Canada reported a surprise 289,600 jobs additions for May, against predictions for 500,000 losses. The Covid-19 pandemic eliminated over 3,000,000 positions between January and April. Hopes that those losses were temporary are slowly fading, as the unemployment rate increase to 13.7%, on the back of a surge in job seekers. It is repeated in the US and suggests more significant economic disappointments cannot be excluded. The US Federal Reserve, committing to no interest rate increase until 2023, remains cautious and maintains its course of financial support, confirming deep structural issues. Give the severe correction in the USD/CAD, a short-term advance following the breakout in price action is a typical development within the dominant bearish trend.

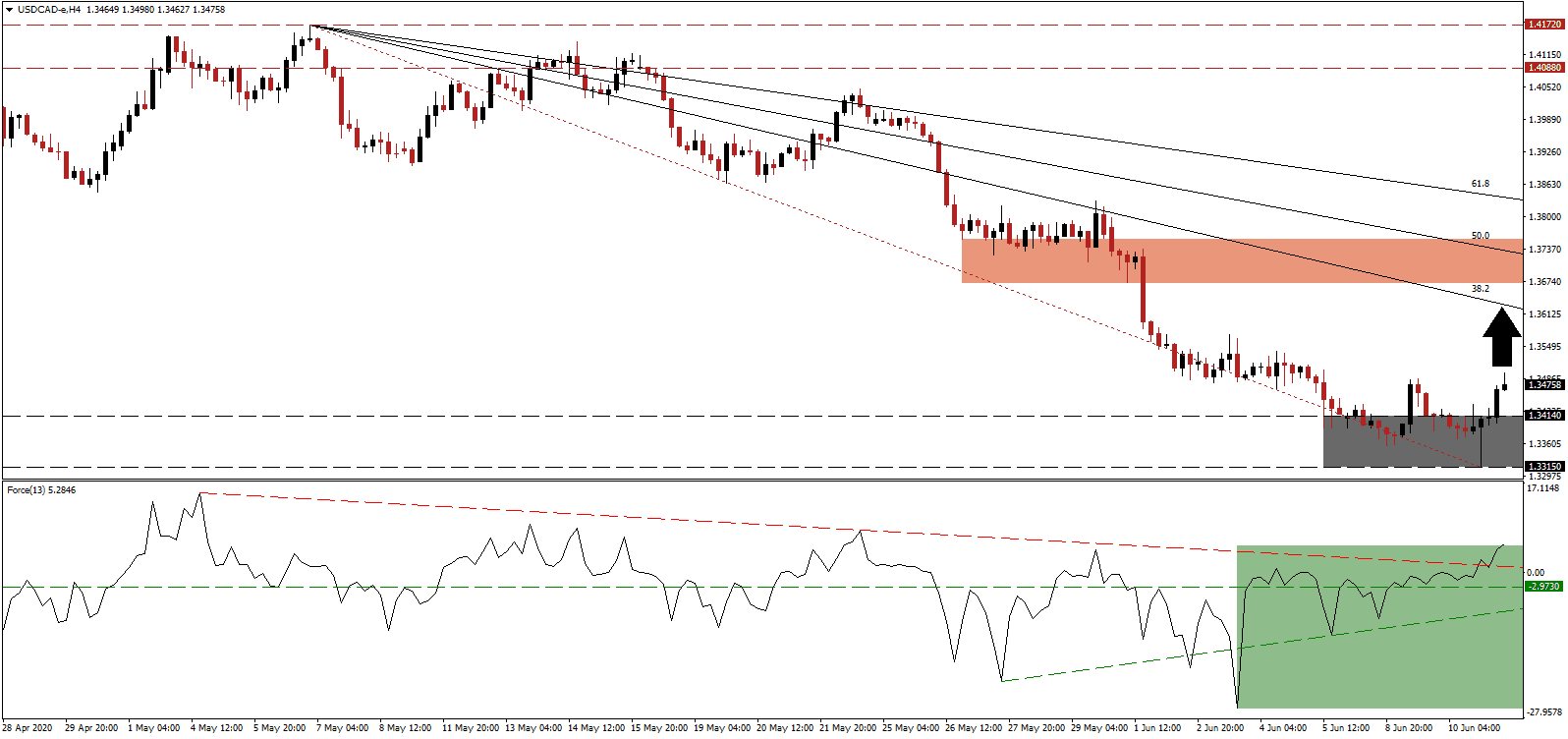

The Force Index, a next-generation technical indicator, recovered from a new multi-week low and embarked on an advance after reclaiming its ascending support level. Expanding bullish momentum was the conversion of its horizontal resistance level into support, as marked by the green rectangle. The Force Index has now pushed trough its descending resistance level with bullish momentum intact. Bulls have regained control of the USD/CAD after this technical indicator moved into positive territory.

While unexpected job additions in May suggest the peak of the pandemic was in April, retail and hospitality companies added temporary staff to comply with new requirements to resume activities. They include employees conducting temperature checks, disinfecting goods and surfaces, and crowd control. The easing of social distancing rules will provide a boost to economic indicators off of depressed levels, but with global infections spiking, a subsequent downturn remains a distinct possibility. The USD/CAD is positioned to extend into its short-term resistance zone located between 1.3672 and 1.3756, as identified by the red rectangle.

After the pessimistic outlook of the US Federal Reserve, a spike in volatility followed, anticipated to expand, as traders and investors adjust portfolios a step closer towards reality. The Canadian Dollar, a commodity currency with substantial exposure to the energy market, enjoyed a bullish catalyst from the recovery in oil prices. It is likely to fade, but ongoing negative progress out of the US keeps bearish pressures intact. The descending 38.2 Fibonacci Retracement Fan Resistance Level is expected to enforce the downtrend and pressure the USD/CAD into a breakdown below its support zone located between 1.3315 and 1.3414, as marked by the grey rectangle.

USD/CAD Technical Trading Set-Up - Temporary Breakout Extension Scenario

Long Entry @ 1.3475

Take Profit @ 1.3610

Stop Loss @ 1.3410

Upside Potential: 135 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 2.08

A breakdown in the Force Index below its ascending support level will bypass the pending breakout extension in the USD/CAD. Price action is then favored to accelerate to the downside. Forex traders are advised to consider any advance from current levels an outstanding selling opportunity, magnified by an increasingly bearish outlook for the US economy. The next support zone awaits this currency pair between 1.3153 and 1.3190.

USD/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3355

Take Profit @ 1.3155

Stop Loss @ 1.3410

Downside Potential: 200 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.64