The US dollar has rallied a bit during the month of June after fallen rather hard against the Canadian dollar. A lot of this is probably influenced by crude oil, but recently the downgrade of Canada by Fitch, albeit to AA+ and outlook stable, suggests that there are serious problems in Canada. We have recently seen Canadian banks downgraded as well, and quite frankly they should be considering the property bubbles that I have seen firsthand in several Canadian cities.

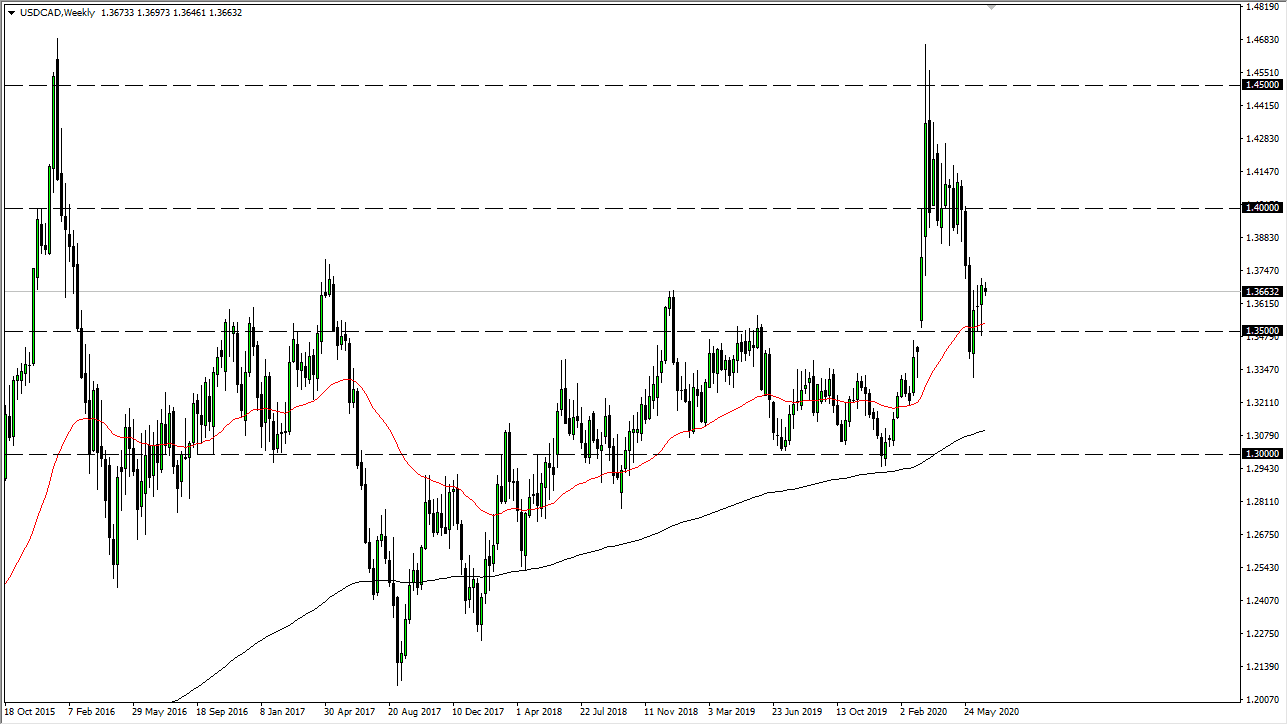

Furthermore, we have the crude oil market which has skyrocketed as of late but is starting to run into serious resistance now. While oil may not roll over and sell off drastically, the reality is that the easy money has already been made in crude oil, and therefore the easy money in buying Canadian dollars may have already been made. When I look at the technical analysis, I can also make an argument for potential support just below, due to the fact that the 50 week EMA is sitting underneath the last couple of candlestick for the month of June.

The Canadian dollar is highly influenced by crude oil, but it is also highly influenced by commodity prices in general. The bulk of money flowing into Canada is based upon crude oil, but there are also gold and other mining operations that bring in a fair amount of currency as well. If the global economy is going to slow down, it will bring in a lot less demand for most of their commodities, with perhaps gold and silver been a bit of an outlier. Having said that, those markets are not big enough to float the currency higher.

The “double whammy” for this pair breaking to the upside might be the fact that people will be looking towards the US Treasury markets for safety, thereby driving up the value of the US dollar. Having said all of that, this pair does tend to be rather choppy as Canada and the United States are such large trading partners, and therefore there is a lot of transactions in the market that are done out of necessity, and not any type of valuation. All that being said, it does look like the 1.35 level has offered a bit of support, and now looks as if we may be setting up for a range back up towards the 1.40 level, although it may not necessarily be the easiest trade.