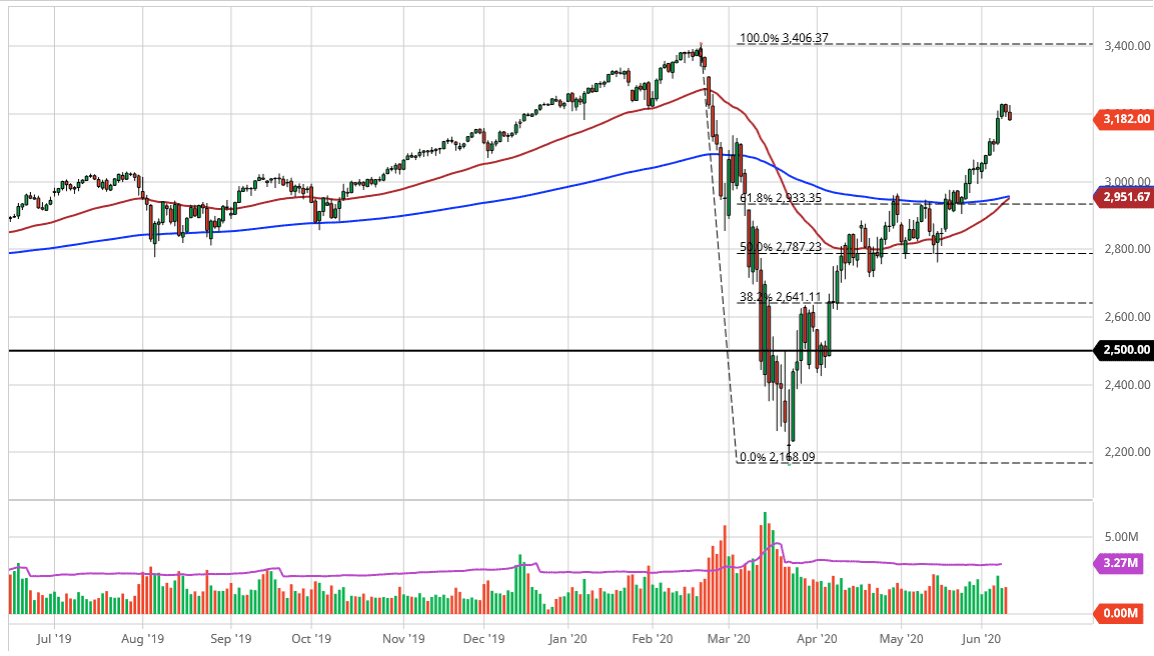

The S&P 500 initially tried to rally during the trading session on Wednesday but gave back the gains as we started to reach towards the highs of the previous couple of sessions. By doing so, the market then found plenty of sellers, breaking down towards the 3185 handle. The reserve decision and statement of course is something that we need to be aware of, and the reaction of course is something that is worth paying attention to. Perhaps the traders on Wall Street did not get enough monetary methadone this time, and therefore traders are looking to perhaps take significant profits as the market has gotten too far ahead of itself.

Looking at the candlestick, it is extremely negative looking, so if we break down below the lows of the day, we probably drift a bit further to the downside. That being said, if we were to break above the highs of the last three candlesticks, then the market is likely to go reaching towards the highs again. However, the market desperately needs to pull back to find some type of reality again, so we may be getting ready to see that. To the downside, the market is likely to see the 3100 level as an area of intense interest, and most certainly the 3000 level will be.

The 3000 level was previous resistance, so it makes sense that it is supported on the way back down. After all, it is a large, round, psychologically significant figure, and the 200 day EMA is starting to race there as well. Speaking of the 200 day EMA, the 50 day EMA is starting to turn around and break above it, which would be a “golden cross”, something that longer-term stock traders pay quite a bit of attention to. Regardless, I think we are parabolic, and it is likely that we need to find more balance in the market as we shot far too low in the selloff, and now have shot far too high. Ultimately, this is a market that I think continues to see a lot of volatility, as it has completely disconnected from reality. “Financial stuffing of liquidity” seems to be the biggest thing driving this market, but that can only last for so long. Eventually market start to focus on things like fundamentals again, but I do not think were quite there yet. A pullback is a simple mechanical move in a market that is overbought.