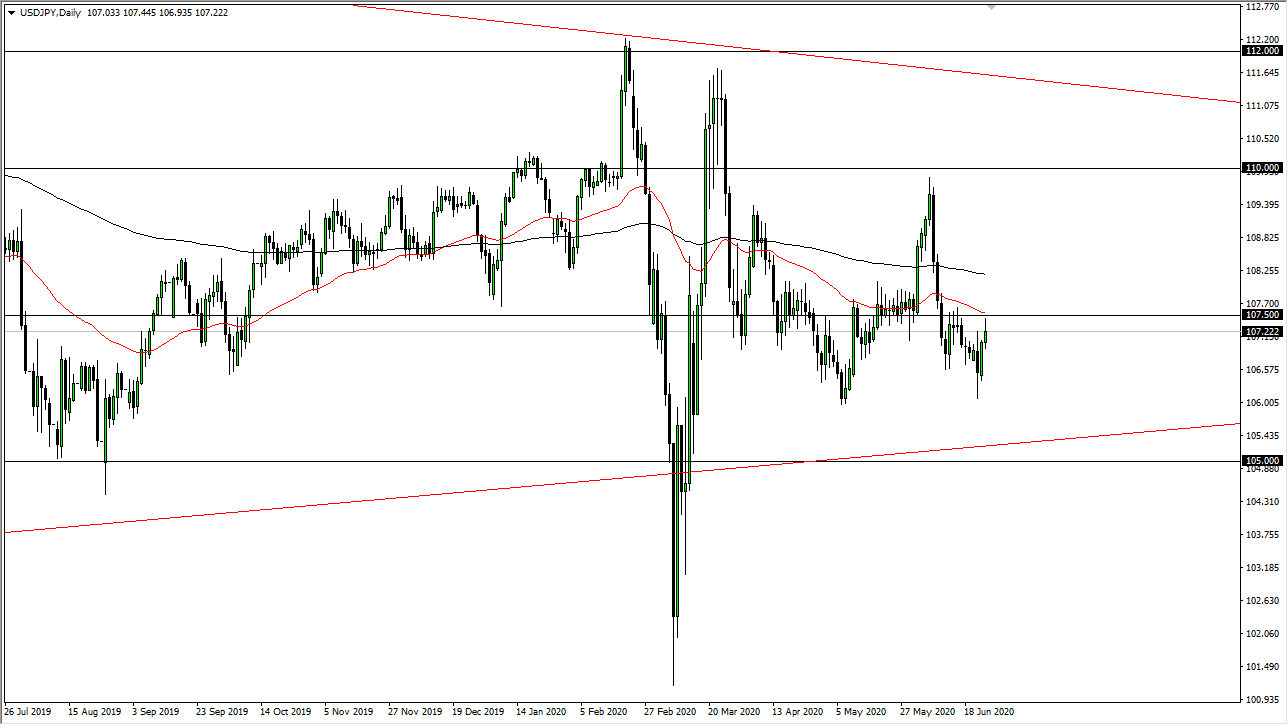

The US dollar has rallied a bit during the trading session on Thursday to reach towards the ¥107.50 level. The 50 day EMA is sitting right there, and that of course will cause quite a bit of resistance as well. In fact, I think that the 50 day EMA begins significant resistance all the way to the ¥108 level. At this point, the market is likely to rollover a bit from there, to go looking towards the ¥106 level, an area that has been massive support. We have seen the market bounce from there previously, and I think we are going to test that yet again.

This is more or less going to be an indictment on the US dollar, and not so much the Japanese yen. We had seen a massive breakdown earlier in the week, but then we turned around to show signs of strength yet again. At this point in time, this is a market that will continue to be very erratic and choppy, because both of these currencies are certainly considered to be safety currencies, so a lot of people will be looking to flood both of their accounts with them in order to protect from the geopolitical issues. The US Treasury market of course will attract a lot of currency due to the fact that people might be a bit afraid, but at the same time the Japanese yen is also considered to be even “safer” than the greenback. With all of this, it will continue to compress this market.

A compressed market can only stay that way for so long, and as a result it is likely that we will continue to see the market take off in one direction or another given enough time. Having said that, the market is likely to see a huge move as this pair has been so quiet. If we break down below the ¥105 level, then the market could go much lower. If we break above the ¥110 level to the upside, the market is likely to go even higher. In the meantime, we are probably going to look at short-term back-and-forth trading and that is probably going to be the way going forward. I do believe that this is a pair that is worth paying attention to, but mainly to decide what is going on with the Japanese yen against other currencies.