The USD/ARS has proven to be a one way road long term as the Argentine Peso faces sustained losses of value. The economic and corruption woes of Argentina are well documented and I am not going to recount it illustrious history of poor management here. Traders who seek greater value from the Argentine Peso should have their logic tested and take a look at nearly any type of technical chart to try and change their minds. The USD/ARS does not offer a lot of encouragement for those who believe the US Dollar should be sold against the Argentine Peso in forex currently.

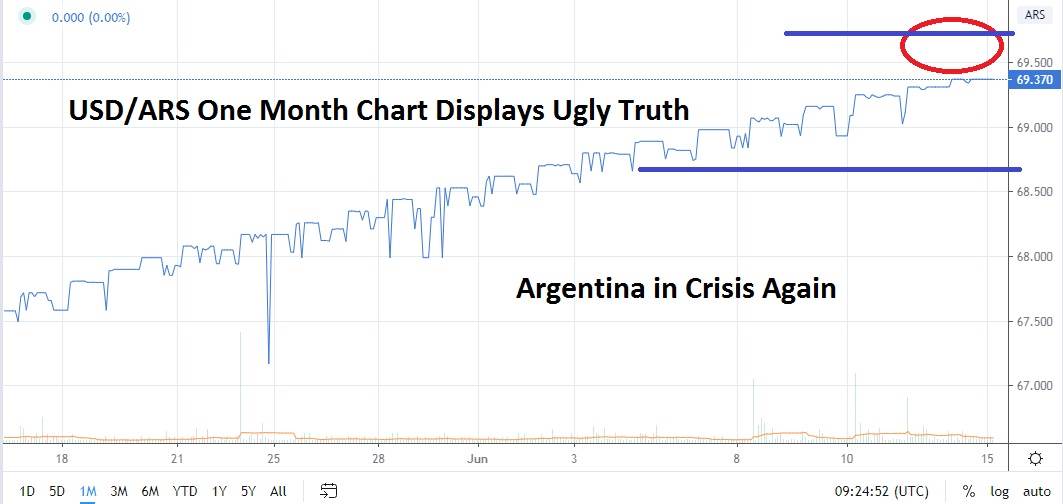

The chart displayed today for the USD/ARS is not mistakenly marked regarding the resistance circle drawn above its current price levels. The USD/ARS has been dynamically experienced falling value for Argentina’s citizens who try to conduct their business in their national currency. Confidence on the street regarding the value of the Argentine Peso remains skeptical at best. At worst, critics of the current Argentine government find an easy and unflattering comparison to Venezuela. The current Argentine government has begun talking and trying to act on nationalization of one of the nation’s biggest commodity companies. This socialistic trial has been met with resistance, but it remains to be seen what the outcome will be as government officials debate the merits (and utter destruction) of free markets.

So how do you make money trading the USD/ARS? The answer is not as simple as it would appear. Yes, you should shout NOT be holding the Argentine Peso. You should be buying the US Dollar against the ARS. However, remember the Argentina government is not a transparent standard in the world of governance and finance. Argentina’s bonds which are owned by financial institutions abroad, which bet on the Macri led government which was in power before, are now having to deal with a populist movement in Argentina which seeks a renegotiation of payment terms. Yes, you have heard this before from Argentina, its history of failed economics mirrors Greece in many respects.

Buy the USD/ARS if you have patience and can place your stop loss around the 68.800 support level. Use your leverage wisely, because volumes are questionable in the USD/ARS. This is not a guaranteed trade, but until the trend of the Argentina Peso long term changes, it does not appear weaker values are about to reverse and dramatically improve anytime soon.

Argentine Peso Short Term Outlook:

Current Resistance: 69.500

Current Support: 68.800

High Target: 72.000

Low Target: 68.000