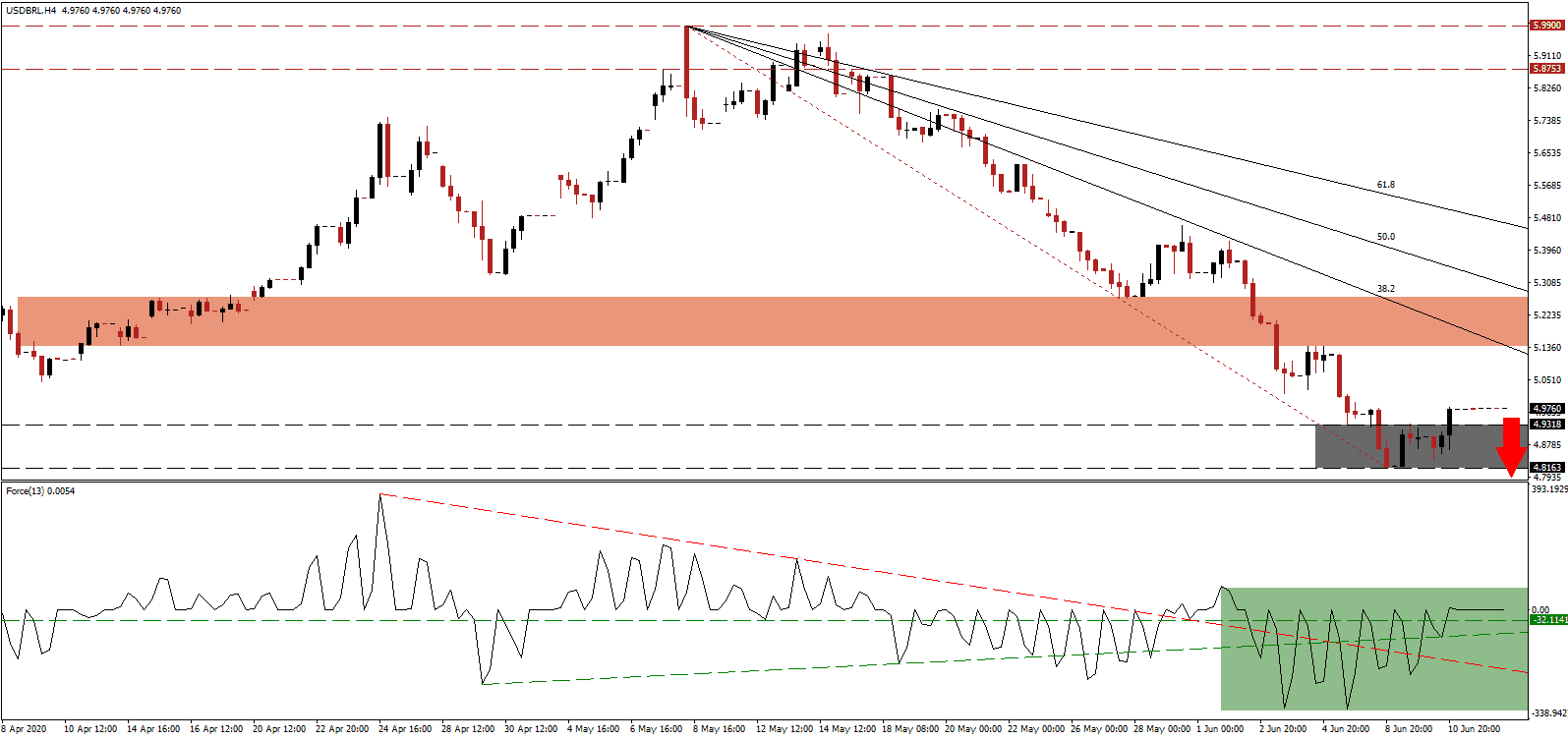

Brazil’s government stopped publishing Covid-19 data and took down the official website. President Bolsonaro did declare the figures do not accurately represent the country’s situation. Many critics believe the real data is considerably higher than the official statistics. Brazil presently ranks second globally in infections behind the US, and third in the total death toll. The Brazilian government ordered a review claims to confirm speculation several states inflated statistics. After the USD/BRL was able to complete a breakout above its support zone, bullish momentum remains absent, suggesting a resumption of the sell-off.

The Force Index, a next-generation technical indicator, maintains the conversion of its horizontal resistance level into support but is unable to add to gains after crossing above the 0 center-line. It risks a swift reversal, and given the proximity of the ascending support level, a double breakdown is favored. Bears will then regain control of the USD/BRL and collapse below its descending resistance level, serving as support, is likely to follow.

President Bolsonaro adopted a controversial approach to the Covid-19 pandemic, attempting to limit quarantines, curfews, and social distancing measures. He insists the economic damage will be higher than that of the virus. Brazilian federal police raided the home of Rio de Janeiro Governor Witzel, as part of an alleged corruption probe involving government Covid-19 funds. Deflating upside pressure in the USD/BRL, driven by US economic disappointments, warrants a pending downward revision of the short-term resistance zone, currently located between 5.1403 and 5.2695, as marked by the red rectangle, confirming the accumulation of breakdown pressures.

One bright spot emerging from the travel restrictions is Brazil’s current account deficit, which could turn into a surplus in 2020. April saw the most significant excess in history at $3.8 billion. Positive progress in financial conditions of Latin America’s largest economy, and the world’s seventh most populous nations, is adding a distinct long-term bullish driver for the Brazilian Real. The descending 38.2 Fibonacci Retracement Fan Resistance Level is anticipated to force a breakdown in the USD/BRL below its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle. Price action is then clear to extend its correction until it challenges its next support zone between 4.3819 and 4.4525.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 4.9700

Take Profit @ 4.3800

Stop Loss @ 5.1200

Downside Potential: 5,900 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.93

In case the ascending support level pushed the Force Index higher, the USD/BRL is likely to drift into the top range of its short-term resistance zone. Given the worsening outlook for the US economy, confirmed by US Federal Reserve Chairman Powell, Forex traders are recommended to take advantage of any breakout attempt with new net short positions. The upside potential is confined to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.2700

Take Profit @ 5.4700

Stop Loss @ 5.1700

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00