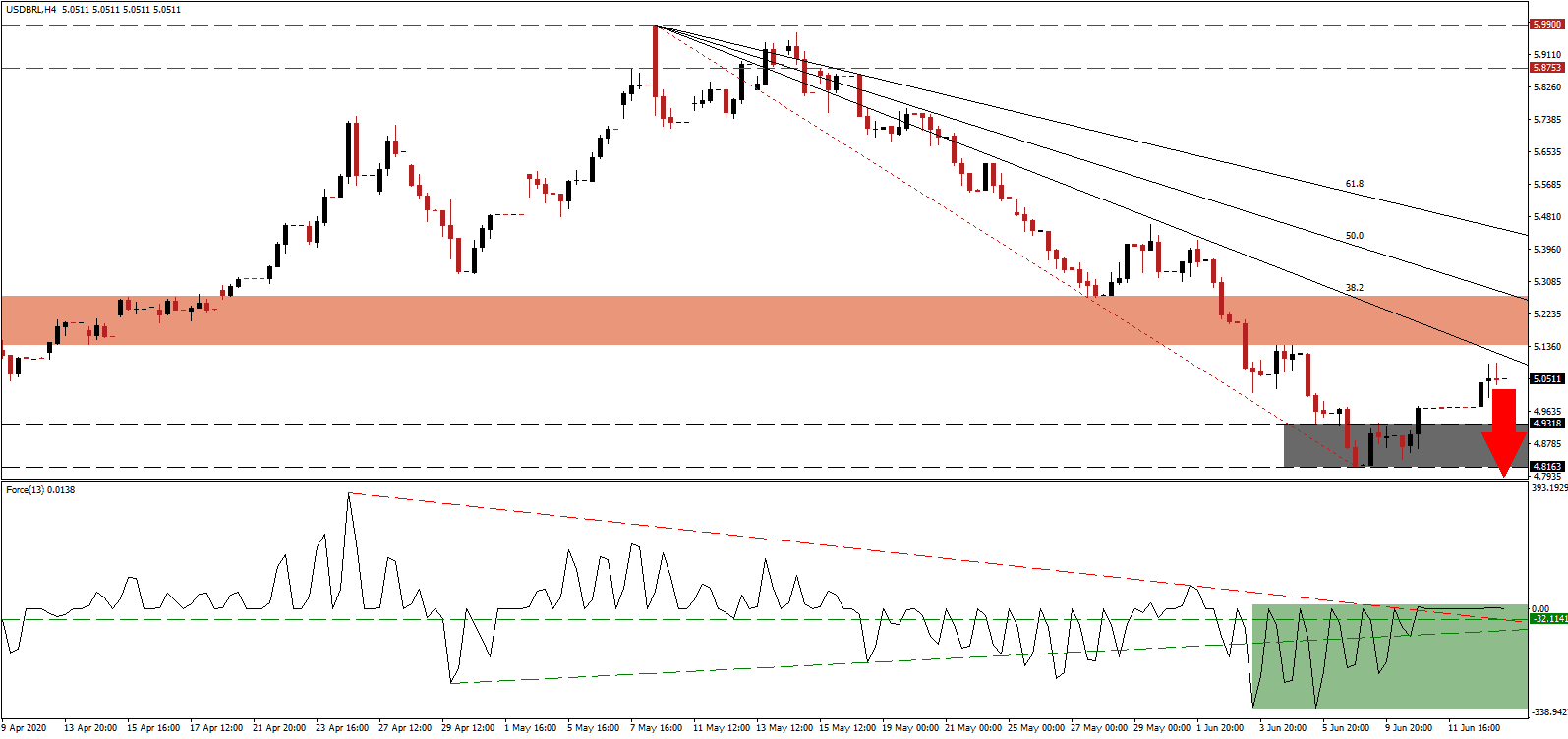

Brazil endured another weekend of protests, which are common since the outbreak of the Covid-19 pandemic. Demonstrators, for and against the government of President Bolsonaro, defied social distancing recommendations despite Brazil being the second-most infected country behind the US. While anger over falsified virus data swept across the country, anti-government rallies are shrinking in volume. Education Minister Abraham Weintraub joined the pro-government protests calling for the closure of Congress and the Supreme Court. The USD/BRL briefly spiked but was rejected by its descending 38.2 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, flatlined after the conversion of its horizontal resistance level into support. It was followed by a move above its descending resistance level, as marked by the green rectangle. The Force Index is expected to collapse from current levels amid the lack of bullish momentum. A correction in this technical indicator below the 0 center-line and breakdown below its ascending support level will grant bears complete control of the USD/BRL.

Adding to economic stress resulting from the pandemic is the estimated loss of $2 billion from Brazil’s dominant soccer economy. The Brazilian Club Federation announced B$115 million in credit lines to teams in the top two divisions. The number is dwarfed by the US sports industry, expected to suffer $12 billion in losses in 2020. Breakdown pressures in the USD/BRL are on the rise after price action stalled below the bottom range of its short-term resistance zone located between 5.1403 and 5.2695, as identified by the red rectangle.

Two of Brazil’s major vaccine producers initiate steps to begin mass production of a potential vaccine. Optimism may be short-lived as the virus is mutating, rendering any vaccine useless for an extended period. A cure is required to combat the pandemic effectively. The global focus on a vaccine could ensure the longevity of Covid-19 and allow it to join the influenza virus as a recurring seasonal threat. Price action is well-positioned to correct into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle. From there, the USD/BRL may accelerate into its next support zone between 4.3819 and 4.4525, driven by increased bearishness out of the US economy.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.0500

Take Profit @ 4.3800

Stop Loss @ 5.2200

Downside Potential: 6,700 pips

Upside Risk: 1,700 pips

Risk/Reward Ratio: 3.94

Should the Force Index bounce off of its descending resistance level, serving as temporary support, the USD/BRL may attempt to push higher. The upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to consider this an excellent short-selling opportunity on the back of magnifying problems out of the US with subsidies for the unemployed set to expire in six weeks.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.3000

Take Profit @ 5.4700

Stop Loss @ 5.2200

Upside Potential: 1,700 pips

Downside Risk: 800 pips

Risk/Reward Ratio: 2.13