Brazil reported a 1.5% decrease in its first-quarter GDP, while the Finance Ministry announced it expects a more significant second-quarter contraction. President Bolsonaro was one of the last leaders to accept the devastating impact of the Covid-19 virus on the health of its population and economy. His delayed response is blamed for the rapid spread in Latin America's largest economy, which trails only the US. Testing remains insufficient, and pressures for President Bolsonaro’s resignation are on the rise. Despite the short-term negative impact on the Brazilian economy, the long-term outlook remains positive, aiding the breakdown sequence in the USD/BRL.

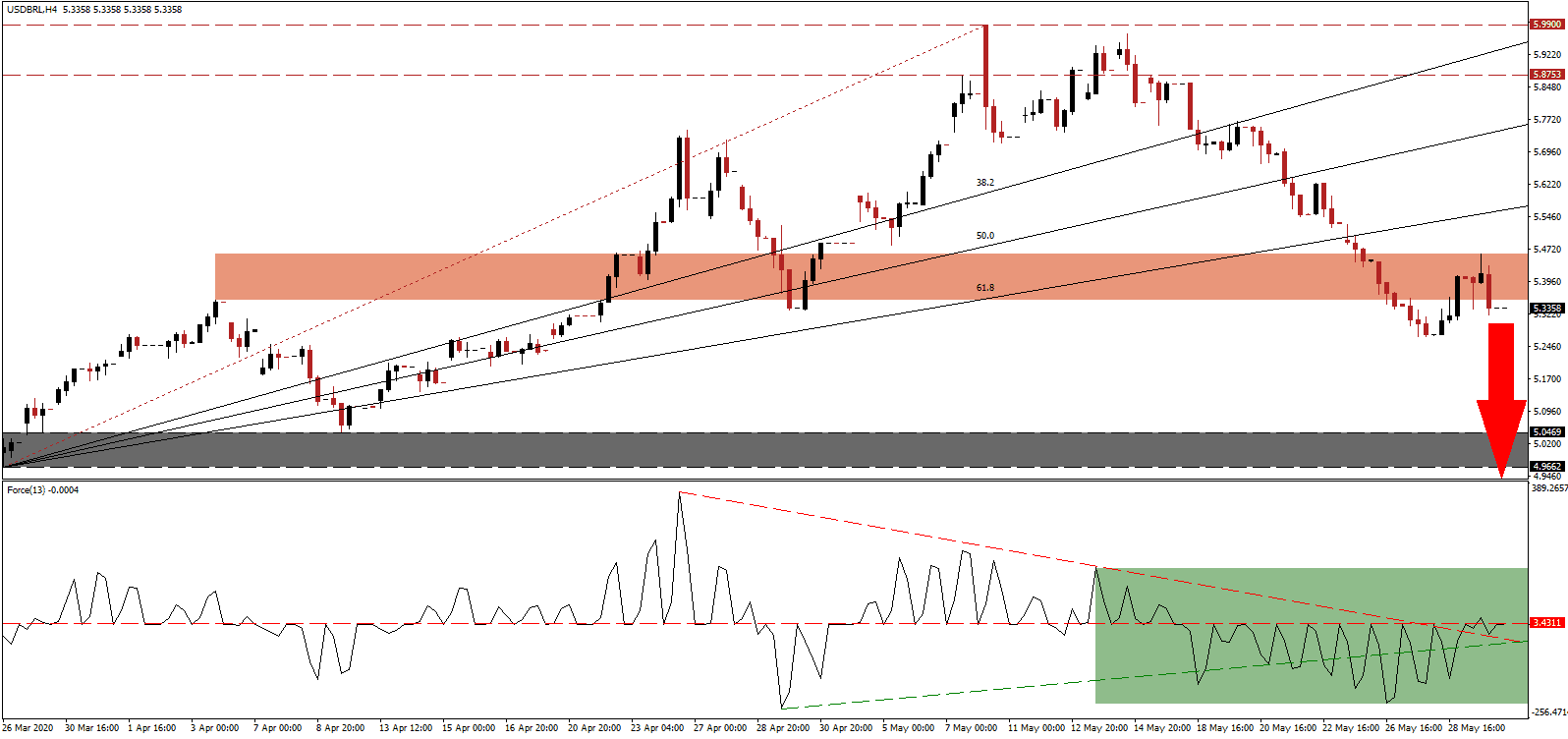

The Force Index, a next-generation technical indicator, confirms the absence of bullish momentum. A reversal of the most recent multi-week low materialized, which led to a push above its ascending support level and descending resistance level. The Force Index approached its horizontal resistance level, as marked by the green rectangle, from where rejection is favored to result in a retracement of the advance. Bears remain in control of the USD/BRL with this technical indicator struggling at the 0 center-line.

President Bolsonaro announced plans to expedite privatizations and fiscal reforms. A complete overhaul of the country’s complicated tax system is adding to long-term bullish pressured in the Brazilian Real. A reduction in public spending supports fiscal responsibility, and an improvement in trade remains paramount to the post-Covid-19 recovery. Countries that will use the economic shock created by the global pandemic will emerge more efficiently, moving forward. The USD/BRL is, therefore, anticipated to extend its corrective phase following the breakdown below its short-term resistance zone located between 5.3529 and 5.4611, as identified by the red rectangle.

Intensifying downside pressures on this currency pair was the collapse below its ascending 61.8 Fibonacci Retracement Fan Support level, converting the entire sequence into resistance. It provided the required volume for an accelerated breakdown in price action. The USD/BRL is likely to face a spike in volatility before resuming the sell-off into its support zone located between 4.9662 and 5.0469, as marked by the grey rectangle. More downside is probable but will require a new catalyst, most likely provided by increasing weakness out of the US. The next support zone awaits between 4.6418 and 4.7458.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3350

Take Profit @ 4.6500

Stop Loss @ 5.5550

Downside Potential: 6,850 pips

Upside Risk: 2,200 pips

Risk/Reward Ratio: 3.11

In case the Force Index uses its descending resistance level as a platform to surge higher, the USD/BRL is likely to follow suit. Given the bullish long-term outlook for the Brazilian economy, and the bearish conditions out of the US, the upside potential is limited to its 38.2 Fibonacci Retracement Fan Resistance Level. It is passing through the resistance zone located between 5.8753 and 5.9900. The 6.0000 level provides significant psychological resistance, and Forex traders are advised to consider this an outstanding selling opportunity.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.7250

Take Profit @ 5.9500

Stop Loss @ 5.6250

Upside Potential: 2,250 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.25