The silver markets have gone back and forth during the trading session on Thursday, initially gapping much higher but then falling hard. With that being the case, the market is likely to see a lot of volatility going forward, but this is a market that is extraordinarily bullish longer term, as we have seen a massive bounce from the upside. That being said though, silver has one thing working against it: it is an industrial metal.

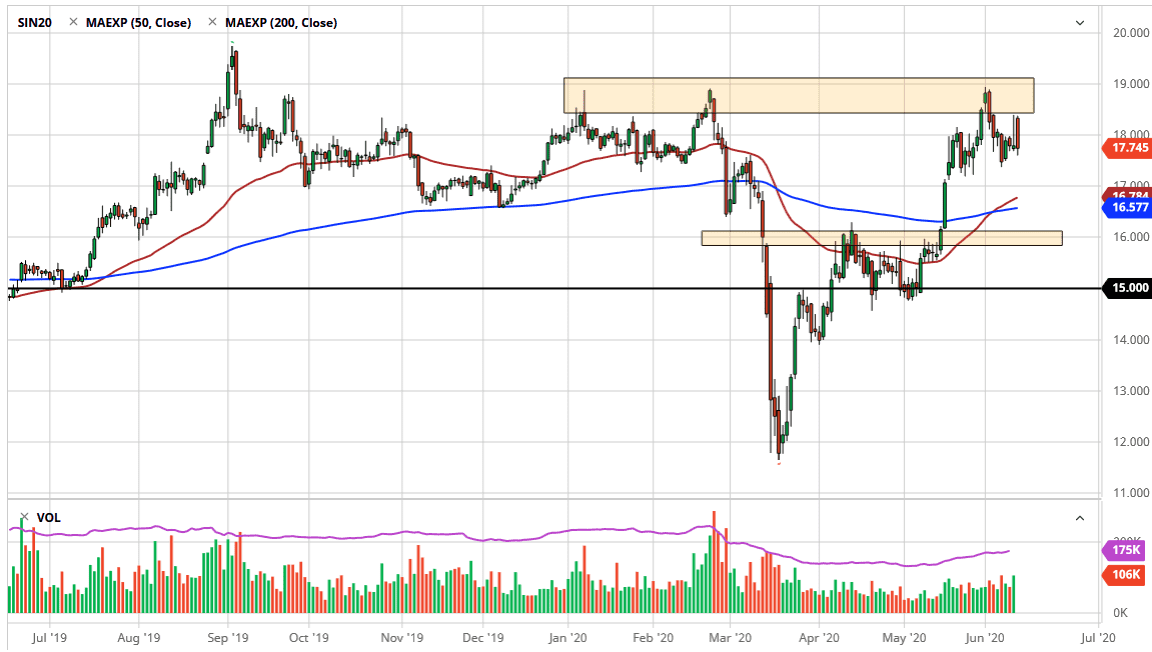

Yes, there is the precious metals aspect of the trade, but if you are looking to trade precious metals, it is going to be gold that you are more than likely going to get the best return from. At this point, the market continues to find plenty of support near the $17.20 level underneath, just as the $18.50 level offers a little bit of resistance, with the $19 level being even more resistant. That being said, I do believe that the market is likely to buyers on dips, because longer-term it still looks extraordinarily strong due to the central banks around the world easing monetary policy. In other words, they are bringing down the value of their perspective currencies, driving up the value of hard assets such as silver.

Underneath the 17 point to zero dollars level of course is the $17.00 level, both of which should offer support. The 50 day EMA is reaching towards that area, which of course also will offer plenty of support. All things being equal I think that dips continue to offer plenty of buying opportunities, as we have seen so much buying pressure every time it pulls back.It is not as if things have suddenly changed, and in fact the Federal Reserve has suggested that the quantitative easing is going on for an even longer amount of time than originally thought. Granted, the gold market is much more bullish, but silver should follow in a bit of a sympathy move, and as a result I do like the idea of picking up value. The $20 level above will be the longer-term target, and if we can break above there then it is likely that the market looks going towards the $50 level. In fact, if we can break above the $20 level, this is likely going to be a scenario where things start to accelerate quite rapidly.