Volatility in the USD/CNH is poised to remain elevated. Early indications point towards China backing away from portions of the phase-one trade truce US President hailed as an exceptional deal for the US. China has repeatedly pointed out that supply-demand will dictate acquisitions of US goods. The agricultural part of the deal appears the first one to crumble. China has increased purchases of soybeans from Brazil and did suggest domestic demand is not sufficient to justify buying from the US. While the USD/CNH is retreating from its most recent peak, intensifying tensions between the US and China gives the latter incentive to allow a devaluation of its currency by markets, making exports cheaper. With price action approaching its next support zone, a price action reversal may follow.

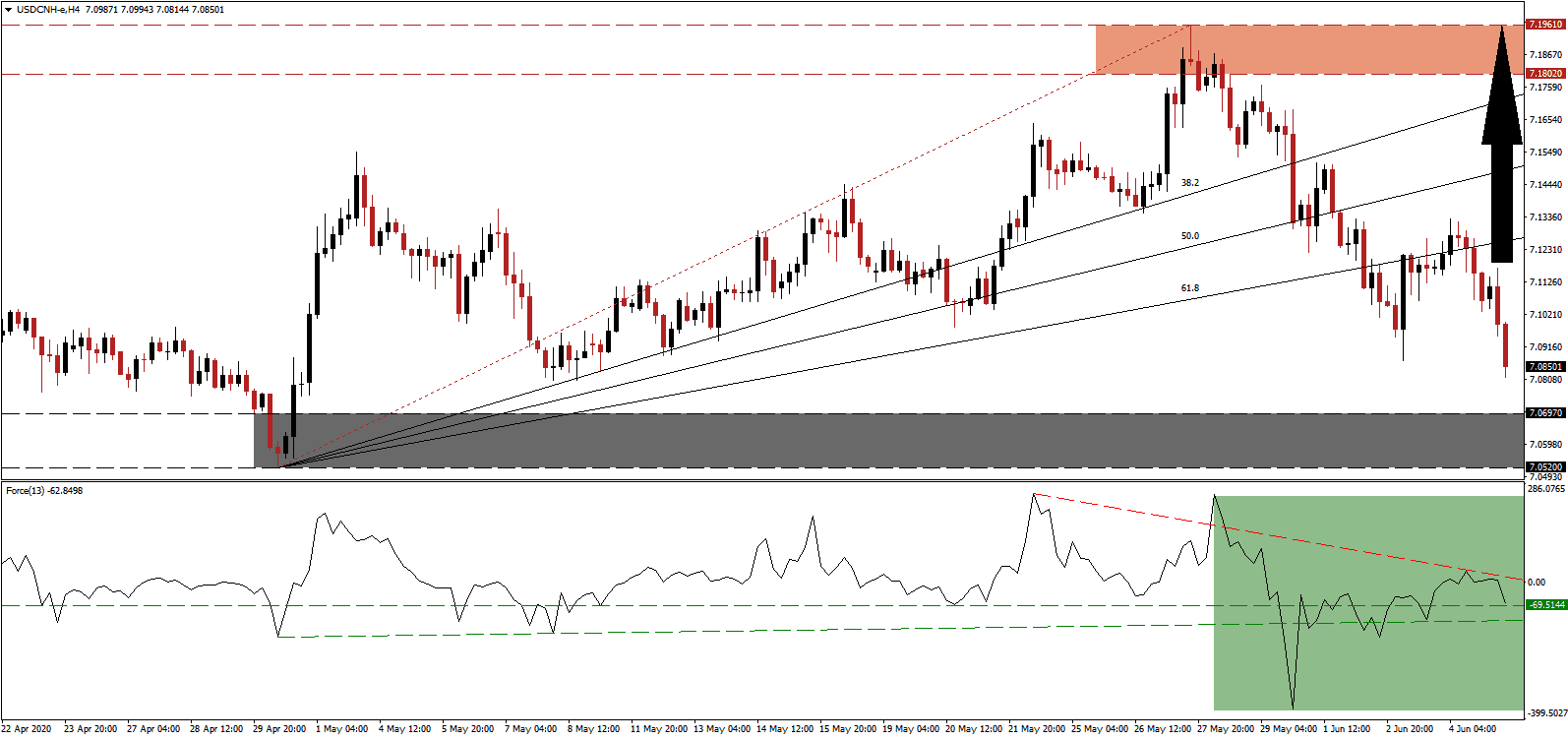

The Force Index, a next-generation technical indicator, initially plunged to a new multi-month low before reversing. A secondary correction resulted in a higher low and the formation of a positive divergence. After the descending resistance level rejected the Force Index, as marked by the green rectangle, it is now challenging its horizontal support level. Bears have temporarily taken charge of the USD/CNH with this technical indicator sliding into negative territory. The ascending support level is anticipated to pressure it above the 0 center-line, allowing bulls to regain control.

President Trump’s government path to worsening relations with China is adding to economic pressures. The latest division erupted over Hong Kong, the semi-autonomous region of China, after the passing of a new security bill governing Asia’s financial center. A monetary war between the world’s two biggest economies appears unlikely due to mutual damage without a change in the status quo. While the USD/CNH may briefly drop into its support zone located between 7.0520 and 7.0697, as identified by the grey rectangle, the long-term outlook is increasingly bullish. A combination of US weakness and the Chinese desire for a weaker currency provides a breakout catalyst.

China and the US are on different economic paths, magnified by the outbreak of the Covid-19 pandemic. After the US left the Trans-Pacific Partnership (TPP) in January 2017, the Comprehensive Progressive Trans-Pacific Partnership Agreement (CPTPP) was signed by eleven countries. China has now expressed a willingness to join it. In the US, the generous stimulus pays employees 101% of their salaries to not got to work. An amendment is considered to offer bonuses for those who do return. With a debt-to-income ratio of 136% and a saving rate of 7.8%, consumers will remain under pressure, demanding more government assistance. It adds to upside pressures in the USD/CNH to accelerate back into its resistance zone located between 7.1802 and 7.1961, as marked by the red rectangle. The ascending Fibonacci Retracement Fan sequence is favored to guide price action higher after this currency pair reclaims its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/CNH Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 7.0850

Take Profit @ 7.1950

Stop Loss @ 7.0500

Upside Potential: 1,100 pips

Downside Risk: 350 pips

Risk/Reward Ratio: 3.14

In the event the Force Index extends its correction, driven lower by bearish pressures from its descending resistance level, the USD/CNH could be dragged lower. The 7.000 level provides significant psychological support. It was once regarded as the upper limit for this currency pair. Forex traders are recommended to consider it an outstanding buying opportunity, on the back of intensifying economic concerns, out of the US. The next support zone awaits price action between 6.9826 and 7.002.

USD/CNH Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 7.0350

Take Profit @ 7.0000

Stop Loss @ 7.0500

Downside Potential: 350 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 2.33