This morning’s Indian services PMI for May delivered a disappointing improvement from April’s all-time low. It confirms the economy has a long path to recovery, a fact evident across the global economy. Prime Minister Modi is under intensifying pressure to address an economic slowdown that started before the global Covid-19 pandemic forced nationwide lockdowns. Last week’s first-quarter GDP data showed an annualized expansion of 3.1%, the worst in eight years. The dismal recovery in the services sector mirrors last week’s manufacturing data. Despite disappointments, the USD/INR remains resilient on the back of more prominent concerns out of the US. The short-term resistance zone is favored to rekindle the dominant bearish chart pattern and inspire a breakdown.

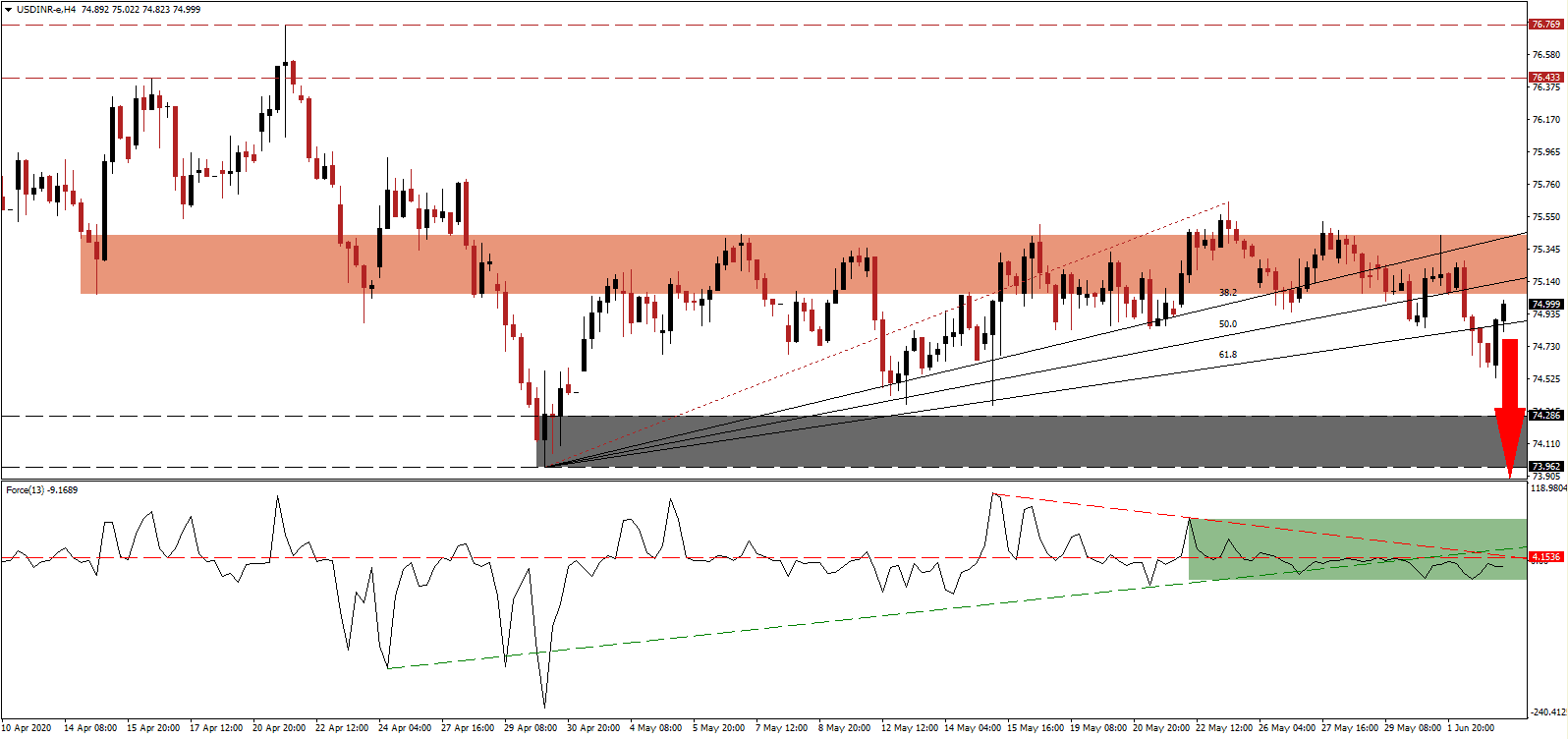

The Force Index, a next-generation technical indicator, confirms bearish pressures and maintains its position below the horizontal resistance level. Adding to downside momentum was the breakdown below its ascending support level, as marked by the green rectangle, while the descending resistance level is increasing bearish momentum. This technical indicator is poised to extend its slide deeper into negative territory with bears in complete control of the USD/INR.

India’s government attempts to strike a balance between stimulating the economy and remaining fiscally responsible. It is apparent in the ₹20 trillion spending package, which consists mostly of expedited pre-approved infrastructure projects and a lack of debt-funded capital injections. It generates a long-term bearish catalyst for the USD/INR, magnified by the uncontrolled and unsustainable debt binge practiced in the US. This currency pair is anticipated to face rejection by its short-term resistance zone located between 75.059 and 75.433, as identified by the red rectangle.

One bright spot for the slowing Indian economy was agriculture, hoped to accommodate millions of migrant workers who returned home to villages. An early and violent locust outbreak is dimming the prospects and could derail the sector. While food security is not an immediate concern, developments should not be ignored. The USD/INR is well-positioned to correct into its support zone located between 73.962 and 74.286, as marked by the grey rectangle. A breakdown below the redrawn ascending 61.8 Fibonacci Retracement Fan Support Level is likely to provide the required downside volume for a breakdown extension into its next support zone between 72.348 and 72.702.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.000

Take Profit @ 72.350

Stop Loss @ 75.650

Downside Potential: 26,500 pips

Upside Risk: 6,500 pips

Risk/Reward Ratio: 4.08

In the event the Force Index spikes above its ascending support level, serving as resistance, the USD/INR may attempt a breakout. Given ongoing negative progress out of the US, Forex traders are advised to consider any advance as an outstanding secondary short-selling opportunity. The upside potential is confined to its resistance zone located between 76.433 and 76.769, which is pending a downward revision.

USD/INR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 75.900

Take Profit @ 76.450

Stop Loss @ 75.650

Upside Potential: 5,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 2.20