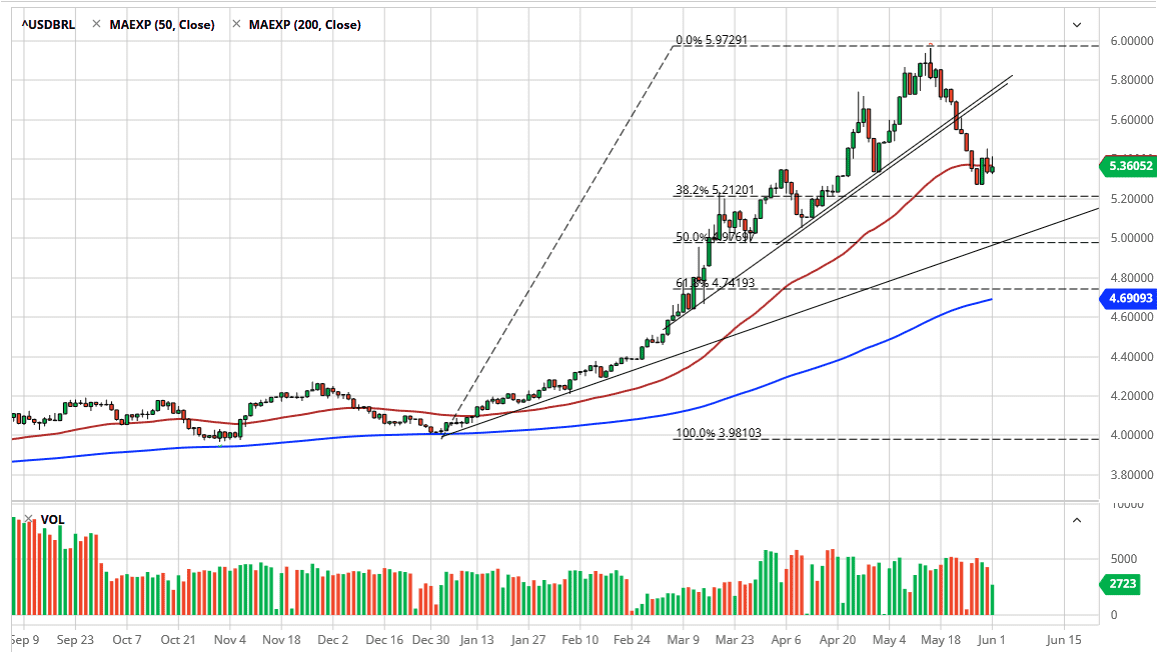

The US dollar has gone back and forth during the course of the trading session on Monday as we continue to see a lot of push and pull when it comes to emerging market currencies. The US dollar has been sold off quite drastically over the last several weeks, but the market is now starting to test an area in the neighborhood of 5.35 Real where we had seen a lot of resistance. By pulling back towards that area yet again, we are now testing an area that should feature a significant amount of “market memory.”

The 50 day EMA is specifically in the middle of this little bit of consolidation, and therefore it is likely that the technical traders out there will continue to pay a lot of attention to this area. I think there is significant support down to at least the 5.25 Real level, and then if we break down below there, then we should see plenty of support near the 5.00 Real level because of that trend line in the fact that the 50% Fibonacci retracement level is essentially right at the same level as well. In other words, I think it is only a matter of time before the US dollar continues to gain against the emerging market economies and currencies around the world, and therefore this is a significant uptrend that we should continue to see going forward.

On the other hand, if we do break above the 5.40 Real level, then it is highly likely that the US dollar will go reaching towards the 5.60 Real level, followed by the highs again which is so close to the 6.00 Real level. Looking at this market, it is obvious that even though we have had a significant pullback as of late, quite frankly the US dollar still is extraordinarily strong when it comes to this pair. Furthermore, the Brazilian coronavirus numbers are much higher than most of the world, and that obviously will have a negative effect on the currency as well. It is not until we break down below the 5.00 Real level that I would be concerned about the overall trend. Even then, we still have the 200 day EMA underneath so it is possible that the market will continue to find plenty of buyers. If you squint, you can make an argument for a bearish flag, so that is one thing to keep an eye on but at this point it is still difficult.