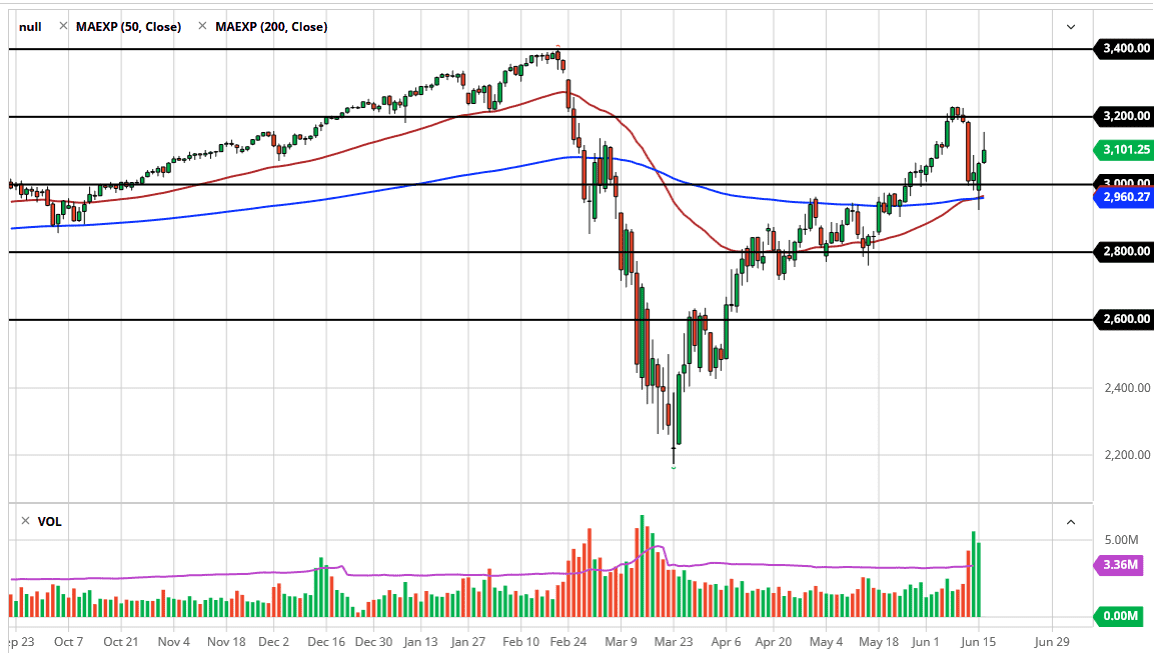

The S&P 500 has rallied significantly during the trading session on Tuesday, especially during the Globex session as Asian and European traders jumped all over the S&P 500. People are looking at the index as an opportunity to take advantage of the overall attitude, and at this point the market looks as if it was going to go looking to take out the 3200 level. That is a large, round, psychologically significant figure that of course comes into play.

Having said that, the market has pulled back from there rather significantly, and as a result it has offered a little bit of value. However, you can see that we have not turned around and spiked higher as we did in the NASDAQ 100. The main reason for the pullback was when Jerome Powell suggested that the Federal Reserve may not necessarily liquefy the markets forever. As per usual, Wall Street through a tantrum, and then he walked back those comments a bit. Jerome Powell is testifying in front of Congress and therefore Tuesday and Wednesday could be rather volatile.

That being said, I do think that the market is trying to get to the 3200 level, and it is only a matter of time before it happens. With that being the case, I think that it is only a matter of time before buyers come in and try to pick up this market regardless. After all, the Federal Reserve is coming in and picking up the stock market every time it can, so it is likely that the market will eventually find buyers on dips. The fact that the 3000 level offer quite a bit of support is a good sign for the longer-term uptrend, so therefore I do believe it is only a matter of time before we find buyers. It is difficult to short this market, at least not until we break down below the 2800 level. Even then, the 2600 level will come in as massive support. To the upside, if we can break above the 3200 level, then the market is likely to go looking towards the 3400 level. I do like the idea that finding value is the best way to go, but I also recognize that fighting the Fed is a great way to lose money, so that is probably the biggest thing to keep in mind.