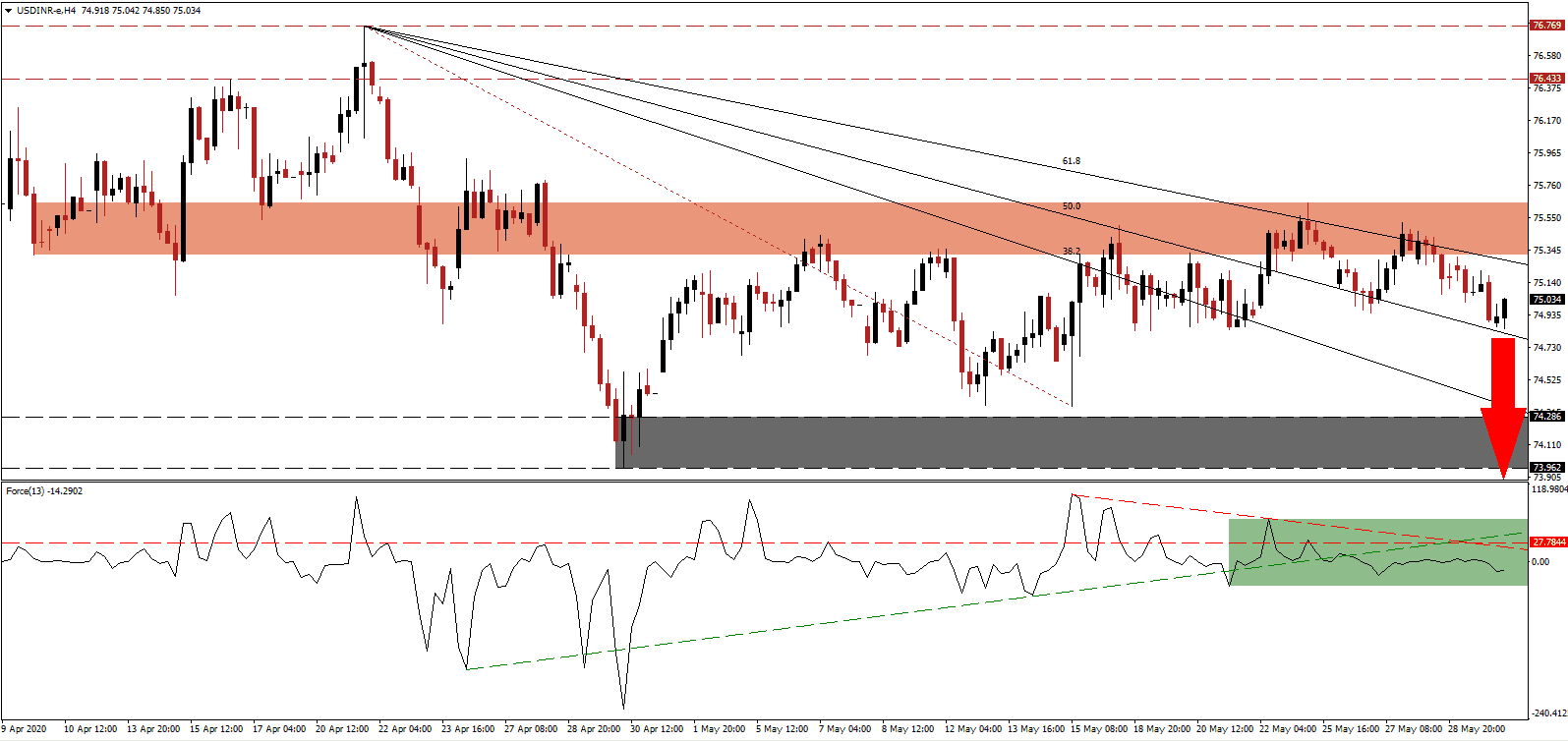

India, home to Asia third-largest economy, was slowing before the outbreak of the Covid-19 pandemic forced a nationwide lockdown. The first-quarter GDP expanded by 3.1%, the lowest growth rate in eight years. This morning’s manufacturing PMI for May shows a significantly smaller rebound in activity than forecast and remains deep in the depressive territory. Despite the negative data flow, the USD/INR remains resilient and maintains its bearish bias. Price action is well-positioned to extend the breakdown below its short-term resistance zone, enforced by its descending Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level and moves farther away from its ascending support level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle. Bears are in complete control of the USD/INR with this technical indicator below the 0 center-line, favored to collapse deeper into negative territory.

Manufacturing weakness led the disappointing first-quarter GDP data and is set for a repeat in the second quarter. The ₹20 trillion spending package announced by Prime Minister Modi is unlikely to address the slowdown, as it lacks fresh capital and consists of expedited pre-approved infrastructure projects. Adding to concerns is the decrease in deposits at local banks, but the USD/INR weakness is driven dominantly by bearish progress out of the US. It allowed this currency pair to correct below its short-term resistance zone located between 75.316 and 75.648, as marked by the red rectangle.

Agriculture remains a rare bright spot for the Indian economy, but an early locust outbreak is diminishing hopes for millions of migrant workers who returned to their villages due to the lockdown. Providing a bullish catalyst for the Indian Rupee is the relative fiscal responsibility exercised by Prime Minister Modi’s government. In conjunction with US monetary and foreign policy, the conditions are ripe for a breakdown in the USD/INR below its support zone located between 73.962 and 74.286, as identified by the grey rectangle. An extension of the corrective phase into its next support zone located between 72.348 and 72.702 is expected, driven by ongoing US economic weakness and its growing debt pile.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.050

Take Profit @ 72.350

Stop Loss @ 75.700

Downside Potential: 27,000 pips

Upside Risk: 6,500 pips

Risk/Reward Ratio: 4.15

A breakout in the Force Index above its ascending support level, providing current resistance, could result in a temporary counter-trend reversal in the USD/INR. The upside potential remains limited to its resistance zone located between 76.433 and 76.769, which is pending a downward revision. It will provide Forex traders with a secondary short-selling opportunity, supported by intensifying US Dollar weakness.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.050

Take Profit @ 76.500

Stop Loss @ 75.850

Upside Potential: 4,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.25