Over the past four months, foreign investors took over $11.8 billion out of Brazil’s equity market. This highlights the fear that as the Covid-19 pandemic swept across the country, placing it second only to the US, President Bolsonaro was one of the final leaders to implement economic restrictions due to the virus. This deflated confidence in his leadership.

Brazil has started to reopen its economy, but consumer spending may be depressed for an extended period until the pandemic is under control. Adding a distinct bullish driver for the Brazilian Real is the willingness to speed up economic reforms. Given the magnitude of the breakdown in the USD/BRL, a brief price spike is favored to precede a more massive sell-off.

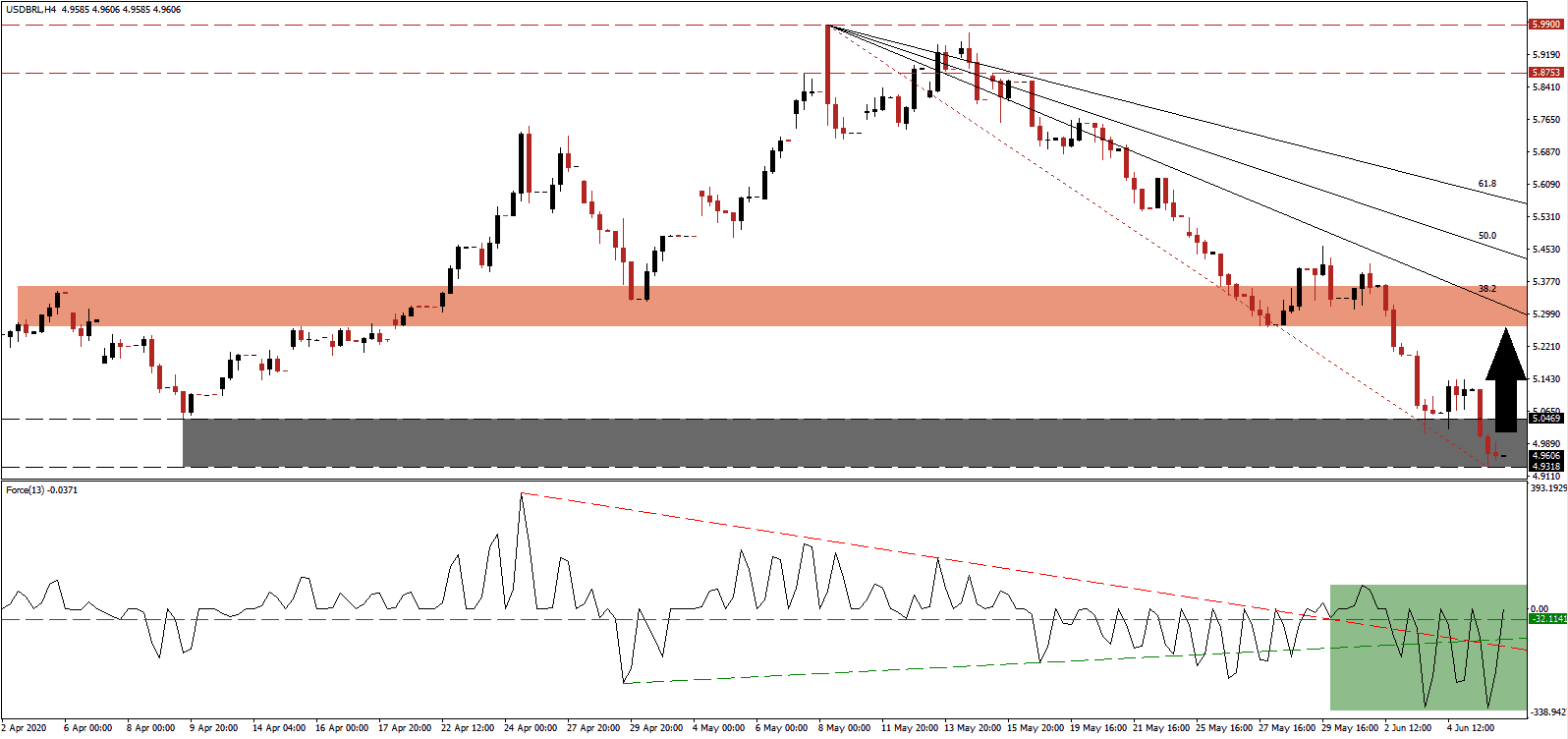

The Force Index, a next-generation technical indicator, points towards a rapid spike in bullish momentum after recording a new multi-month low. It has led to a move above its ascending support level and descending resistance level, as marked by the green rectangle. Additionally, the horizontal resistance level was converted into support, following the breakout in the Force Index above it. Bulls wait for this technical indicator to cross above the 0 center-line to temporarily gain control of the USD/BRL before a breakdown is anticipated.

Brazil reported a 4.2% decrease in exports in May, lowering the trade surplus to $4.5 billion. Year-to-date, exports dropped by 4.5%, and the trade surplus is down by 17.9% to $16.3 billion as compared to the same period in 2019. While foreign capital fled the country, it is likely to remain a short-term event. Chinese domestic demand is boosting major Brazilian companies, placing a floor under selling pressure. The USD/BRL is well-positioned for a quick counter-trend advance out of its support zone located between 4.9318 and 5.0469, as identified by the grey rectangle, keeping the long-term downtrend intact.

Confirmed Covid-19 infections surpassed two million in the US, by far the highest number globally. Despite not meeting the requirements to reopen state economies, all initiated the process. Infection rates have risen, while the riots and protests across the US have spiked the likelihood of a surge in new cases. The upside potential in the USD/BRL is confined to its descending 38.2 Fibonacci Retracement Fan Resistance Level, which is on the verge of exiting the short-term resistance zone located between 5.2682 and 5.3658, as marked by the red rectangle. It will warrant a downward adjustment, adding to breakdown pressures.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @4.9605

Take Profit @ 5.2605

Stop Loss @ 4.8505

Upside Potential: 3,000 pips

Downside Risk: 1,100 pips

Risk/Reward Ratio: 2.73

Should the Force Index correct below its descending resistance level, serving as temporary support, the USD/BRL is favored to resume its dominant bearish trend. Forex traders are advised to take advantage of any breakout attempt with new net short positions on the back of a worsening economic outlook for the US. It is despite Friday’s NFP report, which could be reversed as initial jobless claims have increased. The next support zone is located between 4.5082 and 4.6418.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 4.7705

Take Profit @ 4.5105

Stop Loss @ 4.8505

Downside Potential: 2,600 pips

Upside Risk: 800 pips

Risk/Reward Ratio: 3.25