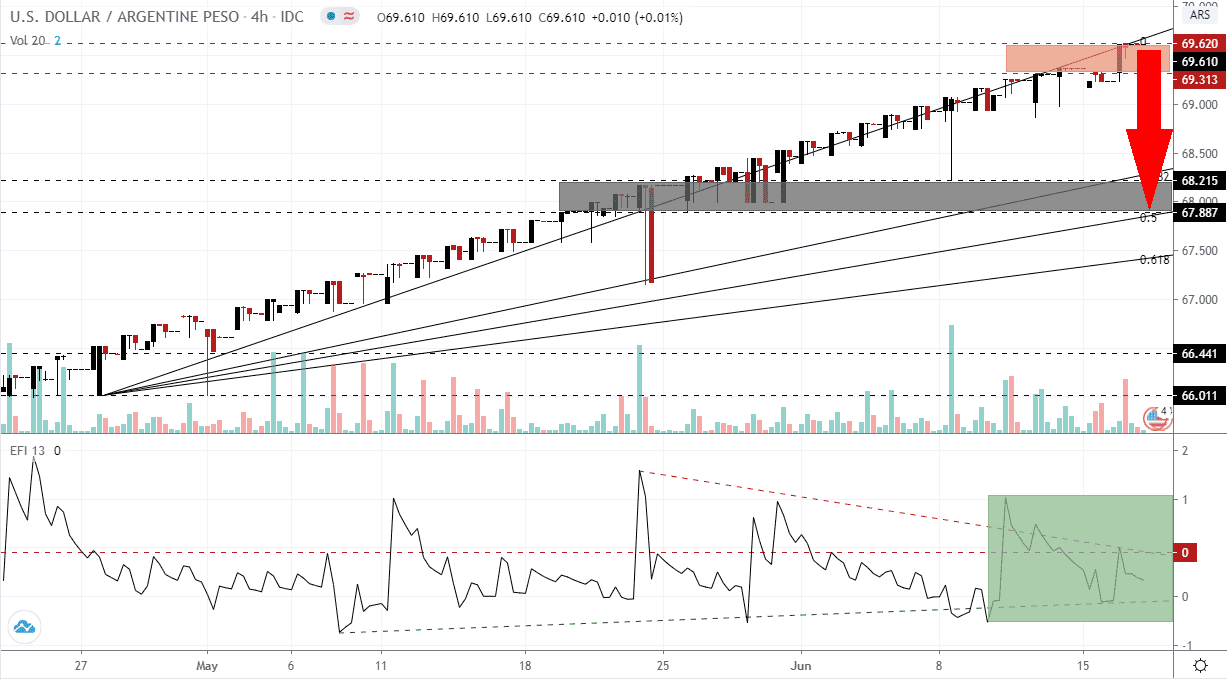

Most economies around the world are struggling to find a solution to the global Covid-19 pandemic, which initiated a recession likely to last longer than market participants price. Misguided optimism merged with the dismissal of warnings by healthcare officials, central banks, epidemiologists, and economists alike. Argentina is primarily focused on reaching an acceptable debt restructuring deal with creditors to avoid yet another default. It has added to a collapse in the Argentine Pesos, evidenced in the steady advance in the USD/ARS, despite intensifying stress and a bearish outlook for the US economy. Price action has reached a resistance zone from where buying pressure is fading.

The Force Index, a next-generation technical indicator, suggests a price action reversal is imminent. A negative divergence formed due to the decrease in the Force Index while this currency pair appreciated. Following the rejection by its horizontal resistance level, as marked by the green rectangle, the descending resistance level is increasing breakdown pressures. A collapse in this technical indicator below its ascending support level will grant bears complete control of the USD/ARS.

After the 2005 and 2010 debt restructuring, Argentina opted for voluntary default in 2014. The negotiations were dominated by 7% of debt holders who did not agree to the terms. President Macri made an effort to settle with the holdouts to end the default and return to capital markets. By November 2016, the country settled with remaining creditors for $475 million. Argentina is now back at renegotiating a debt restructuring for $65 billion. Uncertainties remain, but the USD/ARS presently stalled inside of its resistance zone located between 69.313 and 69.620, as marked by the red rectangle, and a breakdown is pending.

With Argentina and two of the principal debt holders working towards an agreement, they remain apart. The Ad Hoc Bondholder Group and Exchange Bondholder Group offered to accept up to a 46% loss on net-present value, with rumors of 48% circulating. The government insists on 50%. Another area of disagreement remains a clause tied to Argentina’s GDP favored by bondholders versus the preference of the government to agricultural exports. An agreement could spark a profit-taking sell-off in the USD/ARS, taking it into its short-term support zone located between 67.887 and 68.215, as identified by the grey rectangle, and enforced by the 50.0 Fibonacci Retracement Fan Support Level.

USD/ARS Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 69.600

Take Profit @ 67.890

Stop Loss @ 70.000

Downside Potential: 1,710 pips

Upside Risk: 400 pips

Risk/Reward Ratio: 4.28

A breakout in the Force Index above its descending resistance level is likely to spike the USD/ARS farther to the upside. Forex traders are advised to remains cautiously bullish on the back of a potential agreement between Argentina and its bondholders. Negative US progress in regards to the Covid-19 pandemic magnifies bearish pressures on price action. The next resistance zone awaits between 70.604 and 71.310, a new all-time high.

USD/ARS Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 70.400

Take Profit @ 71.300

Stop Loss @ 70.000

Upside Potential: 900 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.25