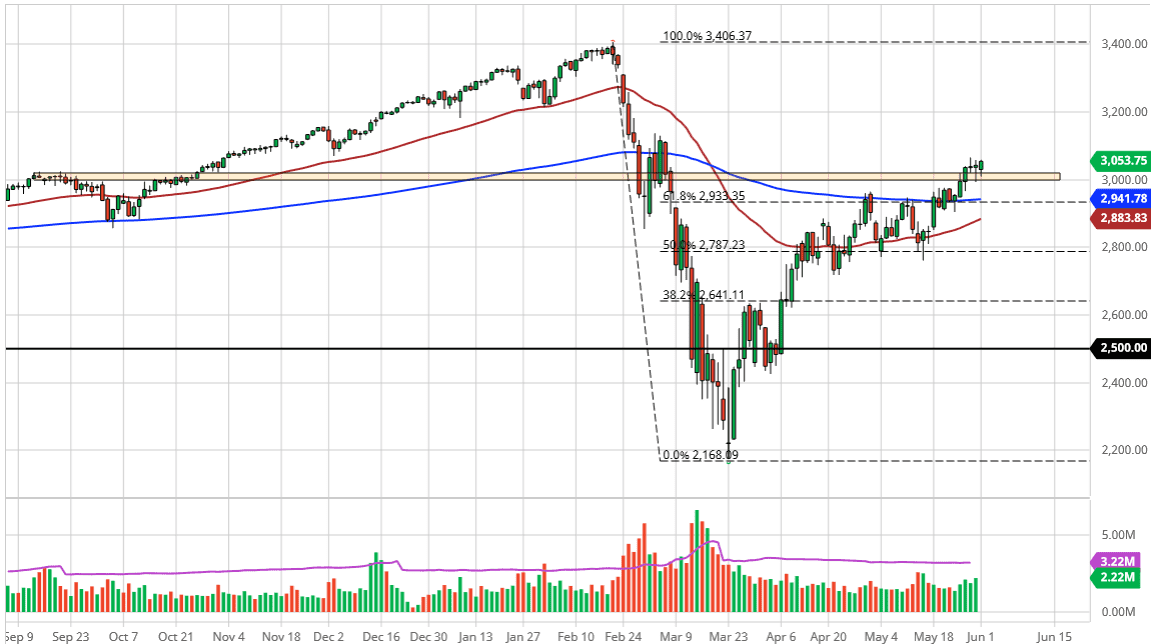

The S&P 500 initially fell during trading on Monday, but as you can see, we ended up seeing a lot of noise but then turned around to see buyers jump in and push this market back up to the upside. At this point, the market is likely to see continued choppiness, and as a result I think that the buyers simply come in and pick up dips every time they happen. Because of this, the market is going to continue to be one of those “FOMO markets” that cause a lot of headaches.

I am starting to see reports that massive amounts of new trading accounts have opened up, something that generally is in a good sign. However, it looks like in the short term we are more than likely going to see a lot of buying until it does not work. With that in mind I believe that it is not until we break down below the 200 day EMA that a lot of traders will start to get concerned. As long as we have plenty of “the Fed has my back” attitude out there, this will probably continue to see buyers on these dips.

With all that in mind, I fully anticipate that we will probably go looking towards the 3100 level. There is a lot of noise between the 3000 and the 3100 level so I fully anticipate that the market will be very noisy in this general vicinity and is probably going to be best traded in exceedingly small bits and pieces. If we do break above the 3100 level, then it is highly likely that the stock market simply reaches the highs yet again. The S&P 500 is not quite as skewed to one side of the equation as the NASDAQ 100 is as far as the top stocks, but it is pretty close. With that being said, I like the idea of taking advantage of dips unless of course we break down below the 200 day EMA which would more than likely open up a move down to the 2800 level. Do not pay attention to the economy, do not pay attention to earnings, pay attention to price because clearly everything has become completely disjointed. That is going to be the case, difficult to fight this way of liquidity and “hopium” trade that continues.