The S&P 500 seems to be unforgiving in its bullish pressure. After all, the market had sold off quite drastically in anticipation of the Donald Trump speech about China but ended up the day at the very highest. In fact, we almost broke above the top of the candlestick from the Thursday session which was a little bit of a shooting star. In other words, it looks like the market is just going to keep going higher no matter what happens. It is quite astonishing actually, but it only proves what I have been saying for several months now and have known for years: the stock market has nothing to do with the economy. That is the biggest misnomer that you are taught as a trader, that earnings, inflation, and other things like that matter. But in the end, since 2008 the only thing that has mattered is how loose the Federal Reserve is with monetary policy.

This is the way things work, at least until they do not work. There have been several close calls, and every time something bad happens the Federal Reserve steps in. The stock market knows that the Federal Reserve is going to have its back no matter what. Because of this, there is always somebody willing to step in and buy the market regardless what happens. When the market turned around from the most recent plunge, it was after the Federal Reserve stepped in and started talking about buying junk bonds. Astonishing, but it is the world we live in.

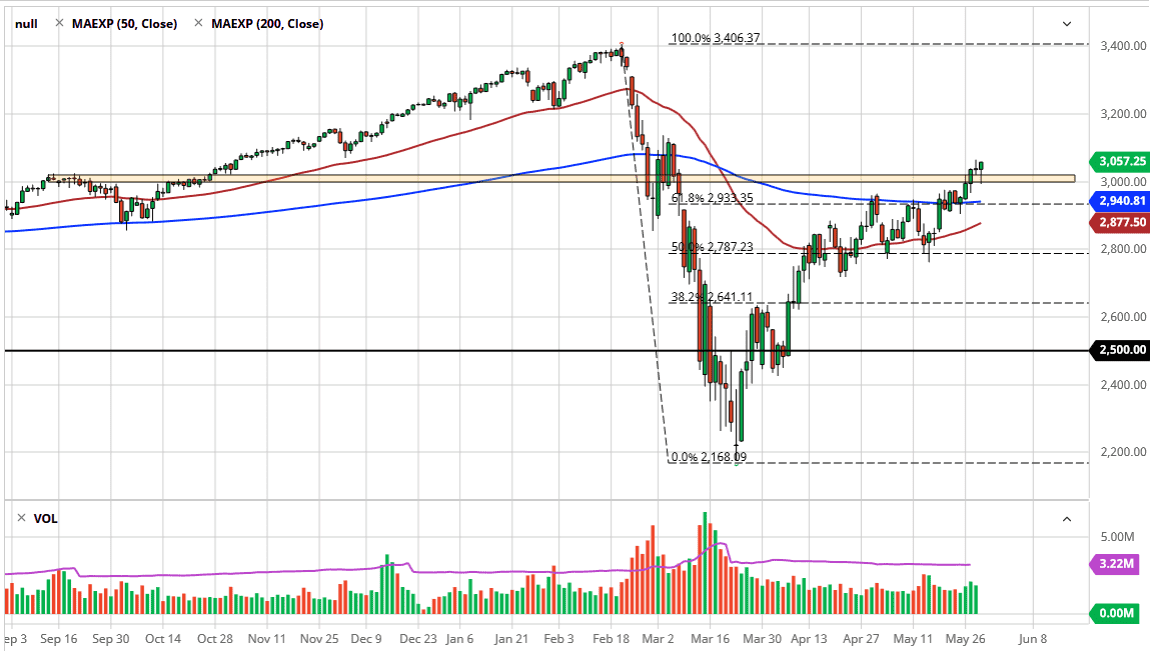

All that being said, market looks as if it is going to try to get to the 3100 level where I expect to see some resistance. This is because we are right in the middle of a block of noise that extends up to that level from the breakdown in early March. Whether or not we can break above there is a different question, but we need some type of catalyst to really scare the market in order for that to stick. Pullbacks at this point in time will more than likely have plenty of support not only at the 3000 handle, but the 200 day EMA. A lot of people out there are attributing this rally to short covering, but at the end of the day it really does not matter why it is going higher, just that it is.