the monetary methadone that they want so badly, we could see a major “risk off” scenario. In fact, I believe that the Federal Reserve is probably the biggest risk that the markets face right now, even though the risk appetite is certainly overdone during the last several weeks. This pair essentially had gone nowhere for quite some time, so we could find ourselves doing that as well. I do not like the idea of getting too cute with this trait, but this seems to be an area where think the buyers will try to push the market to the upside. I also think that it is more or less a grind back and forth, and I would not expect much in the way of fireworks anytime soon.