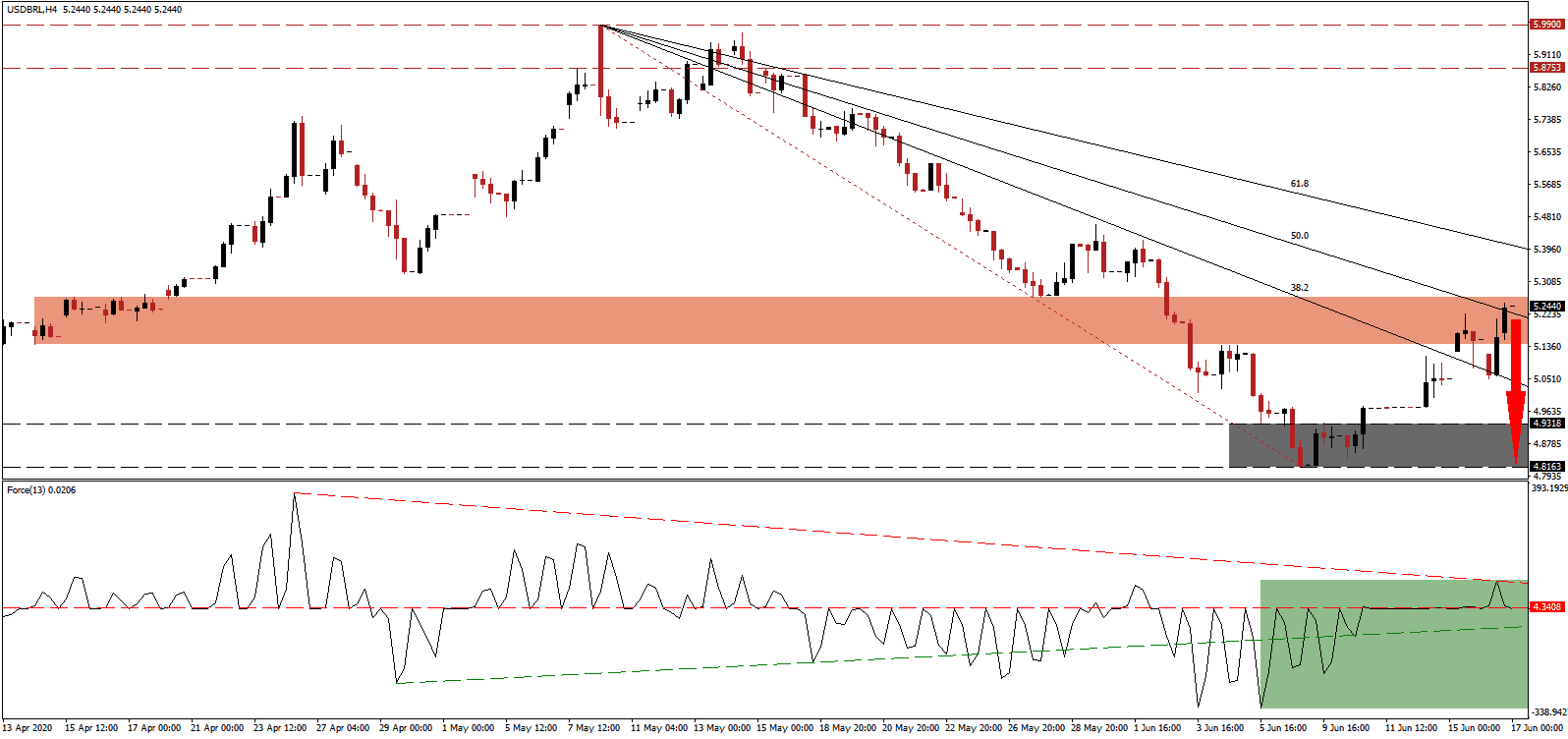

Brazilian retail sales for April recorded a record plunge, following US retail sales data for the same period. They confirmed a massive second-quarter GDP contraction is probable. While US retail sales bounced back with a record increase in May, industrial and manufacturing production for the same month disappointed, severely denting optimism for a sustained recovery. US Federal Reserve Chairman Powell cautioned financial markets against the pace of the central bank's extended market manipulation of the corporate bond market. It limited the price spike in the USD/BRL, which is facing a lower high and rejection inside of its short-term resistance zone.

The Force Index, a next-generation technical indicator, points towards an insignificant spike as this currency pair advanced. It was swiftly reversed, but warranted an adjustment of the descending resistance level, continuing to exercise downward pressure on price action. With the Force Index initiating the conversion of its horizontal support level into resistance, as marked by the green rectangle, a breakdown below its ascending support level is favored. Bears wait for this technical indicator to move into negative territory to resume complete control of the USD/BRL.

New Covid-19 infections are surging globally, led by Brazil, as record daily infections plague Latin America’s largest economy. With the virus spreading from wealthier, urban coastal regions inland towards poorer communities, Brazil is on track to become the second country to register over 1,000,000 infections. The worsening pandemic is merely trumped by the US, where infections surge in states that reopened their economies aggressively. It adds to breakdown pressures in the USD/BRL below its short-term resistance zone located between 5.1423 and 5.2672, marked by the red rectangle.

Despite the intensifying pandemic, numerous Brazilian regions are easing lockdown measures, risking further acceleration of the disease. President Bolsonaro repeatedly confirms his assessment that a nationwide lockdown will result in more harm, to citizens and economy alike, than the virus. One positive catalyst for the Brazilian Real remains a likely current account surplus, while the US is adding to its record deficits. The descending 61.8 Fibonacci Retracement Fan Resistance Level is expected to enforce the dominant bearish chart pattern, forcing the USD/BRL into a retreat into its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.2400

Take Profit @ 4.8200

Stop Loss @ 5.3400

Downside Potential: 4,200 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 4.20

In case the Force Index pushes above its descending resistance level, the USD/BRL is likely to extend its current advance. While a temporary price spike is possible, Forex traders should consider a breakout as a secondary short selling opportunity. The upside potential remains limited to an area between its 61.8 Fibonacci Retracement Fan Resistance Level and its intra-day high of 5.6018, closing a previous price gap.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 5.4400

Take Profit @ 5.6000

Stop Loss @ 5.3400

Upside Potential: 1,600 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.60