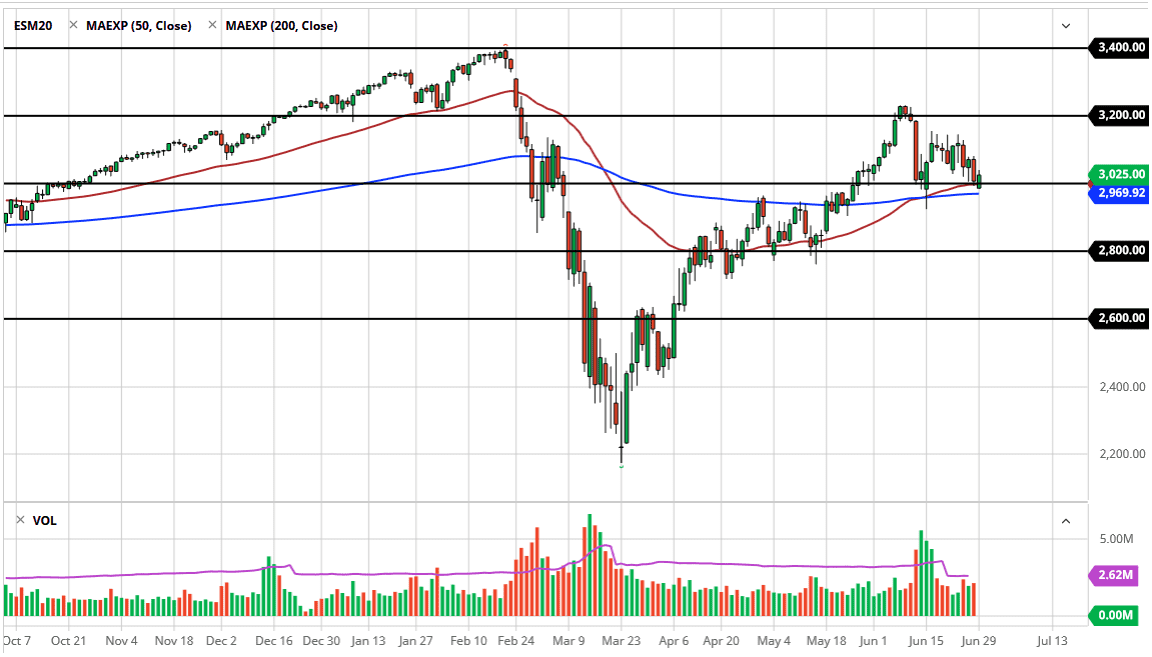

The S&P 500 initially gapped lower to kick off the trading session on Monday as people started to worry about coronavirus figures again during the weekend. However, as you can see the market is finding quite a bit of support below the 50 day EMA and the 200 day EMA. With that being the case, it is likely that the market could turn around and try to rally towards the 3100 level. After that, the 3150 level is a target as well. Ultimately, we could go all the way back to the 3200 level where it is going to see a lot of sellers.

At this point in time, I believe that the market is more than likely going to see a lot of volatility, but it is still going to be a market that has a lot of buyers underneath more than anything else. After all, the Federal Reserve continues to flood the markets with liquidity and therefore it is likely that the stock market will continue to rally based upon this alone. Yes, I recognize that there is absolutely no economic reason whatsoever for the market to be at the high levels that it is, but at the end of the day price is truth, and there is nothing you can do to fight it. I have a lot of macroeconomic friends out there working in the industry that continue to chime in about how the economy in the stock market are not matching up, but that has not been the case for almost 12 years.

After all, after the Great Financial Crisis, there has been nothing, but massive amounts of liquidity thrown into the marketplace and the Federal Reserve is doing everything he can to lift the market. Credit markets are showing problems, but at this point it is likely that the markets will continue to “whistle past the graveyard”, as the market has seen a lot of negativity out there, but it does not seem to care. In fact, I think that the 2800 level underneath is the absolute floor, and I do not even know how we get there. If we break down below the 200 day EMA, we could make a move towards there, but I do not see that happening quite yet. Ultimately, this is a market that continues to see a lot of buyers, and therefore short-term pullbacks are more than likely going to continue to be jumped on. Keep in mind that we get the jobs number at the end of the week.