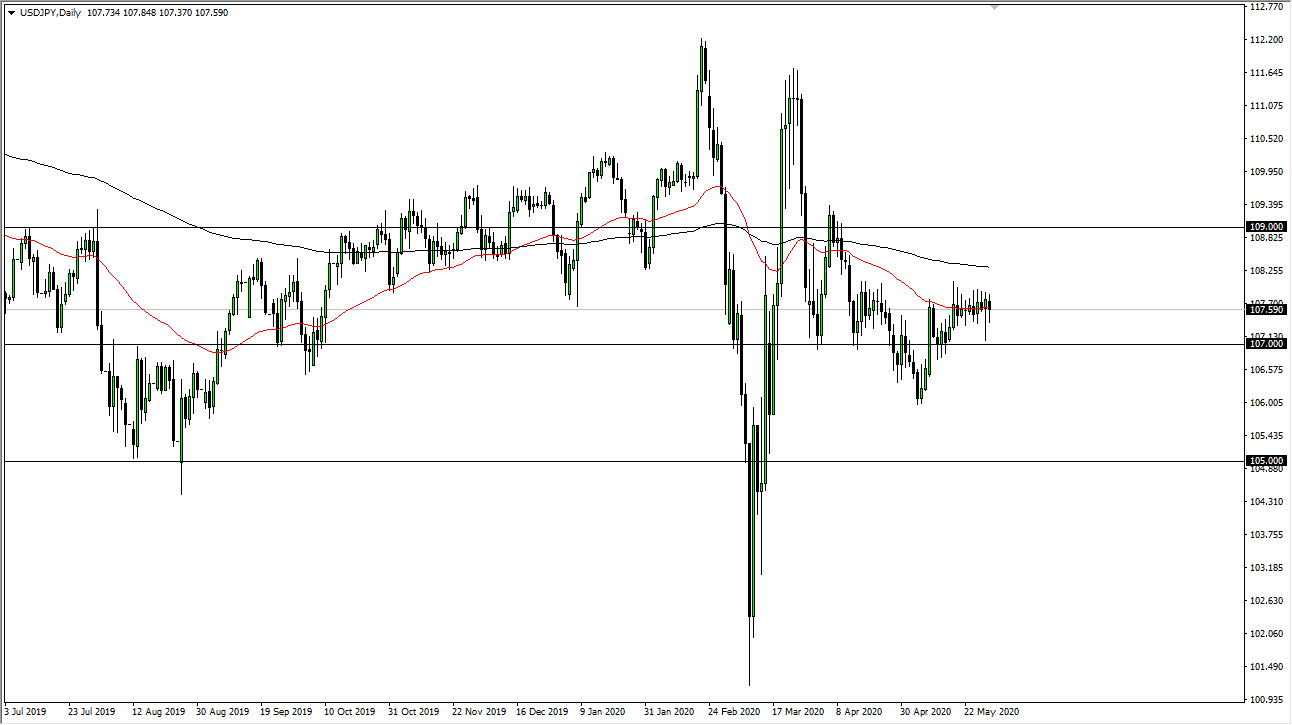

The US dollar continues to go back and forth, doing almost nothing at the 50 day EMA against the Japanese yen. It has been this way for a couple of weeks now, and when you expand out from that you have the ¥107 level underneath offering support, and the ¥108 level above offering resistance. Ultimately, this is a market that continues to show a lot of volatility and if you are looking for short-term trading opportunities, this could be the place to be. With that in mind I believe that traders will continue to trade short-term charts and simply pick up 10 to 20 pips at a time. If you are looking for some type of bigger move, you are not seeing it anytime soon in this pair.

Looking at this noise, you can see why traders are avoiding this pair and I most certainly am doing the same thing. If the market does make it an impulsive candlestick, then I can start to look at through the lens of something a little bit more interesting, but right now I would need to see the market break down below the ¥106.90 level, which could open up a move down to the ¥106 level. Otherwise, if the market was to break above the ¥108 level, then I would have to look at a move towards the 200 day EMA and then eventually the ¥109 level. Ultimately, this is a market that is basically untradable at this point, unless of course you are a high-frequency traders, which I suspect is basically who is in the market now.

There are no fundamental reasons to think that this changes anytime soon, but if there some type of melt down in one of these currencies then you will more than likely see that move. The pair is quite often typically correlated quite nicely to the S&P 500, but even that long-term correlation has been destroyed. This is a market that I think will continue to see a lot of back and forth until we get a sudden rush. Eventually we will get that sudden rush, and when we do then we can place a trade. Until then, there is not much to see here, and you should probably just move right along. I anticipate that this pair has essentially already try to go to sleep for the summer, which some currency pairs will do.