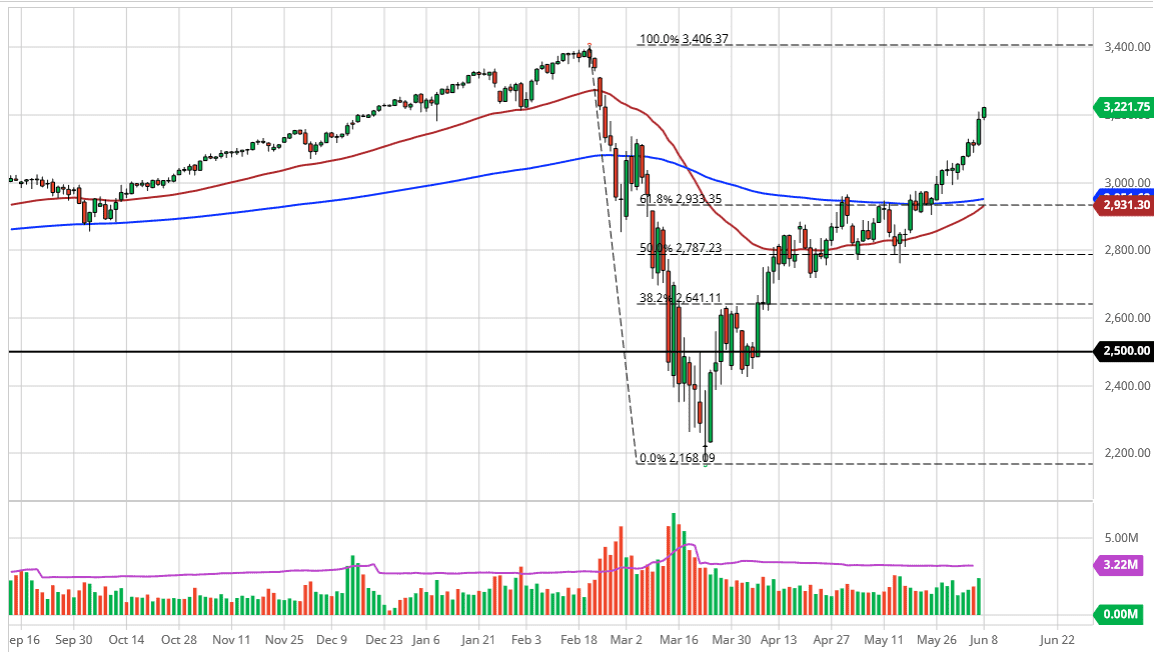

The S&P 500 has rallied quite drastically during the trading session on Monday, as we have cleared the 3200 level. At this point it is highly likely that we will go towards the all-time highs, which is basically the 3400 level. The NASDAQ 100 has already broken out above the all-time high and at this point it is exceedingly difficult to fight this trend. I think this rally is ridiculous and completely divorced from reality, but “price is price” and you cannot fight that. Ultimately, the market looks as if it is ready to rocket towards the upside, and you have to look at pullbacks as potential buying opportunities.

The 3000 level underneath is massive support from what I see, as the 50 day EMA is getting ready to break above the 200 day EMA, the so-called “golden cross.” I believe that 3000 level is an especially important level, so if we were to break down below there, it is possible that we may see a move down to the 2800 level, possibly even lower than that. That being said, with the Federal Reserve liquefy the markets and doing everything they can to pump the stock market, it is difficult to fight this move anytime soon.

The US dollar getting crushed has helped the markets as well, and ultimately, I believe that will be one of the most important things to pay attention to, the value of the US dollar. If it starts to strengthen suddenly, that will work against the stock markets in general. I do not see that happening in the short term though, and it should be noted that the US dollar is being stretched to points where we could see it get devalued quite significantly. If that is the case, this is going to continue to be a very parabolic market, and I think that the “blow off top” scenario as the one you have to look at.

The candlestick for the trading session on Monday is closing at the top of the range, and that certainly suggests that we could get a bit of follow-through, especially considering just how strong it was at the end of the session, typically when the institutions get involved, flooding the market with all kinds of liquidity. That being the case, it is highly likely that we continue going higher in the short term, but I do look at pullbacks as value, at least in a perverted sense of the word “value.”