Today’s US NFP report is expected to result in a volatility spike and an increase in trading volume. With the primary attention on riots across the US, the rise in Covid-19 infections since the easing of lockdown restrictions has gone virtually unnoticed. Robert Refiled, the Director of the Centers for Disease Control and Prevention, testified before the House of Representatives that concerns over the ignorance of guidelines are worrisome. He added that not all 50 states met the White House requirements for easing restrictions, but are doing so. The long-term trend in the USD/CHF remains distinctly bearish, but a brief short-covering rally is favored to emerge.

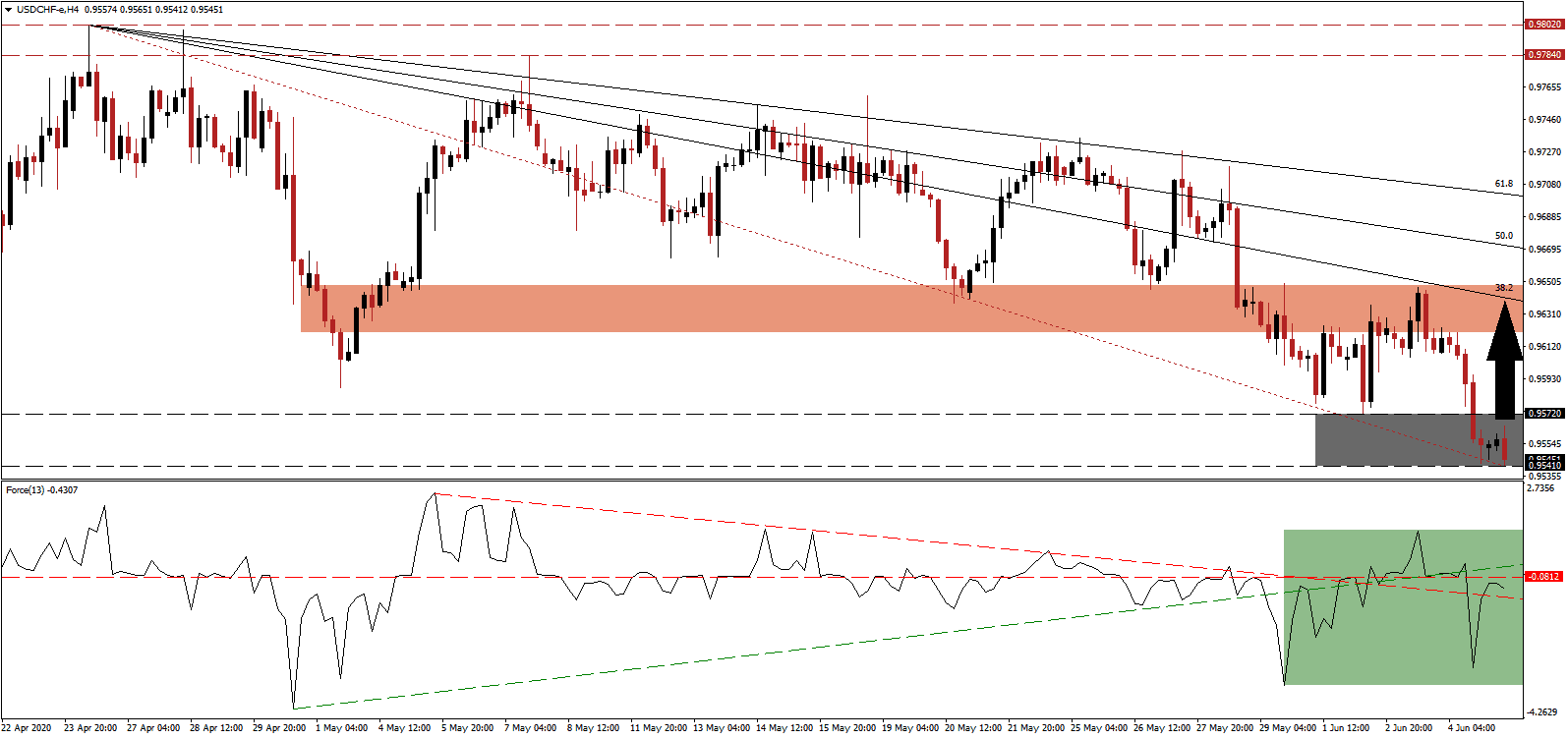

The Force Index, a next-generation technical indicator, suggests a price action reversal is pending after a higher low led to the formation of a positive divergence. While the ascending support level and the descending resistance level reversed roles, a minor advance cannot be excluded after the Force Index pushed above its descending resistance level. It remains below its horizontal resistance level, as marked by the green rectangle. Bears remain in control of the USD/CHF with this technical indicator in negative territory.

Switzerland faced a more significant contraction in the first quarter than expected, and April retail sales for April disappointed. With an easing of the lockdown measures, authorities did announce they will no longer impose fines for ignoring social distancing measures unless the group exceeds 30. The build-up in bullish momentum suggests a short-term breakout in the USD/CHF above its support zone located between 0.9541 and 0.9572, as marked by the grey rectangle, remains a possibility. It will keep the long-term downtrend intact and ensure its longevity.

Adding to bullish progress in the Swiss Franc is the option of Swiss pension funds and large institutional investors to use funds of funds to invest in small-to-medium (SME) businesses. It can provide vital funding and boost the domestic economy. The issuance of cumulative preferred shares, which are slowly gaining traction across the Swiss financial market, further enhances this option. Any advance in the USD/CHF is limited to its downward revised short-term resistance zone located between 0.9620 and 0.9648, as identified by the red rectangle. The descending 38.2 Fibonacci Retracement Fan Resistance Level is passing through this zone, anticipated to enforce the well-established bearish chart pattern.

USD/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.9545

Take Profit @ 0.9625

Stop Loss @ 0.9515

Upside Potential: 80 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.67

Should the Force Index correct below its descending resistance level, the USD/CHF is likely to resume its dominant downtrend. While a small counter-trend advance is required for the health of the long-term corrective phase, the acceleration of negative progress out of the US could delay it. Forex traders are advised to consider any breakout as an excellent short selling opportunity. The next support zone awaits between 0.9317 and 0.9390.

USD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.9485

Take Profit @ 0.9325

Stop Loss @ 0.9535

Downside Potential: 160 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.20